According to Vietnam Customs statistics, cotton imports in September reached over 102,000 tons, valued at more than $166 million, a decrease from the previous month.

In the first nine months of the year, Vietnam imported over 1.3 million tons of cotton, worth over $2.2 billion, marking a 19% increase in volume and a 3% rise in value compared to the same period last year.

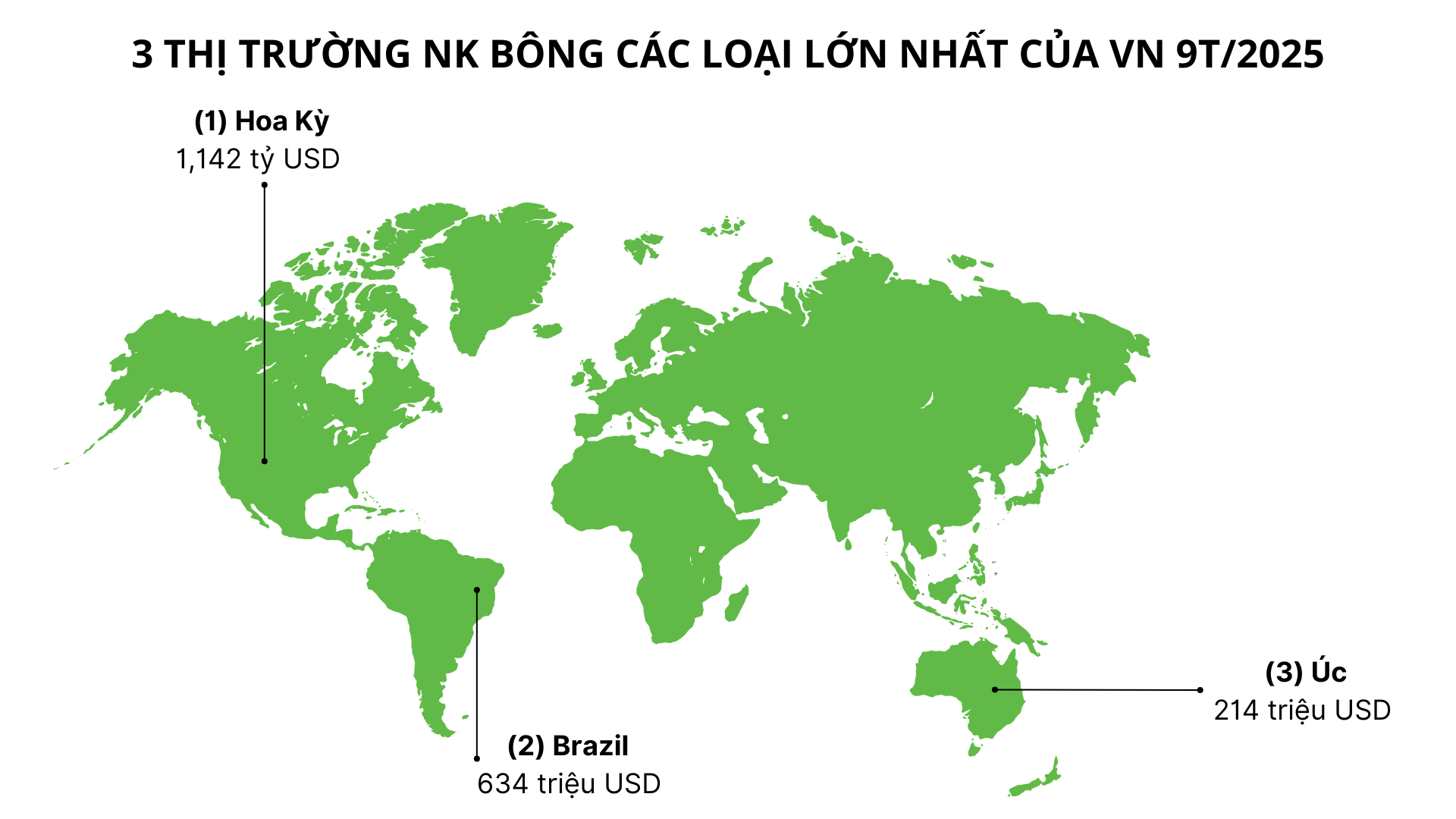

During this period, the U.S. remained Vietnam’s largest cotton supplier, providing 650,000 tons, surpassing $1.1 billion, with a significant 127% increase in volume and 91% in value compared to 2024.

The average price stood at $1,757 per ton, a 15% decrease year-over-year. The U.S. market’s share in Vietnam’s total cotton imports has grown to approximately 49%.

Brazil ranked second with 365,000 tons in the first nine months, equivalent to $634 million, showing an increase in volume but a decrease in value. Meanwhile, imports from Australia saw a sharp decline in both volume and value.

Vietnam is the world’s third-largest cotton importer, consuming 1.5 million tons annually. It also ranks as the sixth-largest exporter of fiber and the third-largest exporter of textiles and apparel globally, following China and Bangladesh.

Despite being a key export sector, Vietnam’s textile industry heavily relies on imported raw materials, with a dependency rate of approximately 60%. Cotton is an essential raw material for producing yarn, fabric, and garments. The U.S., as the world’s largest cotton exporter, offers high-quality cotton favored globally.

According to Nikkei Asia, U.S. cotton exports to China plummeted in the first half of 2025, while significantly increasing in other Asian markets, particularly Vietnam. This shift reflects the global apparel supply chain’s realignment due to tariffs and U.S.-China trade tensions.

LSEG data reveals that U.S. cotton exports to China in the first six months dropped by about 90% year-over-year. Conversely, exports to markets like Pakistan, Turkey, and especially Vietnam saw notable increases, with Vietnam’s imports nearly tripling.

This shift also impacts the U.S. domestic market. The U.S. Department of Agriculture reported that cotton exports in the fiscal year ending July reached 11.9 million bales, a 1% increase from the previous year. The decline in Chinese demand was offset by rising demand from other markets. Exports for the upcoming fiscal year are projected at around 12 million bales. Experts predict continued growth in U.S. cotton exports to non-Chinese markets.

A Cornell University study forecasts a slight increase in global cotton trade for the 2025/26 season, with Brazil and the U.S. as leading exporters, and Bangladesh and Vietnam as top importers.

Vietnam and Bangladesh are expected to import 8.1 million bales of cotton, with Vietnam setting a new record as the largest importer.

ACB Reaffirms Commitment to Supporting Businesses at the “Textile and Supply Chain Industry Conference – Solutions Amidst Volatility”

The ACB-hosted conference provided a comprehensive overview of challenges, opportunities, and policy shifts in taxation and customs, with a spotlight on tailored financial solutions designed exclusively for the textile and garment industry.

Vinatex’s 9-Month Profit Surges by 30%, Closing in on 2021’s Record High

By the end of September 2025, Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) is projected to achieve 80% of its annual plan, with profits surging 25-30% year-over-year. The Fiber sector has quadrupled its production targets, while the Garment sector contributed nearly VND 800 billion in profits, propelling the Group closer to its 2021 record highs.

Vietjet to Receive First Boeing 737 MAX Nearly a Decade After Order

The ceremonial handover of the inaugural aircraft is slated to take place at Boeing’s Renton facility in Seattle, Washington, USA, this upcoming weekend.