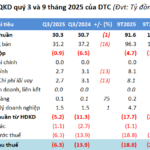

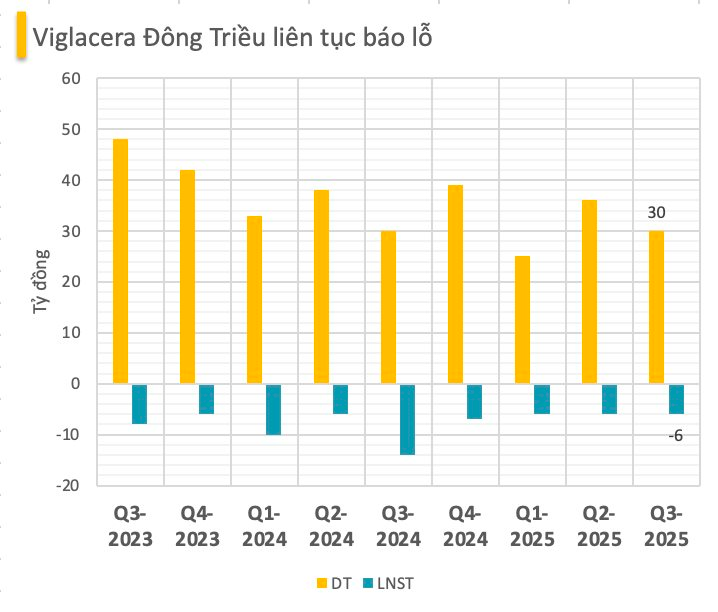

Viglacera Dong Trieu Joint Stock Company (stock code: DTC) has released its Q3/2025 financial report, revealing a net revenue of VND 30.3 billion, a slight decrease of 1.2% compared to the VND 30.6 billion recorded in the same period of 2024.

The company reported a post-tax loss of VND 6.28 billion for the quarter, nearly half the loss of VND 13.93 billion in the corresponding period last year. This marks the 13th consecutive quarter of losses for Viglacera Dong Trieu.

In the first nine months of the year, the company’s cumulative net revenue reached VND 91.6 billion, a 10% decline from the VND 102 billion recorded in the same period of 2024. The post-tax loss for this period was VND 19 billion, an improvement from the VND 30 billion loss in the previous year (a 37% increase compared to the same period).

Viglacera Dong Trieu is the first company to report a loss for Q3 2025.

Due to years of losses, the company’s shares were delisted from the stock exchange and moved to the Upcom trading platform at the end of March 2025.

As of September 30, 2025, Viglacera Dong Trieu recorded an accumulated loss of VND 106.4 billion, with negative equity of VND 5.4 billion.

At the 2025 Annual General Meeting of Shareholders, Viglacera Dong Trieu approved a business plan for 2025, targeting a revenue of VND 185 billion and a pre-tax loss of approximately VND 15 billion. The company also decided to continue withholding dividends for 2024 and did not set a dividend plan for 2025. The last dividend distribution by DTC was in 2021, at a rate of 3% in cash.

Viglacera Dong Trieu Joint Stock Company, formerly known as Dong Trieu Ceramic Construction Company, is a subsidiary of the Glass and Ceramic Construction Corporation (now Viglacera Corporation).

The company’s headquarters are located in Xuan Cam Area, Mao Khe Ward, Quang Ninh Province. Its current charter capital is VND 100 billion. Viglacera Dong Trieu operates in the industrial production sector, specializing in the manufacturing of clay-based construction materials.

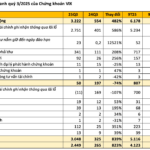

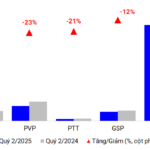

Optimizing Shipping Operations: Navigating Q2 Challenges Amid Oversupply in Oil Tankers and Bulk Carriers

The second quarter of 2025 paints a diverse picture for the maritime industry: container shipping continues to thrive with high volumes and freight rates; meanwhile, oil tankers and dry bulk carriers face challenges due to excess supply, resulting in significant profit declines for many businesses in these sectors.