Recently, VNDirect Securities Corporation (stock code: VND) reported that a foreign institutional investor failed to settle payment within the stipulated timeframe.

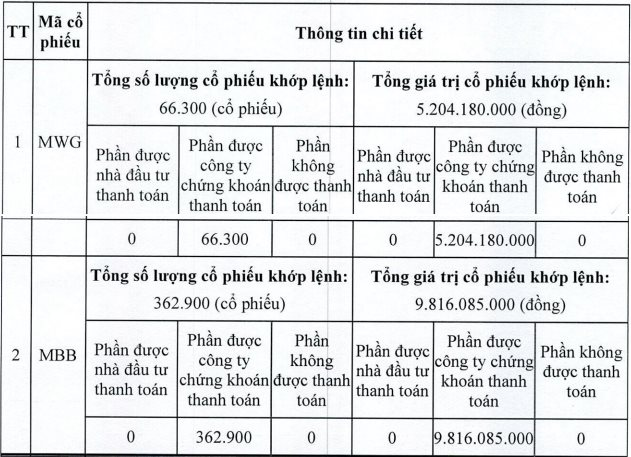

Specifically, on October 7, United Sustainable Asia Top – 50 Fund (Singapore) executed buy orders for two stock codes: 66,300 shares of MWG, valued at over VND 5.2 billion, and 362,900 shares of MBB, valued at over VND 9.8 billion. The total settlement amount for these transactions exceeded VND 15 billion.

However, the Singaporean entity failed to make the payment, leaving VNDirect Securities responsible for covering the amount.

By October 9, 2025, VNDIRECT had successfully transferred the corresponding shares to the respective clients/investors in compliance with current regulations. Both VNDIRECT and the investor adhered to the legal framework governing the Non-prefunding mechanism, ensuring timely fulfillment of obligations and strict adherence to Vietnam’s securities market procedures.

Circular 68 issued by the Ministry of Finance, effective from November 2, 2024, allows foreign investors to place buy orders without pre-funding (Non-prefunding). In cases where foreign investors fail to settle payments, the responsibility shifts to the securities company through which the order was placed, utilizing their proprietary trading account.

Since the implementation of Non-prefunding, VNDirect is the second securities company to report a failed transaction by a foreign institutional investor. In mid-December of the previous year, Vietcap Securities (stock code: VCI) had to settle nearly VND 4 billion for the purchase of 26,600 FPT shares on behalf of Aegon Custody B.V. (Netherlands).

The resolution of the Non-prefunding issue marks a significant milestone, enabling Vietnam’s stock market to be upgraded to secondary emerging market status according to FTSE Russell’s criteria. This achievement underscores Vietnam’s decisive and synchronized reform efforts, enhancing its global investment standing.

At the recent Investor Day event, Mr. Lê Anh Tuấn, CEO of Dragon Capital, emphasized that the market upgrade is a well-deserved outcome of over a decade of relentless efforts by regulatory bodies. This advancement is not merely technical but symbolizes the market’s comprehensive maturation.

While the FTSE Russell upgrade is pivotal, Vietnam’s ultimate goal is MSCI’s recognition as an emerging market. Mr. Tuấn likened MSCI to the “biggest fish,” asserting that achieving this goal will drive both qualitative growth and structural expansion of the market.

“I anticipate that within five years, Vietnam’s stock market will achieve growth equivalent to that of the past 10–15 years combined, across policy, infrastructure, and market depth,” stated the Dragon Capital CEO.

Drawing on lessons from mature markets and bolstered by strengthening macroeconomic fundamentals, Mr. Tuấn expressed confidence that sustaining double-digit economic growth will propel Vietnam’s stock market into a new growth cycle, enhancing both scale and global competitiveness.

VNDIRECT Shareholders Finalize Strategy to Boost Capital to Nearly VND 20 Trillion

At the extraordinary shareholders’ meeting held on the afternoon of October 10, 2025, shareholders of VNDIRECT Securities Corporation (HOSE: VND) approved a plan to reduce the scale of the private placement of shares. Additionally, they endorsed a supplementary plan to offer shares to existing shareholders.

Anticipating Portfolio Restructuring Trends Post-Market Upgrade

In today’s volatile market landscape, effective investing is no longer about chasing maximum returns but rather optimizing portfolios to align with specific financial goals. When investors clearly define key factors such as expected capital, investment horizon, and risk tolerance, every decision—from asset allocation to rebalancing and instrument selection—becomes more grounded and verifiable.

Prime Minister Issues Directive Following Stock Market Upgrade

Prime Minister Pham Minh Chinh has issued Directive No. 192 on October 8th, focusing on the efforts to upgrade Vietnam’s stock market.