Following a market adjustment, leading stocks rebounded, driving the VN-Index above the 1,700-point milestone. The VN-Index closed the October 9th session at 1,716, marking a nearly 19-point increase from the previous session. Market liquidity surged to nearly VND 34 trillion, reflecting heightened investor optimism following the official announcement of the market upgrade.

Foreign trading activity was a notable downside, with net selling reaching VND 1,742 billion across the market.

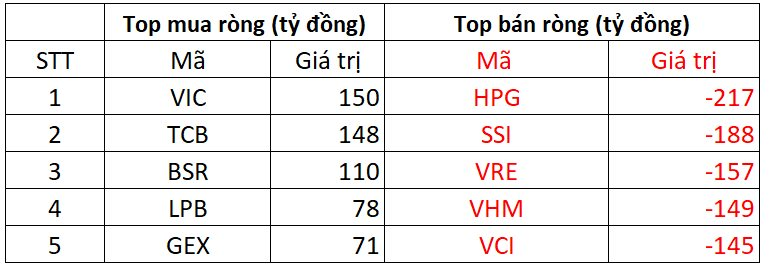

On HOSE, foreign investors net sold VND 1,604 billion.

On the buying side, VIC led foreign purchases on HOSE with over VND 150 billion. TCB followed closely with VND 148 billion in foreign buying. BSR and LPB also saw significant foreign interest, with purchases of VND 148 billion and VND 110 billion, respectively.

Conversely, HPG saw the highest foreign selling at VND 217 billion. SSI and VRE also faced significant selling pressure, with VND 188 billion and VND 157 billion sold, respectively.

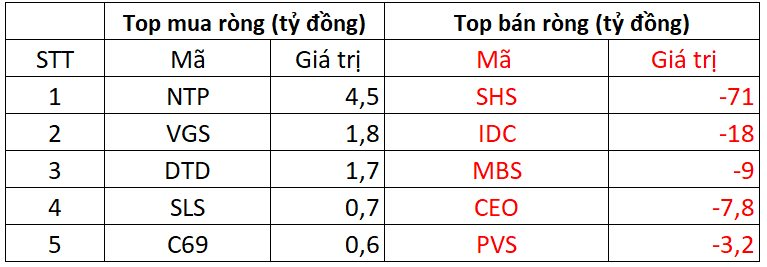

On HNX, foreign investors net sold VND 105 billion.

NTP led foreign purchases on HNX with VND 4.5 billion. VGS followed with VND 1.8 billion in foreign buying. DTD, SLS, and C69 also saw modest foreign buying interest.

SHS faced the most foreign selling pressure on HNX, with nearly VND 71 billion sold. IDC, MBS, and CEO also saw notable selling, ranging from VND 8 billion to VND 18 billion.

On UPCOM, foreign investors net sold VND 33 billion.

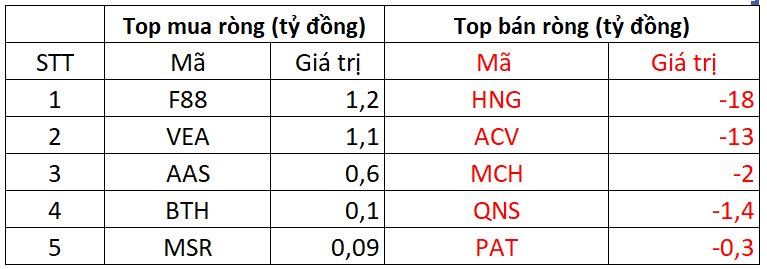

F88 led foreign purchases on UPCOM with VND 1.2 billion. VEA and AAS also saw modest foreign buying interest.

HNG faced the most foreign selling pressure on UPCOM, with VND 18 billion sold. ACV, MCH, and others also saw foreign selling activity.

Vietstock Daily 10/10/2025: Scaling New Heights?

The VN-Index has surpassed its previous peak from September 2025 (equivalent to the 1,700-1,711 point range), accompanied by trading volumes exceeding the 20-session average, signaling a resurgence of market optimism. Simultaneously, both the MACD and Stochastic Oscillator indicators continue their upward trajectory, reinforcing buy signals. Should this momentum persist, the current rally is poised to strengthen, paving the way for the index to achieve even greater heights.