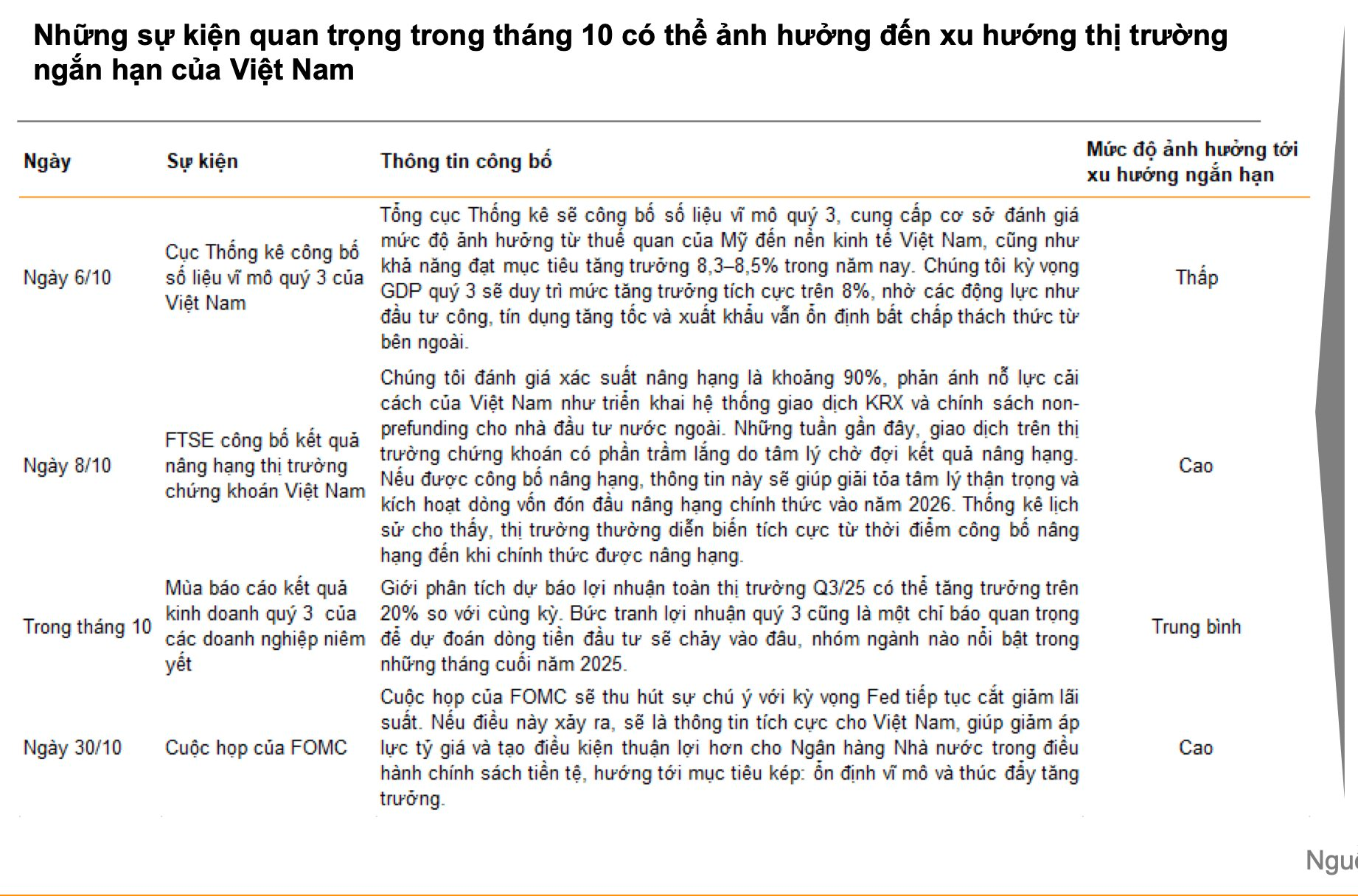

Key Events Impacting the Market in October

In the October report, VNDirect Securities highlights critical events this month that could influence Vietnam’s short-term market trends.

With FTSE’s announcement on market reclassification, investors should closely monitor key dates and prioritize risk management to mitigate unexpected volatility.

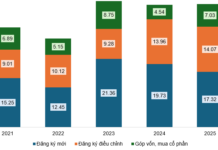

Additionally, the third-quarter earnings season for listed companies will be a focal point for investors. Analysts forecast a 20% year-on-year profit growth, reflecting a robust recovery across multiple sectors. These earnings will serve as a crucial indicator for predicting capital flows and identifying top-performing stocks in the final months of 2025.

Globally, the U.S. Federal Open Market Committee (FOMC) meeting on October 30 is expected to significantly impact the global economy. Markets anticipate further rate cuts from the Federal Reserve.

If this materializes, it would positively affect Vietnam by easing exchange rate pressures and providing the State Bank of Vietnam greater flexibility in monetary policy, supporting macroeconomic stability and economic growth.

Leading Sectors for Year-End Growth

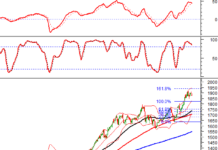

Analysts predict October’s market will be divided into two phases: before and after October 8, when FTSE Russell announces Vietnam’s potential upgrade to Secondary Emerging Market status.

In the base case scenario of an upgrade, liquidity is expected to improve as investors pursue short-term opportunities. The VN-Index may then test the 1,700–1,720 resistance zone.

Over the next 6–9 months, VNDirect maintains a positive outlook for Vietnam’s stock market. In the base case, the VN-Index could target 1,850–1,900 points, driven by three key factors: (1) market upgrade expectations, (2) potential Fed rate cuts, and (3) strong corporate earnings growth.

These factors are expected to drive significant re-rating and bolster investor confidence in the medium to long term.

Recently, the VN-Index has been led by large-cap stocks in real estate, banking, and securities. For the remainder of the year, VNDirect anticipates a shift toward undervalued stocks with clear growth narratives for 2025 and beyond, including public investment (infrastructure, construction materials), energy (oil, gas, power), and retail.

Meanwhile, real estate, banking, and securities—while still offering growth potential—will see increased differentiation based on valuation and mid-term prospects.

VN-Index Surges Past 1,700 Points, Setting a New All-Time High Following Upgrade

The VN-Index soared to yet another all-time high during the trading session on October 9th, immediately following FTSE Russell’s upgrade of Vietnam’s market classification.

What Scenarios Await the Stock Market Before and After the Upgrade Announcement?

The VN-Index briefly touched the 1,700-point milestone before retreating, as trading liquidity dwindled amid investor caution ahead of the highly anticipated market upgrade announcement.