I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 9, 2025

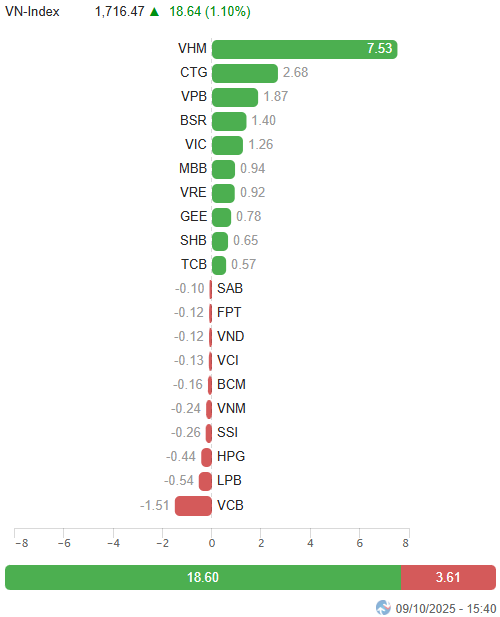

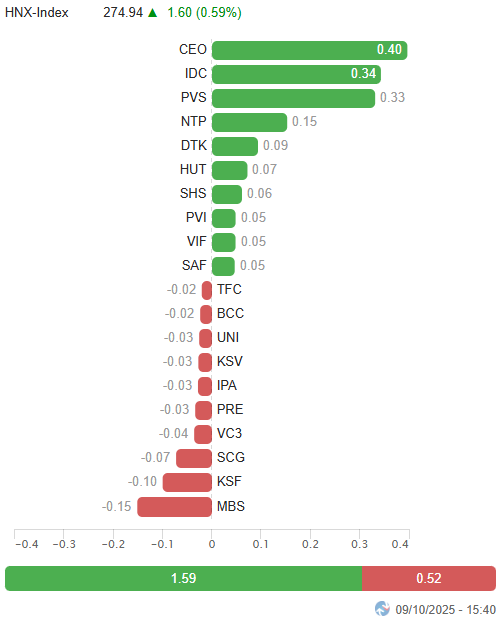

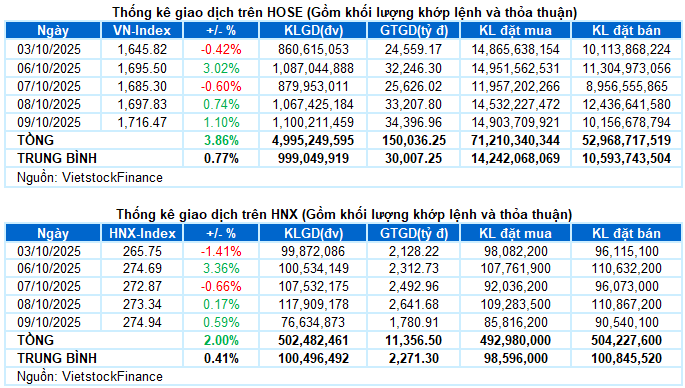

– Key indices maintained their upward trend during the October 9 trading session. Specifically, the VN-Index rose by 1.1%, reaching 1,716.47 points, while the HNX-Index also increased by 0.59%, closing at 274.94 points.

– Trading volume on the HOSE platform saw a slight uptick of 2.6%, surpassing 1 billion units. In contrast, the HNX platform recorded over 72 million matched orders, a 26.4% decline compared to the previous session.

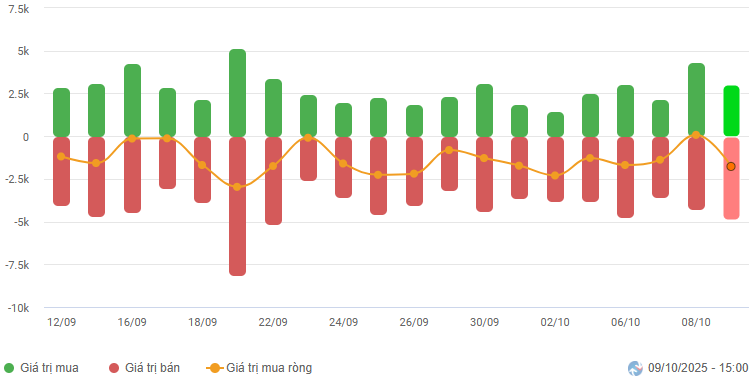

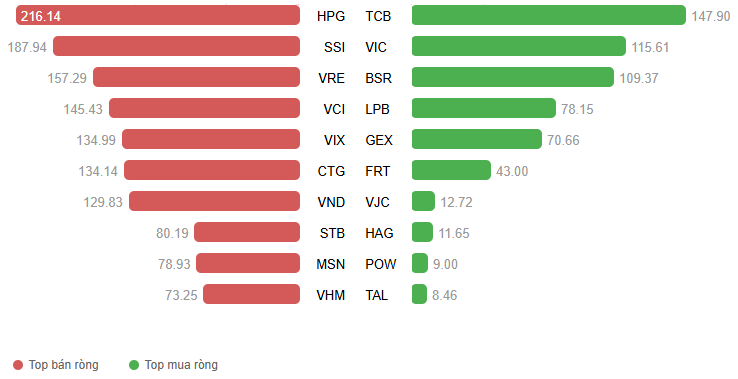

– Foreign investors resumed net selling, with values exceeding VND 1.6 trillion on the HOSE platform and VND 105 billion on the HNX platform.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market continued its upward trajectory during the October 9 session. The VN-Index effortlessly surpassed the 1,700-point mark shortly after opening and steadily expanded its gains, led by the Vin group stocks. However, divergence persisted in the broader market, with a tilt toward declining stocks. After reaching a nearly 20-point increase mid-morning, the VN-Index retreated and fluctuated around 1,710 points for most of the remaining session. Nevertheless, renewed buying interest toward the close propelled the VN-Index to end at 1,716.47 points, up 18.64 points from the previous session.

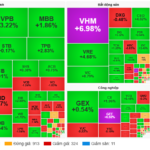

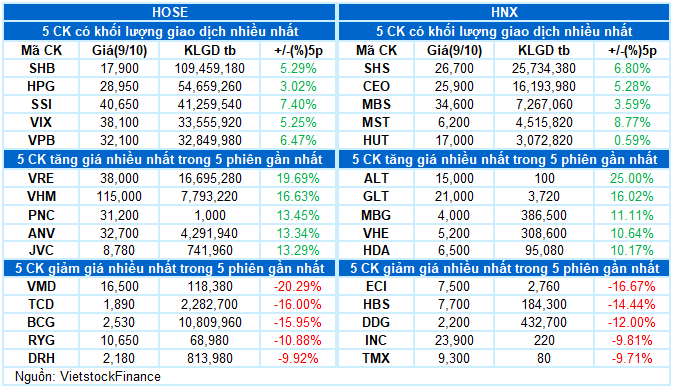

– In terms of influence, VHM remained the market leader today, contributing 7.2 points to the VN-Index. Additionally, CTG, VPB, BSR, and VIC collectively added over 7 points. Conversely, VCB exerted the most significant downward pressure, subtracting more than 1.5 points from the index.

Top Stocks Influencing the Index. Unit: Points

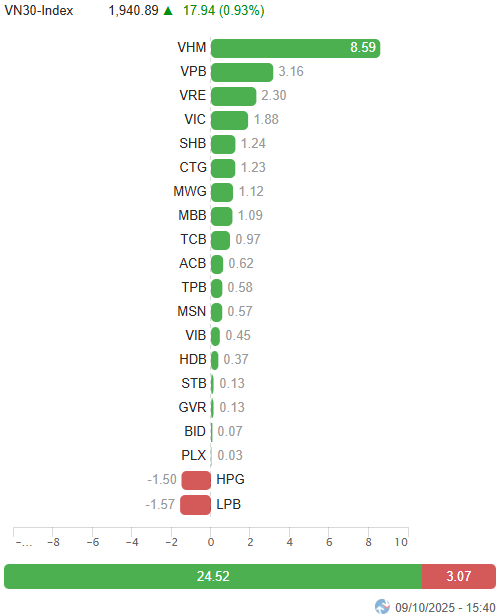

– The VN30-Index gained nearly 18 points, closing at 1,940.89 points. The basket’s breadth favored buyers, with 18 stocks rising, 11 falling, and 1 unchanged. Among these, VHM stood out with a vibrant purple hue. Following closely were VRE, CTG, SHB, and VPB, all surging over 3%. Conversely, LPB, SSI, VCB, and BCM faced selling pressure, declining more than 1%.

Green dominated most sectors. Energy led the market with a remarkable 3.61% increase, as stocks like BSR hit their ceiling, and PVS (+3.09%), PVD (+2.34%), OIL (+1.8%), and PVC (+1.74%) traded actively.

Meanwhile, the real estate sector also made a strong impression today, highlighted by stocks such as VHM reaching its upper limit, VRE (+4.68%), CEO (+4.02%), DIG (+5.32%), PDR (+2.64%), TCH (+1.29%), IDC (+3.46%), HDC (+2.82%), and VPI (+3.02%).

In contrast, the communication services sector lagged, declining 0.6%, as major industry stocks like VGI (-0.58%), FOX (-1.23%), YEG (-0.71%), CTR (-0.84%), and SGT (-1.73%) faced significant adjustment pressures.

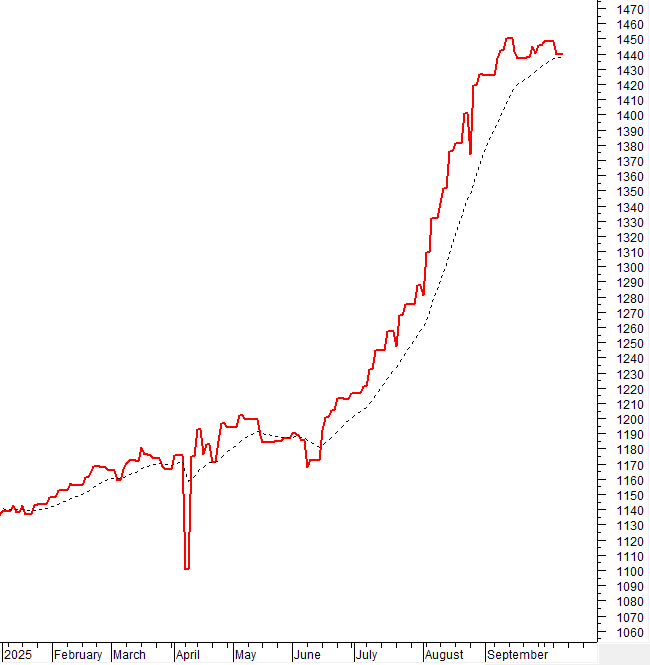

The VN-Index surpassed its September 2025 peak (equivalent to the 1,700-1,711 range) with trading volumes above the 20-session average, indicating a return of optimistic sentiment. The MACD and Stochastic Oscillator indicators continued their upward trend after generating buy signals.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Surpassing the September 2025 Peak

The VN-Index surpassed its September 2025 peak (equivalent to the 1,700-1,711 range) with trading volumes above the 20-session average, signaling a resurgence of optimistic sentiment.

Simultaneously, the MACD and Stochastic Oscillator indicators maintained their upward trajectory after issuing buy signals. If this trend persists, the current rally will be further reinforced, enabling the index to conquer new heights.

HNX-Index – Crossing Above the Middle Band of Bollinger Bands

The HNX-Index rose and crossed above the Middle Band of Bollinger Bands. However, trading volume needs to improve above the 20-session average to solidify the recovery.

Currently, the Stochastic Oscillator continues its upward movement after generating a buy signal, while the MACD is gradually narrowing its gap with the Signal line. If the MACD soon confirms a renewed buy signal, the index’s short-term outlook will become more positive.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors were net sellers during the October 9, 2025 trading session. If overseas investors continue this trend in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS FOR OCTOBER 9, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:20 October 9, 2025

Market Pulse 09/10: First-Ever Breach of 1,700 Points

At the close of the trading session on October 9th, Vietnam’s key stock market indices unanimously ended in the green. Specifically, the VN-Index climbed 18.64 points to reach 1,716.47, the HNX-Index rose 1.6 points to 274.94, and the UPCoM-Index gained 0.27 points, closing at 110.7.

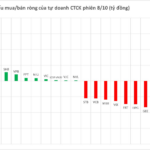

Proprietary Trading Firms Unexpectedly Turn Net Sellers, Offloading Over VND 1 Trillion in the October 8th Session

In the latest market analysis, proprietary trading firms have significantly offloaded shares, with VHM leading the sell-off. The stock witnessed the most substantial net selling pressure, amounting to a staggering -148 billion VND. This data highlights VHM as the most actively sold stock by securities companies’ proprietary trading desks.

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

Investors Remain Unfazed by Local Currency Depreciation Amid Strong Stock Market Performance

VinaCapital’s experts forecast a 4-5% depreciation of the Vietnamese Dong this year, with a similar outlook for next year. According to Mr. Kokalari, if the economy and stock market perform well, investors are unlikely to be overly concerned about this modest devaluation. Nonetheless, it remains a point worth monitoring.