I. MARKET TRENDS IN WARRANTS

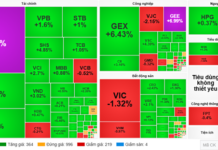

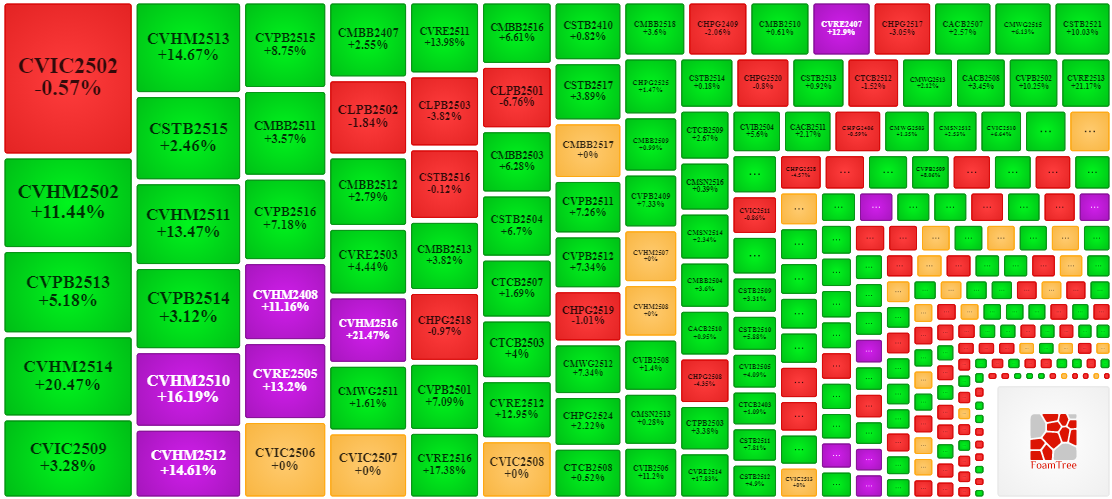

By the close of trading on October 9, 2025, the market saw 158 gainers, 84 decliners, and 36 unchanged securities.

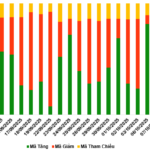

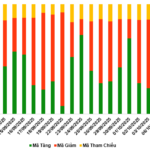

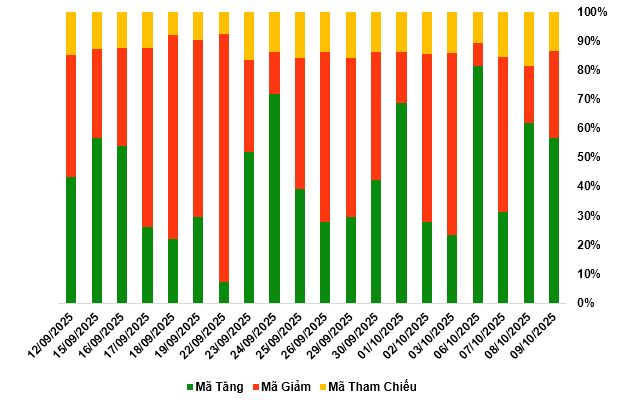

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

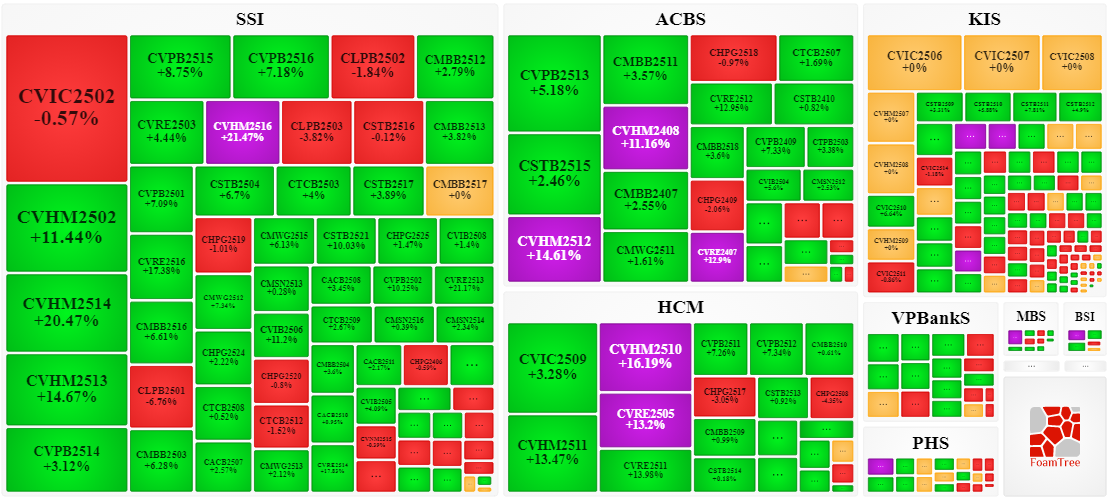

During the October 9, 2025 session, buyers maintained control, driving prices higher for most warrant codes. Notable gainers included CVHM2502, CVPB2513, CVIC2509, and CSTB2515.

Source: VietstockFinance

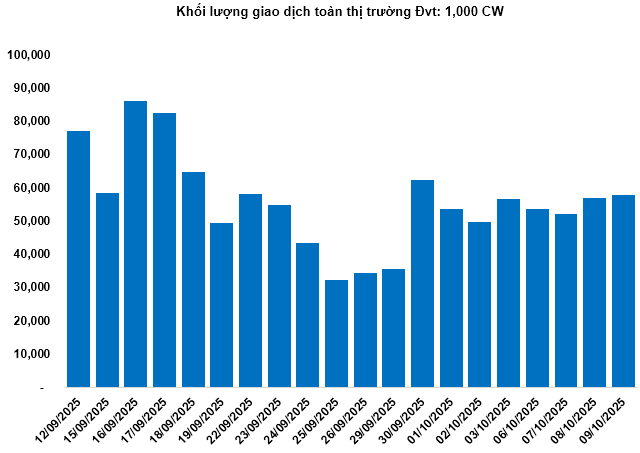

Total market volume on October 9 reached 57.69 million CW, up 1.42%; trading value hit 156.68 billion VND, a 0.99% increase from October 8. CVRE2513 led in both volume and value, with 4.73 million CW traded, totaling 20.53 billion VND.

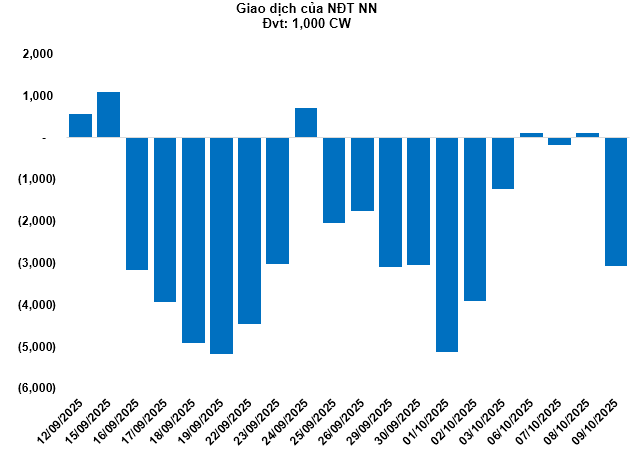

Foreign investors resumed net selling on October 9, totaling 3.06 million CW. CHPG2526 and CHPG2515 saw the highest net outflows.

Securities firms SSI, ACBS, KIS, HCM, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

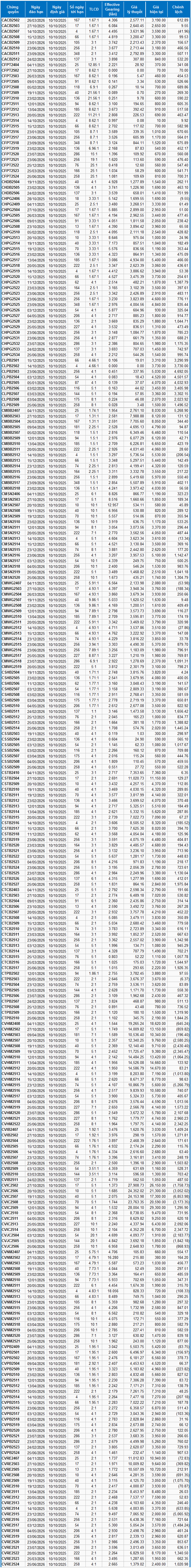

Using a valuation method effective from October 10, 2025, the fair prices of traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturity.

According to this valuation, CVIC2507 and CVHM2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2512 and CVNM2502 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 October 9, 2025

October 9, 2025 Warrant Market: Optimistic Sentiment Persists

At the close of trading on October 8, 2025, the market saw 172 stocks rise, 54 decline, and 52 remain unchanged. Foreign investors returned to net buying, with a total net purchase of 98,300 CW.

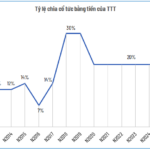

TTT Sustains 5 Consecutive Years of 20% Cash Dividend Payouts

Tay Ninh Tourism and Trading Joint Stock Company (HNX: TTT) has announced the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for October 28, with the payment expected to commence on November 25.

October 8, 2025: Banking Warrant Market Plunges into the Red

At the close of trading on October 7, 2025, the market saw 88 stocks rise, 150 decline, and 44 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of 177,300 CW.