Preliminary statistics from the General Department of Vietnam Customs reveal that in the first nine months of the year, Vietnam exported nearly 8 million tons of steel, valued at USD 5.1 billion. This marks a decline in both volume and value compared to the same period in 2024. However, the market showed signs of recovery in September, with exports increasing by double digits compared to August.

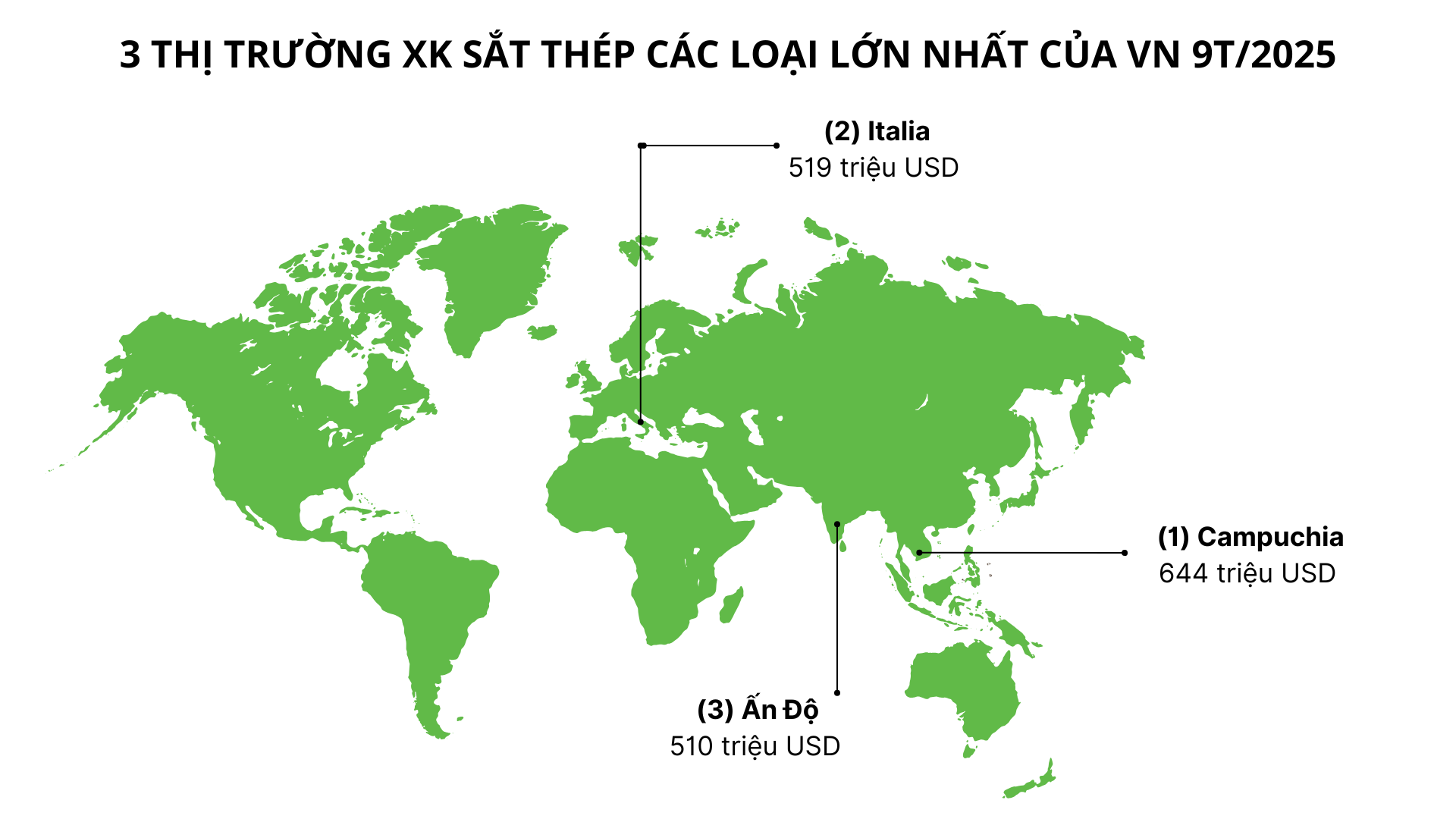

While the overall market experienced a downturn, certain markets witnessed a significant surge in exports. Notably, Cambodia emerged as Vietnam’s largest steel export market, importing over 1.12 million tons valued at more than USD 644 million. This represents a 30% increase in volume and an 18% rise in value compared to the same period in 2024. The average export price stood at USD 571 per ton, an 8% decrease from the previous year.

Vietnamese steel products enjoy a 0% tax rate when exported to Cambodia, as per the Bilateral Trade Promotion Agreement between Vietnam and Cambodia. This agreement was signed on the sidelines of the 7th ACMECS Summit, the 8th CLMV Summit, and the World Economic Forum on the Mekong Region.

Italy ranked second, spending over USD 519 million to import 825,000 tons of various steel products, reflecting an 18% drop in volume and a 19% decline in value. India secured the third position, with a 6% increase in volume but a 9% decrease in value.

Steel exports to the U.S. declined amid the country’s imposition of successive tariffs on metal products, particularly steel. In February, U.S. President Donald Trump signed an executive order imposing a 25% tariff on imported steel and aluminum. By early June, this tariff was raised to 50%, excluding products originating from the UK.

In addition to the general tariffs, certain Vietnamese steel products faced anti-dumping duties. In April, the U.S. Department of Commerce (DOC) announced preliminary anti-dumping duties on Vietnamese galvanized steel sheets, ranging from 39.84% to 88.12%, depending on the company.

In late September, Vietnam’s hot-rolled steel exported to the EU was subjected to a 12.1% tariff. This followed a year-long investigation initiated in August 2024 by the European Steel Association, which argued that low-cost steel imports had severely harmed the bloc’s domestic production.

However, Hoa Phat Group, including Hoa Phat Dung Quat Steel Joint Stock Company and its subsidiaries such as cold-rolled steel, Hoa Phat galvanized steel, and steel pipe companies in Hung Yen, Binh Duong, and Da Nang, was entirely exempt from anti-dumping duties.

The 0% tariff enables Hoa Phat to maintain its competitive edge in the European market, while allowing downstream companies using its hot-rolled coil (HRC) to export to the EU without concerns over material origin.

In contrast, Formosa Ha Tinh, Vietnam’s largest hot-rolled steel producer, along with other companies, remains subject to the 12.1% tariff, facing potential market share erosion in Europe.

Overall, domestic steel production and consumption in 2025 are projected to continue growing, particularly in construction steel and public investment-related products. However, steel exports may face challenges due to increasing trade barriers.