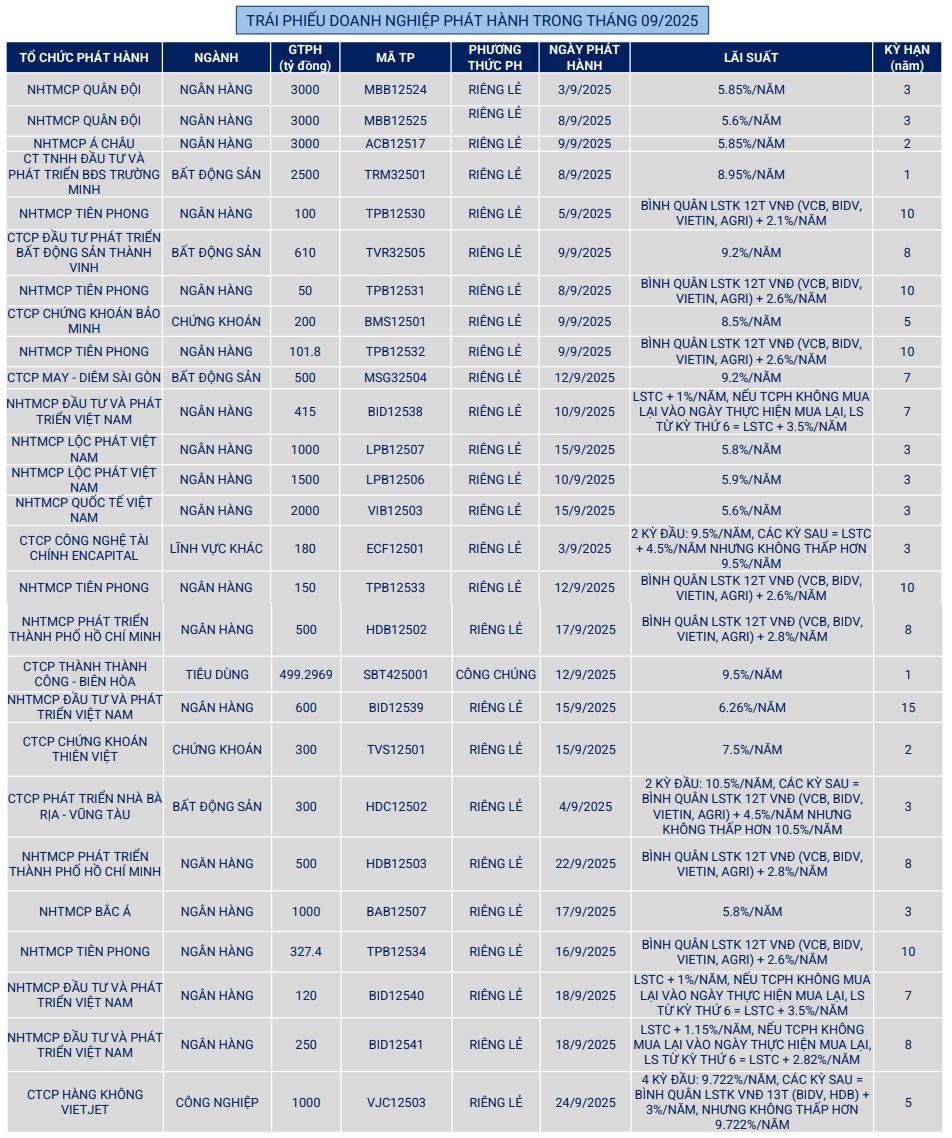

In September 2025, Vietnam witnessed 26 private corporate bond issuances totaling over VND 23.2 trillion, alongside one public issuance valued at VND 499 billion. For the first nine months of the year, private placements reached nearly VND 350 trillion, while public offerings amassed approximately VND 48.3 trillion.

Source: VBMA

|

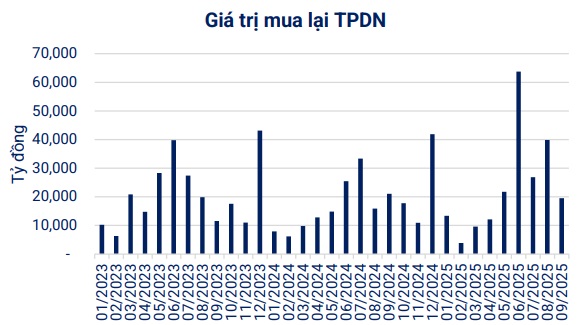

Regarding buybacks, companies repurchased over VND 19.5 trillion in bonds ahead of maturity in September, an 8% decline compared to the same period in 2024. For the remaining three months of 2025, an estimated VND 48 trillion in bonds will mature, with real estate bonds dominating at 38%, equivalent to over VND 18.3 trillion.

Source: VBMA

|

In terms of disclosure irregularities, five bond codes experienced delayed interest or principal payments totaling VND 150 billion in September.

On the secondary market, private corporate bond transactions in September 2025 reached nearly VND 151 trillion, averaging over VND 7.5 trillion per session, a 45% increase from August’s average.

Source: VBMA

|

Upcoming, two notable bond issuances are anticipated. Vingroup Corporation (HOSE: VIC) plans to issue private bonds in Q3/2025, capped at VND 2.5 trillion. These non-convertible, non-warrant bonds are asset-backed, with a face value of VND 100 million and a 2-year fixed interest rate.

Additionally, Vietjet Aviation JSC (HOSE: VJC) will issue private bonds in Q3 and Q4/2025, totaling up to VND 3 trillion. These “triple-free” bonds (non-convertible, non-warrant, unsecured) have a face value of VND 100 million, a 5-year term, and a mixed fixed-floating interest rate.

– 11:03 10/10/2025

The Rising Tide of Resale Condo Prices

The surge in secondary apartment prices can be attributed to a fundamental imbalance in the market dynamics of supply and demand.

Corporate Bonds Rebound, Redemption Pressure Mounts

The Vietnamese corporate bond market is witnessing a notable recovery in both issuance and buyback activities, indicating a resurgence of investor and business confidence. However, alongside these positive signals, there is a mounting maturity pressure, particularly from the real estate sector, which faces significant challenges regarding cash flow and repayment capabilities.

The Ultimate Guide to Secondary Apartment Hunting in Hanoi: Navigating the Fifth Consecutive Quarter of Limited Mid-Range New Launches

The Hanoi real estate market witnessed a notable surge in the second quarter of 2025, with approximately 28,900 property transactions, signifying a remarkable 56% increase compared to the previous quarter. Notably, secondary transactions dominated the market, accounting for 20,400 units, an impressive 2.4 times higher than the 8,500 primary transactions.