Hoàn Mỹ Medical Corporation Reports Stellar H1 2025 Performance

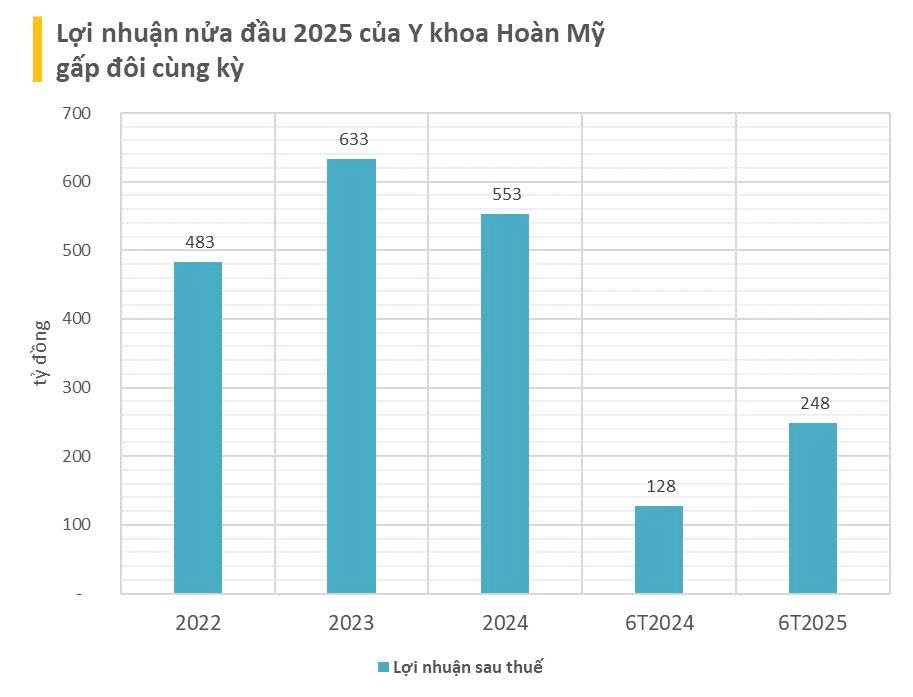

According to its periodic disclosure to the Hanoi Stock Exchange (HNX), Hoàn Mỹ Medical Corporation announced a remarkable after-tax profit of nearly VND 248 billion for the first half of 2025. This represents a near doubling compared to the VND 127.7 billion recorded in the same period of 2024.

Consistent Growth Trajectory

This impressive result extends Hoàn Mỹ’s streak of strong business performance in recent years. In 2024, the company achieved an after-tax profit of VND 553 billion. This marks over three consecutive years of high profitability, with cumulative net profit from 2022 to the reporting date reaching VND 1,917 billion.

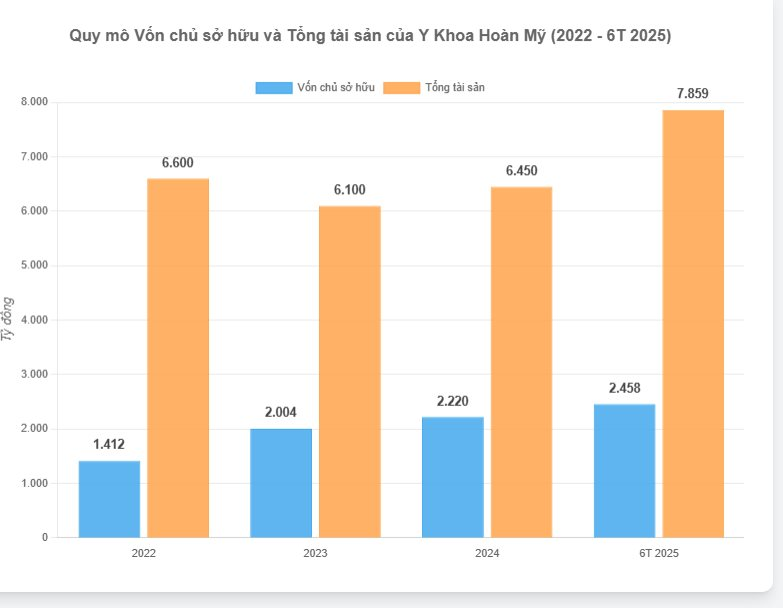

Hoàn Mỹ’s financial report also highlights continued expansion of its balance sheet. As of June 30, 2025, shareholders’ equity rose to VND 2,458 billion. Concurrently, total liabilities increased to VND 5,400 billion, with bank loans surging from VND 840 billion to VND 2,515 billion. Notably, HNX data reveals a VND 1,400 billion bond issuance maturing on October 5, 2025.

Asset Growth and Strategic Expansion

With these results, Hoàn Mỹ’s total assets climbed to VND 7,859 billion.

Founded in 1997, Hoàn Mỹ is a leading private healthcare group in Vietnam. Under the stewardship of Clermont Group, its current owner, Hoàn Mỹ has aggressively expanded through mergers and acquisitions while investing heavily in service quality.

The Hoàn Mỹ hospital and clinic network was established by Dr. Nguyễn Hữu Tùng. In 2009, he secured $20 million from two foreign funds for a 44% stake, marking a landmark M&A deal between a Vietnamese enterprise and foreign investors.

To meet investor expectations, Dr. Tùng later sold Hoàn Mỹ to Fortis Healthcare (India) for $100 million. Fortis subsequently divested its stake to Richard Chandler’s Singapore-based investment group (now Clermont Group).

Vietbank Offers Over 270.9 Million Shares, Projected Charter Capital to Exceed VND 10,900 Billion

Vietbank (VBB) has received approval from the State Securities Commission of Vietnam to issue shares to its existing shareholders through a public offering.

The Launch of Vietcap’s New Exciting Bond Offering

The Vietnamese stock market witnessed a robust recovery in the trading sessions leading up to the holiday break, rebounding from initial tremors. Despite a significant decline in liquidity, the trading floors remained vibrant and captivating, with green hues dominating various industry groups as buying force returned.