This move comes two years after EVG signed a deposit contract with An Khanh Joint Venture Company Limited (An Khanh JVC, DAKC), the developer of the urban area.

According to the Board of Directors’ resolution dated October 7, EVG will liquidate the deposit contract HH5/2023/HĐĐC/AK-EVG signed in August 2023 and recover the entire deposit amount. These funds will be used to settle bank loans, with the remainder allocated for other investment and business activities. EVG also plans to shift its focus to developing the HH5 project with other investors in Q4 of this year.

The project in question, Sky Lumiere Center, is located on the HH5 land plot spanning over 4.8 hectares within the new urban area of Bac An Khanh. As planned, it will be developed into a commercial, service, office, and residential complex with a total construction floor area of more than 194,000 square meters.

A corner of the Splendora An Khanh urban area, now known as Mailand Hanoi City. Photo: Batdongsan.com.vn

|

According to the audited semi-annual financial report for 2025, EVG has short-term receivables of over 637 billion VND from An Khanh JVC, along with 59 billion VND in loan interest receivables as per the agreement signed by both parties in late 2024. EVG has a long-term loan of 523 billion VND from a bank branch in Ha Nam at an interest rate of 12% per annum to execute this contract, with the entire rights and interests related to the deposit contract pledged as collateral.

In reality, EVG is not the project developer but is only at the deposit stage to acquire a portion of the project. According to the company’s leadership, the delay in implementation stems from An Khanh JVC having to seek adjustments to the investment policy, prolonging the transfer process. Meanwhile, EVG continues to incur significant periodic interest expenses, increasing its financial burden.

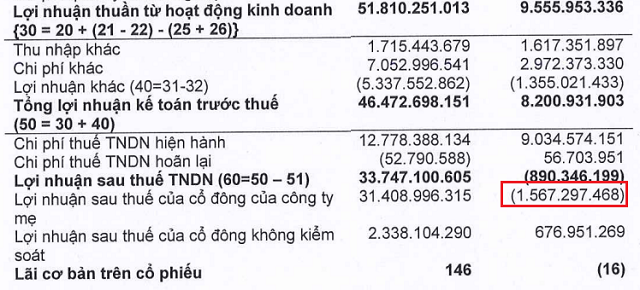

Another critical factor is accounting regulations. Previously, EVG applied Accounting Standard 16 to capitalize interest expenses into the project’s value. However, under new guidelines from the State Securities Commission and the Vietnam Association of Accountants and Auditors, the company must recognize the entire interest expense as a production and business cost for the period, turning profits for 2023-2024 into losses, despite EVG having fulfilled its corporate income tax obligations.

Everland turned profits into losses in 2023 on the 2024 audited financial statements. Source: Everland’s 2024 audited financial statements

|

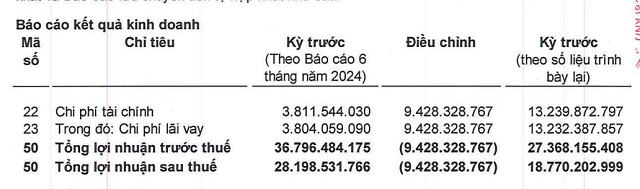

Everland’s increased interest expenses in the first half of 2024 on the reviewed semi-annual financial statements for 2025 have impacted the company’s overall business performance. Source: Everland’s 2025 reviewed semi-annual financial statements

|

If the delay continues, interest expenses will keep being directly recognized as a one-time cost, severely affecting EVG’s business results. Therefore, recovering the deposit at this time is seen as a move to limit financial losses. “We are recalculating everything,” EVG’s leadership shared at the 2025 annual general meeting.

EVG’s leadership stated that the company is only participating in about 15% of the HH5 project’s value, with the remainder coordinated with other partners due to the large investment scale. The fact that the process has only reached the deposit stage is explained by EVG’s need to balance and allocate capital across multiple concurrent projects, preventing deeper involvement at this time.

The auditor of the 2025 semi-annual financial report also emphasized that the slower-than-planned transfer process has forced An Khanh JVC to bear loan interest costs for EVG from March 2024 until the transfer is completed, as per the contract addendum between the two parties.

The change in accounting methods has significantly altered EVG’s financial structure, sharply increasing financial costs in the first half of 2024. Consequently, the net profit for the first half of 2025 reached approximately 20 billion VND, up from over 17 billion VND in the same period last year (after adjustments), despite revenue dropping by 40% to around 387 billion VND.

Everland Group was established in 2009, initially operating in the construction materials supply and trading sector. Later, the company shifted its focus to real estate investment, particularly in the tourism and resort segment. Currently, Everland’s flagship project is the Crystal Holidays Harbour Van Don tourism, resort, and entertainment complex in Quang Ninh, with a total investment of over 5.5 trillion VND.

|

An Khanh Joint Venture Company Limited (An Khanh JVC) was established in 2008 in Hanoi with an initial charter capital of 384 billion VND. The company is a joint venture between Vinaconex (VCG) and Posco E&C (South Korea), each holding 50% of the capital. By 2017, Posco’s stake was acquired by another company, and the charter capital was increased to over 680 billion VND. In early 2018, the position of General Director and legal representative shifted from Mr. Park Jong Jin (South Korean national) to a Vietnamese individual. By August 2020, Vinaconex divested its stake to Pacific Star Investment and Development JSC, raising An Khanh JVC’s charter capital to 780 billion VND, then significantly to 5.98 trillion VND by the end of 2021. The new urban area of Bac An Khanh (now Mailand Hanoi City) is located in the former Hoai Duc district, Hanoi. The project covers 264 hectares with a total investment of approximately 38 trillion VND (equivalent to 2 billion USD), started in 2006, and was expected to be completed by 2015. The urban area includes apartments, villas, and townhouses, along with commercial centers, offices, recreational areas, and public utilities… Despite its large scale and prime location, An Khanh JVC has faced financial difficulties for many years. According to a report submitted to the Hanoi Stock Exchange, the company reported an after-tax loss of nearly 194 billion VND in 2021, and a profit of less than 4 billion VND in 2022, despite having equity of over 3.5 trillion VND. |

What did EVG’s leadership say about the project with a 1.5x cost overrun in Van Don?

– 12:00 09/10/2025

Why do many people buy real estate without a red book?

Recently, there has been a surprising increase in people searching for properties without a red book in the districts and neighboring areas of Hanoi. This trend has caught many real estate agents off guard.

Crystal Holidays Harbour Vân Đồn: Vibrant “Dragon Welcomes Prosperity and Fortune” Lunar New Year Celebration

On February 23, 2024, in Hanoi, Everland Van Don Joint Stock Company (a member of Everland Group) coordinated with An Viet Property Development Company to organize a new year kickoff event and introduce Crystal Holidays Harbour Van Don project. The event gathered over 100 guests, including Chairmen, CEOs, and Business Directors of professional real estate distribution agencies. All are ready and determined to “shake up” the real estate market in 2024 with the Crystal Holidays Harbour Van Don project.