FTSE Russell’s official announcement on October 8th regarding the market’s upgrade has opened up numerous opportunities for the capital market in the upcoming period. This upgrade brings new standards for transparency, discipline in information disclosure, and capital quality. The change is not merely a formal improvement but a profound adjustment in how the market prices and responds to risk. Undisciplined strategies based on short-term expectations will increasingly struggle to deliver stable and sustainable returns. For individual investors, this demands a structured portfolio management system, prioritizing financial goals, liquidity, risk tolerance, and operational costs.

From 2022 onwards, the consequences of individual investors holding illiquid portfolios have become evident, as unexpected market events disrupted investment plans. The key question is no longer which stock to buy but how to construct a multi-layered financial asset portfolio to ensure the achievement of financial goals. This shift in mindset will help mitigate the impact of short-term market fluctuations and reduce emotionally driven investment behavior. As a result, portfolios will not only generate profits but also deliver returns at the right time, meeting expectations and built on a solid foundation. This is crucial for the market’s stable operation and sustainable growth in the coming period.

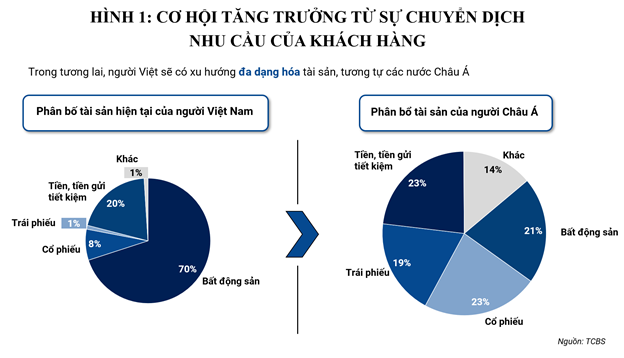

Trends in Diversifying Asset Classes

Every sustainable investment plan must start with a clear definition of its destination, including the target amount, timeframe, acceptable risk level, and progress measurement method. Without concrete answers to these questions, market decisions can easily become emotionally driven. Conversely, once goals are clearly defined, asset selection will follow specific criteria and logic, making the investment journey proactive and goal-oriented.

A well-structured portfolio should balance three core elements: liquidity, income, and growth. For liquidity, investors must consider the ability to convert assets into cash, the bid-ask spread, and market depth. This is crucial for families to handle unexpected financial needs without liquidating long-term assets.

For income, the goal is to establish a stable periodic cash flow through coupon payments, dividends, or rental income, reducing the pressure to sell during unfavorable market conditions. Meanwhile, growth aims to increase the real value of assets above inflation through accumulated corporate profits, stock revaluation, and investment in new business models. While growth offers higher profit potential, it also entails greater volatility and longer holding periods.

The illustration highlights the significant difference in liquidity between individual investor portfolios in Vietnam and other Asian countries. Vietnamese investors hold a large proportion of illiquid assets, primarily real estate, accounting for 70% of their portfolios, compared to 21% in Asia. Meanwhile, financial assets are underrepresented, with stocks at 8% versus 23% and bonds at 1% versus 19%. Additionally, liquidity-supporting and diversifying assets like deposits and alternative investments are underutilized.

Since 2022, many households have been in a passive state, with most assets tied up in real estate, while cash needs for loans, tuition, and medical expenses have surged. This structure narrows the liquidity safety margin, forcing people to sell financial assets or borrow at high costs, significantly reducing the likelihood of achieving financial goals. In contrast, neighboring markets with higher financial asset allocations enjoy the flexibility to adjust to changing investment environments.

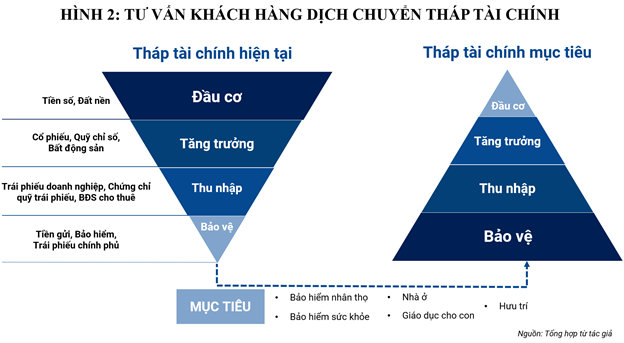

Asset Tower Management Approach

To transition from emotional investing to systematic financial management, investors need not only clear goals but also a framework for strategic asset allocation. The asset tower model is a simple yet effective tool, allowing investors to build portfolios in distinct layers, aligned with life stages and risk tolerance.

The asset tower consists of four layers. The foundation is the protection layer, including emergency funds, deposits, basic risk insurance, and short-term government bonds. This layer is used to handle emergencies and maintain psychological stability.

Above the protection layer is the income layer, comprising carefully selected corporate bonds, bond funds, and rental properties, providing regular cash flow to support daily expenses. Next is the growth layer, including stocks and index funds, aimed at asset accumulation through profit growth and corporate revaluation. At the top is the speculative layer, where high-risk opportunities are allocated a small proportion, with strict position control and stop-loss rules to limit losses during market volatility.

The core principle of the asset tower is to build a strong foundation before expanding to higher layers. However, many portfolios are currently imbalanced, with assets concentrated in growth and speculative layers, while protection and income layers are underfunded. This imbalance makes portfolios vulnerable to market shocks.

Quantitatively, portfolios lacking a protection layer typically experience larger declines, take longer to recover, and have a lower probability of achieving financial goals compared to those built sequentially from the foundation up. Therefore, prioritizing emergency funds, debt repayment plans, and risk insurance is essential before considering growth or speculative assets.

Financial advisors play a crucial role in consulting and structuring client portfolios. They should begin by translating client goals into a specific investment policy statement, documenting financial objectives, timeframes, risk tolerance, and periodic cash flow needs.

After standardization, advisors assess the current asset tower by identifying and classifying all assets and liabilities, evaluating emergency fund adequacy, insurance requirements, and asset liquidity. Based on this analysis, they compare it with the ideal asset tower to make necessary adjustments.

Specifically, the protection layer should cover living expenses for 6 to 12 months and include appropriate insurance. The income layer should generate cash flow to offset part of fixed expenses, enhancing family income stability. The growth layer must align with risk appetite and holding periods. The speculative layer should have a clear allocation limit.

Adjustments should be phased. In the short term, prioritize bad debt resolution, increase liquidity, and reduce speculative positions. In the medium term, restructure illiquid assets and shift towards more flexible financial assets. Long-term, focus on cost optimization and adopt a core-satellite portfolio structure to ensure stability and adaptability in changing market conditions.

With the market upgrade, financial products will become more diverse, offering flexible solutions for family financial needs. The market will shift from seeking short-term opportunities to optimizing portfolios for long-term financial goals. Each investment tool has long-term value when used appropriately and allocated correctly within the overall portfolio. As investors shift from trying to beat the market to achieving specific life goals, they will feel more secure amid short-term fluctuations and remain committed to their investment strategies. This contributes to the market’s stable and sustainable growth, enhancing its role as a long-term capital channel for the economy.

– 10:00 10/10/2025

FTSE Russell Highlights Two Major Implications of Vietnam’s Stock Market Upgrade

Following FTSE Russell’s official confirmation of Vietnam’s upgrade to Secondary Emerging Market status, the firm’s leaders shared notable insights into the decision.