The global supply chain shift is positioning Vietnam as a magnet for massive foreign direct investment (FDI). Leading this wave is CTP, a Dutch-led company headquartered in the Czech Republic, planning to invest USD 1 billion in Vietnam to capitalize on this manufacturing relocation trend.

Founded in 1998 by CEO Remon Vos, currently the second-richest billionaire in the Netherlands, CTP boasts a diverse client portfolio spanning chips, automotive, and multinational giants like Hitachi and H&M. Vietnam marks CTP’s first industrial park venture outside Europe.

CEO Remon Vos.

According to Maarten Otte, CTP’s Director of Investor Relations, in an exclusive interview with Nikkei Asia, Vietnam is the “top choice” for companies relocating manufacturing hubs outside China. Otte noted CTP’s clients are keen on Vietnam as a strategic solution to the global production shift.

To materialize the USD 1 billion investment, CTP has conducted thorough surveys across Vietnam. Potential locations include Hanoi, Haiphong, Hung Yen, Bac Ninh, Vinh Phuc, Da Nang, and Ho Chi Minh City. CTP aims to diversify its presence nationwide to avoid over-reliance on a single location.

A Magnet for Investment

CTP’s plan is not an isolated case but reflects a broader trend, positioning Vietnam as a “top priority destination for manufacturing”, attracting significant foreign investor interest.

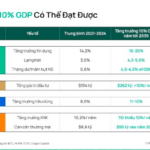

FDI inflows into Vietnam have surged, with the first three quarters showing a 15% year-on-year increase, according to the General Statistics Office.

Beyond manufacturing, Vietnam is emerging as a strategic hub for digital infrastructure and high-tech investments:

- G42, an Abu Dhabi-based tech conglomerate, announced a USD 2 billion investment to develop a hyperscale data center in Ho Chi Minh City, partnering with FPT, VinaCapital, and Viet Thai. This project will establish Vietnam as G42’s Southeast Asian data hub.

Warburg Pincus, the world’s largest private equity firm, has expressed interest in developing high-tech data centers in Vietnam. Having invested over USD 2 billion across various sectors, Warburg Pincus is expanding into digital infrastructure, collaborating with Evolution Data Centres and Zero Two (UAE) to advance green projects.

Investors aim to develop high-tech data centers in Vietnam. Illustrative image

Additionally, the luxury real estate and hospitality sectors are witnessing billion-dollar projects. Notably, The Trump Organization, owned by former U.S. President Donald Trump’s family, is eyeing a USD 1.5 billion golf resort and luxury housing project in Hung Yen, along with plans for a Trump Tower in Ho Chi Minh City.

Initiatives from CTP, G42, Warburg Pincus, coupled with robust FDI growth, reinforce Vietnam’s position as Asia’s emerging manufacturing and technology hub, poised to effectively harness the global capital shift.

Digital Asset Firm DNEX Aims to Raise $430 Million in Capital

DNEX unveils Vietnam’s pioneering digital asset trading simulation platform, aiming to forge the infrastructure for the future of digital finance.

Optimizing Social Housing Policies: Enabling Cash Contributions in Lieu of Land Funds and Adjusting Income Caps for Buyers

The draft decree amending the Social Housing Law introduces a new mechanism allowing developers to pay a fee in lieu of allocating 20% of land in their projects for social housing. Additionally, it raises the income ceiling for eligible buyers and renters. These adjustments aim to address existing challenges and inject fresh momentum into the social housing development program.