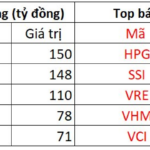

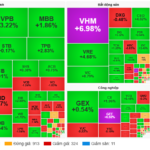

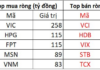

The stock market continued its explosive rally on the morning of October 9th, with the VN-Index surging past the 1,710-point mark, fueled by strong performance from large-cap stocks. At the close, the benchmark index climbed nearly 19 points, setting a new peak at 1,716.47 points, while trading volume on the Ho Chi Minh City Stock Exchange (HOSE) reached approximately VND 34 trillion. Among the standout performers in this record-setting session were Vingroup-affiliated stocks, which surged from the opening bell and maintained their momentum throughout the day.

Leading the charge was VHM (Vinhomes), which hit its daily limit, soaring 7% to VND 115,000 per share. Buy orders at the ceiling price totaled nearly 600,000 units. This marked a historic high for VHM (post-adjustment), propelling Vinhomes’ market capitalization to VND 472.3 trillion.

VIC also gained nearly 1%, closing at VND 179,500 per share, and retained its position as the market leader with a capitalization of VND 691.6 trillion (USD 26.6 billion). Together, VHM and VIC contributed 8.4 points to the VN-Index’s gain.

Other Vingroup-related stocks, such as VRE, rose 4.7% to VND 38,000 per share, while VPL increased 0.7% to VND 87,200 per share. VEF also closed in positive territory at VND 182,900 per share.

Beyond the market’s overall optimism, positive business developments bolstered investor sentiment in Vingroup-affiliated stocks. Most recently, the Hanoi People’s Committee approved the land reclamation for the Vinhomes Smart City urban development project. The 11-hectare site, located at 233, 233B, and 235 Nguyen Trai Street, Khuong Dinh Ward (commonly known as the Cao-Xa-La area), will be developed by a consortium comprising Xavinco Real Estate JSC, Thang Long Real Estate Investment JSC, and Xalivico LLC.

Notably, Xavinco is 96.4% owned by Vingroup, with additional stakes held by Hanoi Soap Company and Royal City Real Estate. Xavinco also partnered with LIX Detergent to establish Xalivico LLC.

Additionally, Vincom Retail is set to receive a substantial dividend from its subsidiary, Vincom Retail Operations LLC. The total dividend distribution amounts to VND 4.48 trillion, payable via bank transfer to shareholders, with completion expected in Q3/2025. This influx is anticipated to bolster Vincom Retail’s Q3 financial performance.

Meanwhile, Vingroup has proposed a feasibility study for a sea-crossing route connecting Can Gio and Ba Ria-Vung Tau under a Build-Transfer (BT) model. According to Vingroup, this project would reduce travel time, enhance connectivity between key regions, and stimulate economic, social, and commercial growth while promoting sustainable urban expansion.

The conglomerate, led by billionaire Pham Nhat Vuong, has pledged to collaborate with Ho Chi Minh City in realizing critical transportation infrastructure plans, thereby improving regional connectivity and fostering sustainable coastal development.

When Capital Tells a Story: 10 Lessons from the Resilient Leaders of The Investors Season 2

After three months on air, *The Investors – The Resilients* talk show has delivered a wealth of inspiring insights from influential figures representing leading organizations such as VPBankS, Dragon Capital, STI, FiinGroup, Đạt Phương, DNSE, and SSID. Their powerful statements continue to resonate, leaving a lasting impact on audiences.

VN-Index Surges Past 1,700 Points, Setting a New All-Time High Following Upgrade

The VN-Index soared to yet another all-time high during the trading session on October 9th, immediately following FTSE Russell’s upgrade of Vietnam’s market classification.

Vietstock Daily 10/10/2025: Scaling New Heights?

The VN-Index has surpassed its previous peak from September 2025 (equivalent to the 1,700-1,711 point range), accompanied by trading volumes exceeding the 20-session average, signaling a resurgence of market optimism. Simultaneously, both the MACD and Stochastic Oscillator indicators continue their upward trajectory, reinforcing buy signals. Should this momentum persist, the current rally is poised to strengthen, paving the way for the index to achieve even greater heights.