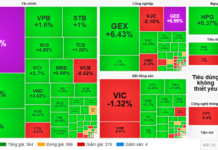

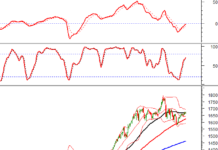

Euphoria swept the market as the VN-Index surged in the final trading session of the week, closing at 1,747 points—a remarkable 31-point increase from the previous session. Market liquidity soared to nearly VND 34 trillion, signaling heightened investor confidence following the official announcement of the market’s upgrade.

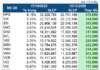

Foreign trading activity remained a drag, though slightly improved, with net selling totaling VND 637 billion across the market.

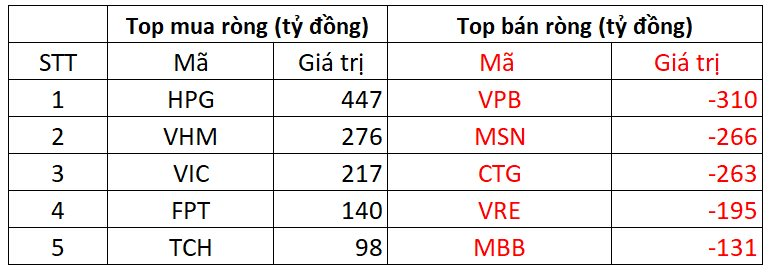

On HOSE, foreign investors net sold VND 460 billion

On the buying side, HPG led foreign acquisitions on HOSE with purchases exceeding VND 447 billion. VHM followed closely, attracting VND 276 billion in foreign investment. VIC and FPT also saw significant inflows of VND 217 billion and VND 140 billion, respectively.

Conversely, VPB topped the foreign sell-off list with VND 310 billion in outflows. MSN and CTG also faced substantial selling pressure, with VND 266 billion and VND 263 billion offloaded, respectively.

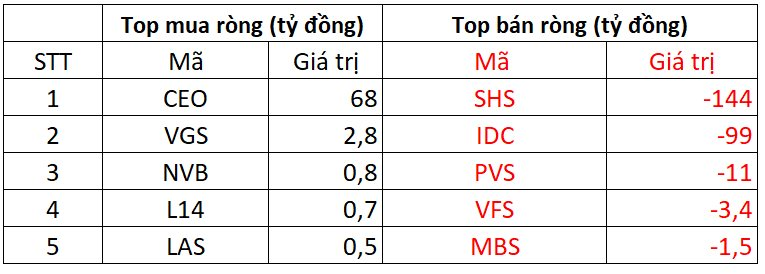

On HNX, foreign investors net sold VND 189 billion

CEO emerged as the top foreign buy on HNX, with net purchases of VND 68 billion. VGS followed with VND 2.8 billion in net buying. Minor net purchases were also recorded in NVB, L14, and LAS.

SHS faced the brunt of foreign selling pressure on HNX, with outflows nearing VND 144 billion. IDC followed with VND 99 billion in sell-offs, while PVS and VFS saw outflows ranging from VND 1 billion to VND 11 billion.

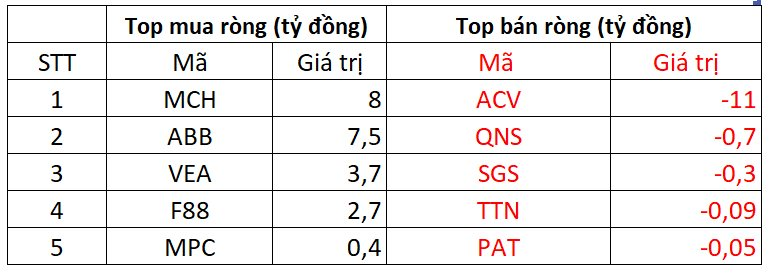

On UPCOM, foreign investors net bought VND 12 billion

MCH led foreign acquisitions on UPCOM with VND 8 billion in purchases. ABB and VEA also saw modest net buying activity.

ACV experienced the most significant foreign sell-off on UPCOM, with VND 11 billion in outflows. QNS, SGS, and others also faced net selling pressure.

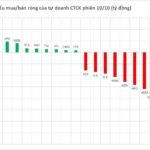

Massive Sell-Off: Brokerage Firms Unload Hundreds of Billions in Stocks During Friday’s Session

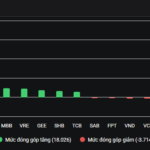

Proprietary trading desks at securities companies collectively offloaded VND 636 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the period in question.

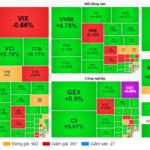

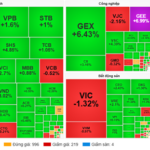

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.