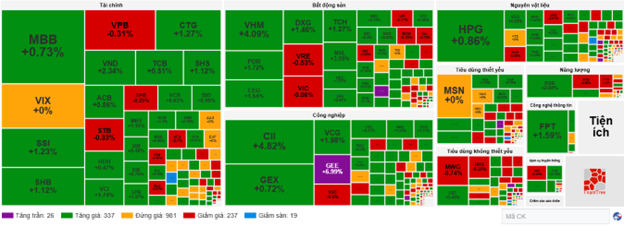

Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 998 million shares, equivalent to a value of more than 32 trillion VND; the HNX-Index reached over 90.9 million shares, equivalent to a value of more than 2.1 trillion VND.

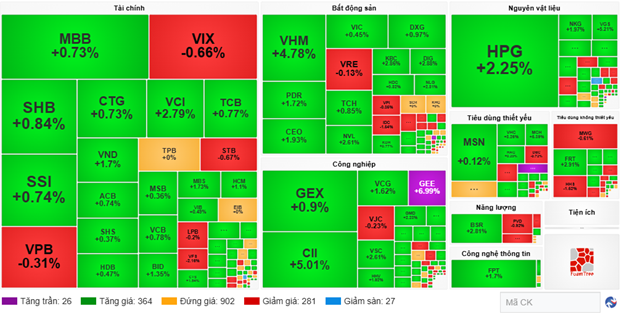

The VN-Index opened the afternoon session with a favorable trend as buyers consistently maintained their dominance, driving the index upward despite the resurgence of selling pressure, and closed in a positive green zone at the end of the session. In terms of influence, VIC, VHM, VRE, and HPG were the most positively impactful stocks on the VN-Index, contributing a 22.1-point increase. Conversely, TPB, VNM, VIX, and BVH faced selling pressure, but their impact was insignificant.

| Top 10 Stocks Influencing the VN-Index on October 10, 2025 (in points) |

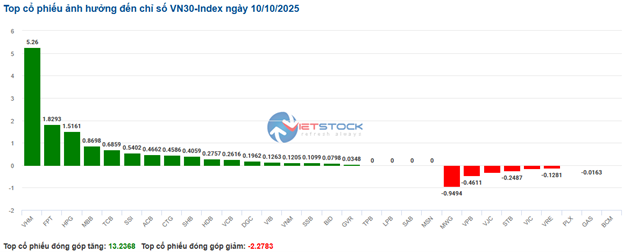

In contrast, the HNX-Index showed a rather pessimistic trend, negatively influenced by stocks such as KSF (-3.76%), IDC (-2.06%), PVS (-1.8%), and SHS (-0.75%).

| Top 10 Stocks Influencing the HNX-Index on October 10, 2025 (in points) |

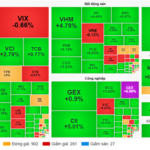

At the close, the market gained points with green dominating all sectors. The real estate sector led the market with a 4.81% increase, primarily driven by VIC (+6.96%), VHM (+6.96%), VRE (+6.18%), and KBC (+2.15%). Following the recovery were the essential consumer goods and information technology sectors, with increases of 1.91% and 1.89%, respectively, led by stocks such as SBT (+7%), MCH (+7.94%), MSN (+1.2%), VHC (+2.36%), FPT (+2.02%), CMG (+1.01%), and POT (+0.52%).

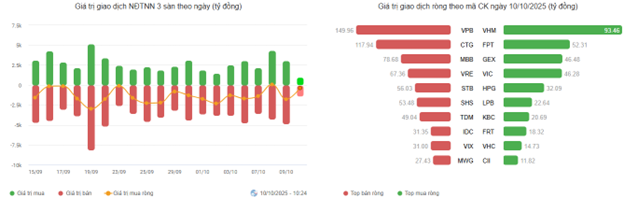

In terms of foreign trading, foreign investors continued to net sell over 540 billion VND on the HOSE, focusing on stocks such as VPB (310.38 billion), CTG (263.14 billion), MSN (249.69 billion), and VRE (195.08 billion). On the HNX, foreign investors net sold over 190 billion VND, concentrated in SHS (144.49 billion), IDC (99.61 billion), PVS (11.01 billion), and VFS (3.45 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Green Dominance Continues

Green remained dominant until the end of the morning session. At the mid-session break, the VN-Index increased by more than 15 points (+0.89%), reaching 1,731.73 points; however, the HNX-Index slightly decreased, hovering around the reference level at 274.89 points. Market breadth favored buyers with 390 advancing stocks and 308 declining stocks.

In terms of influence, VHM was the standout performer this morning, contributing a 5.4-point increase to the VN-Index. Meanwhile, the top 10 negatively influencing stocks only took away 1 point from the overall index.

| Top 10 Stocks Influencing the VN-Index in the Morning Session of October 10, 2025 |

In terms of sectors, green dominated most stock groups. The information technology sector temporarily led the market with a 1.62% increase, primarily driven by the two leading stocks FPT (+1.7%) and CMG (+1.26%).

Additionally, the real estate and industrial sectors traded actively, with buying interest focused on stocks such as VHM (+4.7%), PDR (+1.72%), CEO (+1.93%), NVL (+2.61%), KBC (+2.86%), NLG (+2.94%), and DIG (+3.13%); CII (+5.01%), VCG (+1.62%), VSC (+2.61%), GMD (+2.23%), and GEE reaching their upper limits.

On the other hand, the essential consumer goods sector temporarily lagged with a slight 0.1% decrease, influenced by the adjustments in VPL (-0.57%), MWG (-0.61%), and HHS (-1.52%). However, buying interest remained in stocks such as FRT (+2.91%), HUT (+2.35%), DGW (+1.34%), VGG (+1.11%), and PET (+1.04%).

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of 490.73 billion VND across all three exchanges. Selling pressure was concentrated in VPB and CTG, with values of 198.85 billion and 186.79 billion, respectively. Meanwhile, HPG (193.89 billion VND) and VHM (163.69 billion VND) led the net buying list.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of October 10, 2025 |

10:30 AM: Capital Flows into Financial & Real Estate Stocks, VN-Index Maintains Green

Investor sentiment is somewhat hesitant, with the VN-Index fluctuating around the reference level. Real estate and financial stocks are leading the market’s upward trend.

The breadth of the VN30 group is tilted towards green. Among these, VHM, FPT, HPG, and MBB contributed 8.26 points, 1.82 points, 1.51 points, and 0.86 points, respectively, to the overall index. Conversely, MWG, VPB, VJC, and STB faced selling pressure, taking away more than 1.9 points from the VN30-Index.

Source: VietstockFinance

|

In the financial sector, four stocks significantly influenced the VN-Index: CTG (+1.64%), VCB (+0.47%), BID (+0.86%), and MBB (+1.28%).

Additionally, real estate stocks also spread green, with major players such as VHM (+3.65%), KBC (+3%), NVL (+3.59%), TCH (+1.27%), and PDR (+1.93%). Most other stocks remained stable or slightly decreased.

On the other hand, the communication services sector showed divergence, with red dominating. Specifically, stocks such as VGI, FOX, SGT, and VNB all experienced slight decreases ranging from 0.15% to 1.69%.

Source: VietstockFinance

|

Overall market breadth favored buyers, with over 330 advancing stocks, higher than the approximately 230 declining stocks. The VN-Index increased by more than 12.8 points, reaching 1,729 points; the HNX-Index rose by 0.21%, hovering around 275 points, and the UPCoM-Index increased by 0.51%.

Total trading volume across all three exchanges exceeded 413 million units, corresponding to over 12.2 trillion VND. A downside is that foreign investors continued to net sell over 362 billion VND, concentrated in VPB, CTG, and MBB.

Source: VietstockFinance

|

Opening: Green Dominates Early Session

At the start of the session on October 10, as of 9:30 AM, the VN-Index surged by more than 9 points from the opening and fluctuated around 1,725 points. The HNX-Index saw a slight increase, maintaining 276 points.

Real estate was among the top-performing sectors, with leading stocks such as VHM (+3.13%), CEO (+1.93%), PDR (+2.15%), and NVL (+2.29%).

The energy sector showed impressive growth from the beginning of the session, driven by significant contributions from oil and gas stocks such as BSR (+3.51%), PLX (+0.15%), PVT (+0.28%), and VTO (+0.42%).

In addition to these two sectors, many large-cap financial stocks also showed positive movements. TCB, SSI, HDB, and SHB contributed to supporting the index.

– 15:25 10/10/2025

Technical Analysis Afternoon Session 09/10: Anticipating a Break Above Previous Highs

The VN-Index continues its upward trajectory, with expectations high that it will surpass its previous peak from September 2025 (equivalent to the 1,700-1,711 point range). This optimism is fueled by the emergence of buy signals from both the MACD and Stochastic Oscillator indicators. In contrast, the HNX-Index currently trades below the Middle line of the Bollinger Bands.

Technical Analysis Afternoon Session 10/10: Anticipating a Break Above Previous Highs

The VN-Index has continued its upward trajectory, surpassing its previous all-time high after decisively breaking through the September 2025 peak (equivalent to the 1,700–1,711 point range). Meanwhile, the HNX-Index remains in a state of consolidation, fluctuating around the Middle line of the Bollinger Bands.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.

Vietnam Airlines Stock Soars, Yet Pyn Elite Fund Snaps Four-Month Winning Streak

Pyn Elite Fund stands as one of the largest foreign funds in the market, boasting a managed portfolio valued at an impressive 987 million EUR (over 30 trillion VND, equivalent to approximately 1.1 billion USD) as of the end of September.