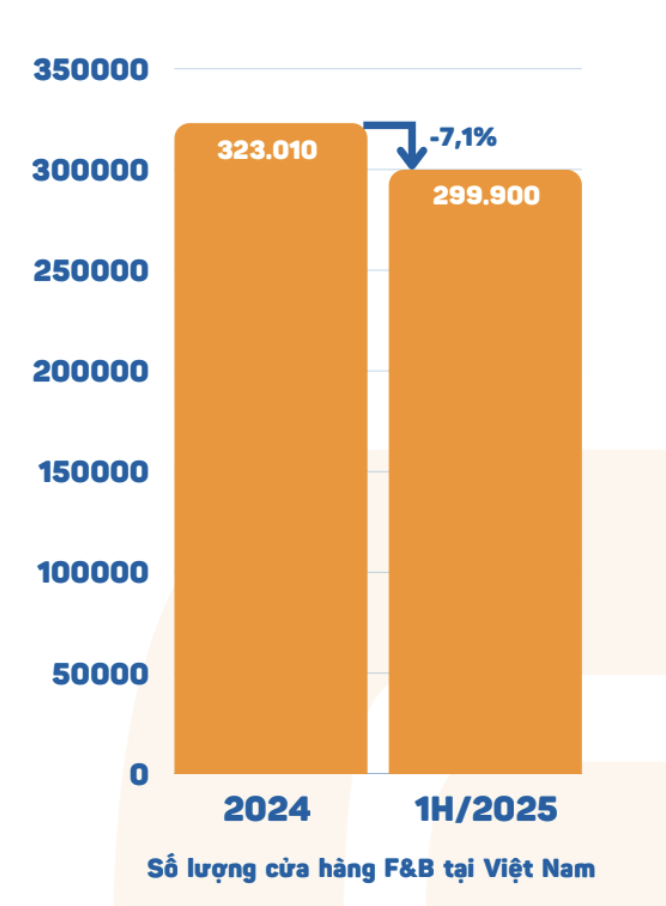

According to the Food and Beverage Market Report for the first half of the year by iPOS, as of June 30th, Vietnam had approximately 299,900 F&B outlets, a 7.1% decrease compared to 2024. Both Hanoi and Ho Chi Minh City recorded declines exceeding 11%, reflecting the market’s challenges.

In the first half of last year, the market saw around 30,000 F&B outlets close, a 3.9% reduction. However, the supply was primarily replenished in the latter half of the year, bringing the total to 323,010 outlets by the end of 2024.

“The first six months of the year are typically a period of ‘natural filtering’ in the market, before entering a cycle of new openings and stronger restructuring in the latter half,” the iPOS report stated.

The phenomenon of “open quickly, close quickly, learn quickly” has become widespread among smaller outlets. Many experimental models, lasting 2-3 months, are abandoned due to insufficient financial capacity or a lack of market potential, particularly among the small outlets that have recently proliferated.

Simultaneously, while the bottom tier is being eliminated, leading brands are restructuring their property portfolios: exiting underperforming locations, repositioning in iconic spots, and enhancing customer experiences.

Starbucks, for instance, closed its Starbucks Reserve Han Thuyen in August 2024, then reopened a Reserve at the prime location in Bitexco Mall and launched a new Reserve-only store in Diamond Plaza on Le Duan Street. This underscores a strategy of elevating space and service standards rather than expanding at all costs. The trend of closing to reopen in more symbolic locations indicates a filtering wave that is freeing up premium “A/B” spaces and creating opportunities for models with strong operational capabilities, capital, and brand power.

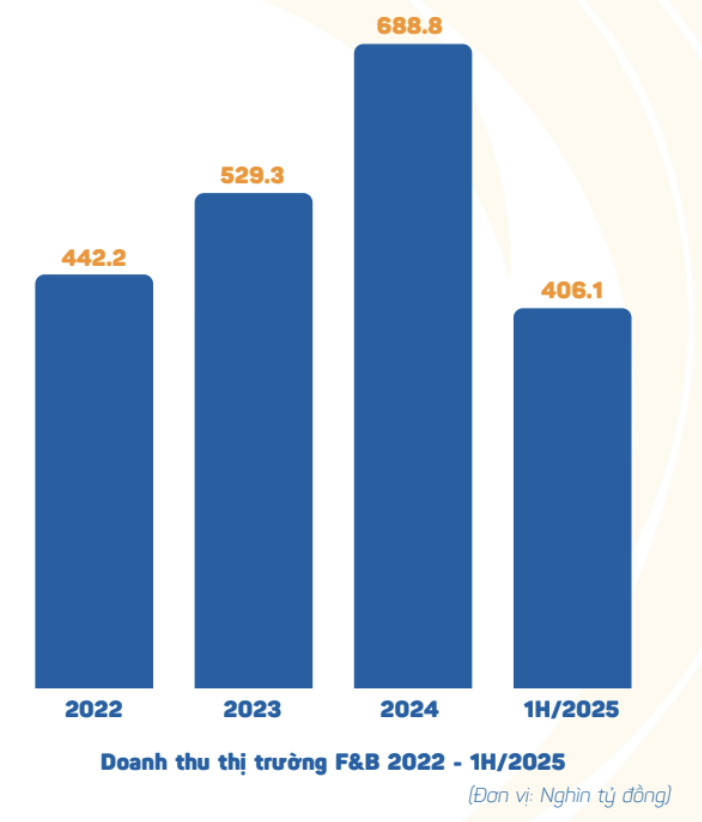

Not only has the scale decreased, but the F&B industry’s revenue in Vietnam fell short of expectations, reaching only 406.1 trillion VND, equivalent to 58.9% of the full-year 2024 revenue.

Despite coinciding with major spending periods (Lunar New Year, April 30th – May 1st), revenue remained below expectations, indicating a slow recovery pace. A deeper analysis reveals that individual purchasing power has not declined: spending per dining/drinking occasion remains consistent, with reduced frequency but higher expenditure per visit.

From a macroeconomic perspective, cost pressures are the dominant factor. Specifically, the average CPI for the first half of the year increased by 3.27% year-on-year, with food and catering services rising by 3.69%, pork by 12.75%, and food by 4.15%. In terms of operations, housing, utilities, fuel, and construction materials increased by 5.73%. Escalating input costs have eroded profit margins and limited promotional incentives, thereby slowing revenue growth to a cautious pace.

Given current consumption patterns, it is projected that the latter half of the year will likely see a maximum increase of around 9.6% compared to the first half, as per the scenario.

Additionally, in the first half of 2025, the “ultra-affordable” F&B model emerged as a unique growth segment in Ho Chi Minh City, exemplified by Tra Sua Vien Vien (7,000 VND) and Tiem Lau Nha An (69,000 VND fish hotpot).

A common strategy is the funnel pricing approach: the 7K/69K price points serve as attractors, driving foot traffic, while revenue and profit margins are generated from actual baskets through toppings, add-ons, and combos. For at least the next six months, the prevailing frugal mindset, coupled with price increases by many brands, creates opportunities for ultra-affordable models to capture additional market share in the mass and lower-middle segments.

The Penultimate Penman: Crafting Captivating Copy for the Web

The Masterful Storyteller: Weaving Words to Enchant and Engage

Mr. Dang Thanh Duy, a prominent figure in the Vietnamese business landscape, has strengthened his position in Vinasun (HOSE: VNS), a leading transportation company. Through a recent acquisition of 500,000 shares, Mr. Duy, who serves as a member of the Board of Directors and the CEO of Vinasun, has increased his stake in the company. This strategic move elevates his ownership stake from 4.99% to 5.73%, translating to nearly 3.9 million shares.

Construction Firm, Hòa Bình (HBC), Turns a Profit by Liquidating Fixed Assets

Let me know if you would like me to tweak it or provide any additional ideas!

The six-month profit for Construction Hòa Bình has plummeted by 94% compared to the same period last year, with only about 13% of the annual target achieved so far.

“King of Shrimp” Reports Q2 2025 Profit Surge of 300%, the Highest in a Decade

As of the first half of the year, Minh Phu’s net revenue remained stagnant at VND 6,468 billion compared to the same period last year. However, their after-tax profit soared to VND 183 billion, marking an impressive 300% growth rate year-over-year for the first half of 2024.