Vietnam Government Bond Market in September: Vibrant Trading, Sustained Liquidity

|

In September 2025, the Hanoi Stock Exchange (HNX) conducted 16 auctions for government bonds issued by the State Treasury, raising VND 16,975 billion.

For the first nine months of the year, the total mobilization value reached VND 255,688 billion, fulfilling over 51% of the annual plan. The majority of bonds issued were 10-year maturities, accounting for nearly 93% of the total issuance. Winning auction rates saw a slight increase, with 3.03% for 5-year bonds, 3.59% for 10-year bonds, and 3.64% for 30-year bonds.

In the secondary market—where previously issued bonds are traded—the listed value reached nearly VND 2,450 trillion, up from the previous month. Average trading volume was VND 16,771 billion per session, with 71.7% being Outright transactions (outright buy/sell) and 28.3% being Repos (buy/sell with repurchase agreement).

Foreign investors accounted for approximately 4% of trading value, net selling VND 676 billion in September. However, cumulatively for the first nine months, foreign investors remained net buyers at VND 2,552 billion, reflecting sustained confidence in Vietnam’s bond market.

– 09:00 09/10/2025

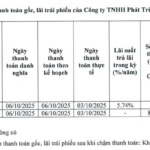

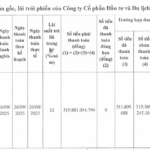

Phú Mỹ Hưng Completes Settlement for a Bond Lot

Phú Mỹ Hưng has successfully settled its TW000F169016 bond series, paying off the principal amount of 80 billion VND and over 1.1 billion VND in interest. This marks the complete redemption of the bond issuance.