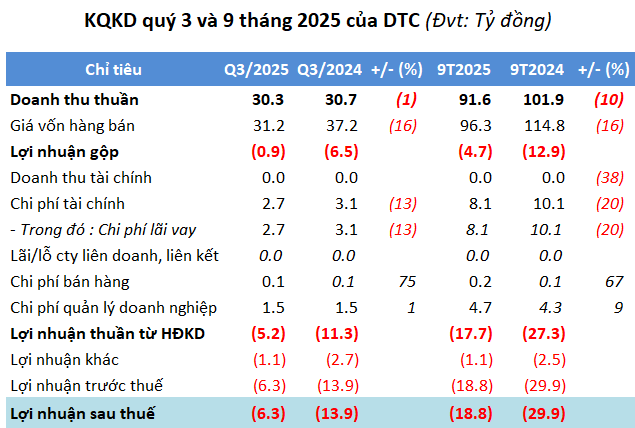

In Q3, Viglacera Dong Trieu recorded net revenue of over 30 billion VND, a slight 1% decrease year-on-year. The majority of this revenue, approximately 26 billion VND, came from the sale of fired clay bricks and tiles, which saw a 14% decline. Despite a significant reduction in production costs, the company still reported a gross loss of nearly 1 billion VND. Total financial, selling, and administrative expenses amounted to over 4 billion VND, a 7% decrease.

After deducting all expenses, DTC continued to incur a loss of more than 6 billion VND, extending its losing streak to 13 consecutive quarters since Q3/2022.

| DTC’s Net Profit from Q1/2022 to Q2/2025 |

According to DTC, the construction materials market in Q3 remained challenging due to the Ghost Month, which led to delays in civil construction projects. Additionally, heavy rainfall and storms in September further reduced consumption below target. High input costs for raw materials (coal, oil, electricity) persisted, while product prices remained unadjusted, contributing to ongoing losses.

To address prolonged losses, DTC announced a restructuring plan for Q4/2025. The company is streamlining production processes, optimizing its organizational structure, and refocusing on high-margin products such as premium bricks, tiles, and decorative items.

In the first nine months, net revenue reached nearly 92 billion VND, a 10% decline; net loss was approximately 19 billion VND, compared to a loss of nearly 30 billion VND in the same period last year.

Source: VietstockFinance

|

For 2025, DTC targets revenue of 185 billion VND, a 30% increase from 2024, but expects a pre-tax loss of 15 billion VND.

As of September 30, 2025, DTC has accumulated losses of over 106 billion VND, with negative equity of more than 5 billion VND. Total assets decreased by 3% since the beginning of the year to nearly 191 billion VND, primarily consisting of inventory valued at over 79 billion VND, up 9%. Liabilities totaled over 196 billion VND, a 7% increase, with financial debt of 123 billion VND accounting for 63% of total debt, despite a 5% reduction from the start of the year.

Viglacera Dong Trieu is an indirect subsidiary of Viglacera Corporation (HOSE: VGC), holding a 40% voting stake.

DTC shares were delisted from HNX on March 26, 2025, due to three consecutive years of losses (2022–2024), and resumed trading on UPCoM from April 4, 2025. Previously, DTC withdrew from UPCoM on October 29, 2021, to list on HNX from November 16, 2021, with a reference price of 11,300 VND/share. However, during nearly three years of listing, DTC shares traded primarily between 4,000–5,000 VND/share, losing over half their value since the initial listing.

DTC leaves HNX after 3 years, returns to UPCoM at 4,600 VND/share

| DTC Share Price Performance Since 2025 |

– 09:06 10/10/2025

“Hot Seat” at Electricity Corporation – TKV Changes Hands

Mr. Bui Minh Tan, a member of the Board of Directors of Vietnam Electricity – TKV, will assume the role of General Director of the company, succeeding Mr. Ngo Tri Thinh, effective October 6, 2025.

Solar Power Trung Nam Thuan Nam Still Accumulates Nearly VND 723 Billion in Losses, Debt Surpasses VND 9 Trillion

Trung Nam Thuan Nam Solar Power Company Limited has submitted its financial report for the first half of 2025 to the Hanoi Stock Exchange (HNX). The report reveals a post-tax profit of nearly VND 126.5 billion, a slight decrease compared to the VND 128 billion recorded in the same period last year.

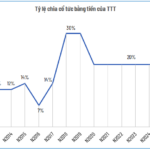

TTT Sustains 5 Consecutive Years of 20% Cash Dividend Payouts

Tay Ninh Tourism and Trading Joint Stock Company (HNX: TTT) has announced the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for October 28, with the payment expected to commence on November 25.