Services

Amid the vibrant Vietnamese stock market eagerly awaiting an upgrade, with liquidity surpassing expectations, MBS continues to make its mark as one of the first securities companies in the HOSE Top 10 market share to release its Q3/2025 financial report, showcasing remarkable growth across multiple metrics.

Profit Nearly Doubles – Joining the “Trillion-Dong Club”

According to the recently published financial report, alongside a robust 44% revenue growth in Q3, MBS effectively managed operational costs, with total expenses rising only 32%—significantly lower than revenue growth. As a result, in Q3/2025 alone, MBS recorded a profit of 418 billion VND, 1.9 times higher than the same period last year, bringing the 9-month cumulative profit to 1,030 billion VND. This milestone marks MBS‘s first entry into the securities industry’s Trillion-Dong Profit Club. With this achievement, MBS has completed 79% of its annual plan and is well-positioned to meet its full-year profit target in the final quarter.

Market Share Surges – Proprietary Trading Reaps Rewards

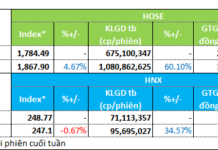

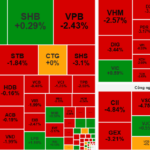

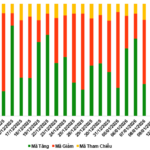

The brokerage segment remains the primary driver of MBS‘s revenue growth. Q3 brokerage revenue reached 370 billion VND, 2.8 times higher than the same period last year, pushing the 9-month cumulative brokerage revenue to 695 billion VND, a 40% year-on-year increase. Consequently, MBS‘s market share on HOSE surged to 5.61%, propelling it into the Top 6 securities companies with the largest market share.

Additionally, Q3 financial services revenue totaled 408 billion VND, a 53% year-on-year increase, bringing the cumulative revenue in this segment to over 990 billion VND. MBS‘s stock trading portfolio generated 157 billion VND in income, 4.8 times higher than the same period last year. Its hold-to-maturity investment portfolio (HTM) contributed 228 billion VND, 1.9 times higher than the same period last year.

These figures represent a breakthrough in MBS‘s 25-year history, demonstrating its effective utilization of market opportunities and the successful integration of service revenue growth with proprietary trading.

Robust Financial Foundation – Industry-Leading Operational Efficiency

As of the end of Q3/2025, MBS‘s total assets surpassed 30,500 billion VND, a 38% increase from the beginning of the year. With an ROE of 15.8%, MBS remains among the companies with the highest operational efficiency in the industry. This clearly illustrates that MBS is not only expanding its scale but also optimizing profitability per unit of capital.

Customer Engagement – Investment in High-Quality Human Resources

Alongside business growth, MBS continuously strengthens customer engagement initiatives. The recently launched “Breakthrough Trading – Win VF3” program has garnered significant market attention, with MBS offering a VF3 electric car and hundreds of valuable prizes to active traders.

Industry experts note that such programs not only showcase MBS‘s financial strength and customer-centric approach but also reinforce its image as a modern, flexible, and user-experience-focused securities company. This is further evidenced by MBS‘s investment in human resources to enhance service quality for investors. Most recently, the company launched a recruitment drive for 100 top brokers with a 95%–100% commission rate, among the highest in the market, underscoring its commitment to sustainable development and service excellence.

|

From joining the Trillion-Dong Club to securing a Top 6 market share, MBS is proving its comprehensive development strategy: scaling operations, investing in talent, and creating tangible value for customers. As the stock market enters a new growth cycle, MBS exemplifies resilience, adaptability, and endurance in its pursuit of new milestones.

|

MBS, established in May 2000 as one of Vietnam’s first securities companies, is a subsidiary of Military Commercial Joint Stock Bank (MB). Currently, MBS is implementing a plan to increase its charter capital to nearly 6,700 billion VND, further solidifying its position as one of the market’s most robust and reputable securities companies. In August 2025, MBS joined the billion-dollar market capitalization group and was honored by Forbes in the TOP 50 Best Listed Companies in Vietnam for 2025. |

– 08:00 10/10/2025

Stock Market Shares: A Compelling Choice to Ride the Upgrade Wave

Vietnam’s official upgrade to secondary emerging market status by FTSE Russell unlocks significant opportunities for the securities sector, particularly for companies with strong fundamentals, robust growth potential, and the capability to attract foreign capital. Amid this backdrop, VPBankS launches its record-breaking IPO, offering an attractive opportunity for investors looking to capitalize on this market elevation.

Vingroup’s Affiliated Stock Surges to Ceiling: What’s Driving the Rally?

The stock price surged to VND 35,000 per share, marking a “sell-side vacuum” and reaching its highest level in over 3.5 years.

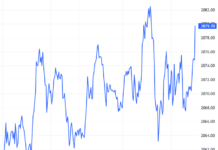

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.