This is a positive development for Vietnam’s market after years of anticipation since being placed on the watchlist in 2018. Following the announcement of the upgrade, numerous assessments have been made.

Market upgrade is positive news

In SSI Securities’ livestream on the morning of October 8th, Mr. Pham Luu Hung – Chief Economist, Director of SSI Research, Head of Training & Development at SSI Securities Corporation stated that FTSE Russell’s decision to upgrade has alleviated many investor concerns.

The upgrade demonstrates that Vietnam has met all global standards. This is excellent news. The need for re-evaluation in March 2026 is also beneficial, as it helps us identify challenges to address them promptly.

The SSI expert believes the upgrade milestone is long-awaited and highly positive for Vietnam’s stock market development. However, the changes made by regulators and market participants over the past 1-2 years will gradually impact the market’s attractiveness to foreign institutional investors.

Mr. Pham Luu Hung – Chief Economist, Director of SSI Research, Head of Training & Development at SSI Securities Corporation discusses market upgrade in SSI’s October 8th livestream.

|

According to PHS Securities’ report, the upgrade will boost foreign investor confidence in Vietnam’s capital market, reduce capital costs, and lower new stock issuance costs. A developed capital market will facilitate listed companies’ fundraising, expand production, and contribute to Vietnam’s GDP growth of around 8% and higher in the new economic era.

The market’s new development phase will encourage listings, diversifying market offerings and expanding Vietnam’s capital market. In reality, after a prolonged lull, Vietnam’s IPO trend is warming up with major names like TCBS, VPBS, F88, and upcoming VPS, Highlands, and Bach Hoa Xanh.

A developed capital market reduces corporate reliance on bank credit and attracts foreign direct investment (FDI). Inbound foreign capital supports production, exports, infrastructure investment, and exchange rates, which foreign investors closely monitor when investing in Vietnam.

What capital inflows are expected?

According to PHS, Vietnam is expected to attract significant international capital after FTSE Russell’s upgrade to Emerging Market status. The upgrade broadens global investor access, particularly for ETFs and mutual funds tracking FTSE indices. PHS estimates $5 billion in active and passive fund inflows.

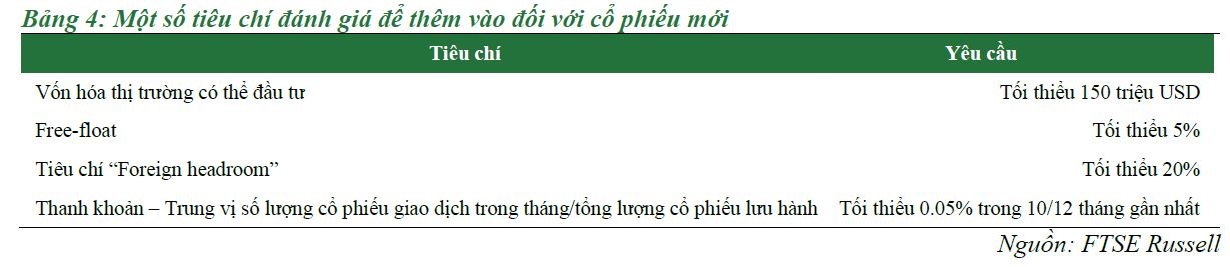

FTSE Russell’s latest report lists 62 stocks in the FTSE Vietnam All-Share Index, including 32 in FTSE Vietnam. Post-upgrade, these stocks will benefit first. However, to attract Emerging Market (EM) fund investment, stocks must meet FTSE Russell’s strict criteria.

ACBS Securities’ update calls the upgrade positive for Vietnam’s stock market after years of waiting. ACBS views the March 2026 review as technical. The September 2026 effective date may delay foreign capital inflows by about six months.

Post-FTSE upgrade, Vietnam’s market may attract two capital types:

First, passive capital automatically allocated at the effective date. Global ETFs like FTSE Emerging Markets ETF, iShares Core MSCI EM ETF, and Vanguard FTSE EM ETF will allocate $600 million to $1.5 billion to Vietnam. However, the effective date for Vietnam’s ETF inclusion is September 2026.

Direct beneficiaries are blue-chip stocks with high foreign ownership limits and liquidity.

The second, larger potential inflow is active capital, which is more stable and long-term, targeting companies with positive earnings prospects, transparency, and good governance. Active funds favor banking, retail, infrastructure, and technology stocks.

Active funds may invest $3 to $7 billion. They can start investing post-upgrade or after the March 2026 review. However, their actions depend on Vietnam’s macroeconomic outlook, including GDP growth, VND depreciation, and VN-Index and stock valuations.

What’s next after FTSE upgrade?

ACBS predicts Vietnam’s next step post-FTSE upgrade is MSCI Emerging Market status. Currently, Vietnam isn’t on MSCI’s watchlist. Meeting MSCI’s stricter criteria, Vietnam could be added to the watchlist by June 2026, with upgrade potential from 2028-2030.

PHS notes challenges like limited brokerage financial capacity in non-pre-funded trading, incomplete transaction failure systems, and exchange rate pressures causing foreign outflows. Global economic-political instability and competition from China, South Korea, Japan, and Taiwan may reduce Vietnam’s short-term appeal.

Vietnam must address global brokerage criteria. SSI’s Chief Economist emphasizes resolving this issue to attract more foreign investors. Foreign investors seek smoother mechanisms to trade via global brokers. This could be resolved within two months by amending relevant circulars.

Easier global brokerage access could attract new foreign investors, increasing new foreign accounts. Vietnam’s appeal also lies in its growth story and listings. Boosting IPOs and new listings will enhance foreign investor interest, deepening the market beyond the upgrade.

– 09:52 08/10/2025

Stock Market Shares: A Compelling Choice to Ride the Upgrade Wave

Vietnam’s official upgrade to secondary emerging market status by FTSE Russell unlocks significant opportunities for the securities sector, particularly for companies with strong fundamentals, robust growth potential, and the capability to attract foreign capital. Amid this backdrop, VPBankS launches its record-breaking IPO, offering an attractive opportunity for investors looking to capitalize on this market elevation.

Prime Minister Directs Key Solutions to Sustain Vietnam’s Stock Market Growth

On October 8, 2025, Prime Minister Phạm Minh Chính signed Directive No. 192/CĐ-TTg regarding the upgrading of Vietnam’s stock market. The directive acknowledges the securities industry’s concerted efforts to implement reforms aimed at fostering a transparent, modern, and efficient market aligned with international standards.

FTSE Russell Upgrades Vietnam: What Do Global Experts Think?

FTSE Russell’s decision to upgrade Vietnam from a frontier market to a secondary emerging market has captured significant attention from international analysts and experts. This marks the first time Vietnam has been elevated by a global index provider, paving the way for the potential influx of billions in new investment capital.