Source: VietstockFinance

|

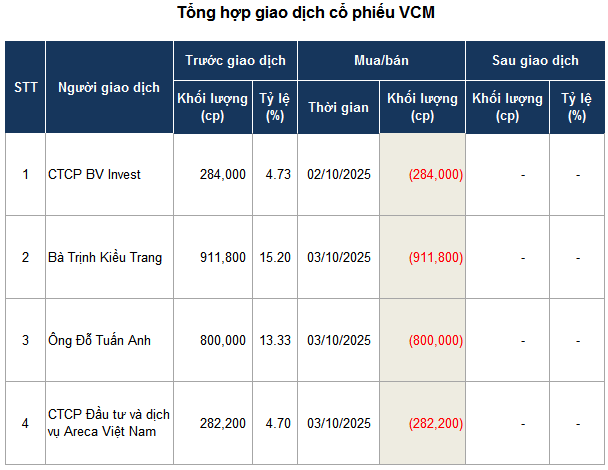

On October 3rd, Mrs. Trinh Kieu Trang sold her entire stake of 911,800 shares in VCM (equivalent to 15.2% of the capital), while Mr. Do Tuan Anh divested his full 800,000 shares (13.33% of the capital). Following these transactions, both individuals officially exited the company’s shareholder list.

The remaining two entities are both affiliated with Chief Accountant Nguyen Thi Thuy Huong. BV Invest, where Mrs. Huong serves as the Head of the Supervisory Board, sold its entire 284,000 shares in VCM (4.73% of the capital) on October 2nd. Areca Vietnam Investment and Services JSC, where Mrs. Huong is a member of the Supervisory Board, also divested its full 282,200 shares (4.7% of the capital) on October 3rd.

Notably, during the two trading sessions when these shareholders executed their transactions, market liquidity was significantly low. On October 2nd, only 600 shares were traded via order matching, while the negotiated volume reached 284,000 shares—matching BV Invest’s sale, valued at approximately VND 2.4 billion. On October 3rd, only 8,800 VCM shares were traded via order matching, but the negotiated volume exceeded 4 million shares, worth over VND 34.4 billion. Comparing this with the total shares sold by the remaining three shareholders (nearly 2 million shares), it is likely that these transactions were conducted through negotiated deals, with an estimated value of around VND 17 billion.

The complete divestment by these four shareholders occurred shortly after VCM announced a rights issue of 6 million shares to existing shareholders, aiming to raise VND 60 billion for M&A activities. The rights ratio is 1:1, allowing shareholders to purchase one new share for every share held at VND 10,000 per share. The ex-rights date is October 6th.

| VCM Stock Performance from Early 2024 to October 9, 2025 |

In the stock market, VCM shares plummeted to VND 8,400 per share during the morning session on October 9th, approximately 16% lower than the offer price. However, over the past three months, the stock has risen by 25%.

| VCM’s 6-Month Business Results Over the Years |

In terms of business performance, BV Life reported first-half 2025 revenue of VND 68 billion—the highest in eight years on a semi-annual basis, 2.3 times higher than the same period last year. However, net profit remained nearly flat at around VND 2 billion compared to the previous year.

– 11:13 AM, October 9, 2025

Heaven Vietnam Securities to Pay 12% Stock Dividend

Following the successful completion of its shareholder stock offering, Thien Viet Securities will distribute a 12% stock dividend for the year 2024.

Market Pulse 08/10: Foreign Investors Halt Net Selling Streak

At the close of trading, the VN-Index surged by 12.53 points (+0.74%), reaching 1,697.83 points, while the HNX-Index climbed 0.47 points (+0.17%) to 273.34 points. Market breadth favored the bulls, with 389 advancing stocks outpacing 285 decliners. Similarly, the VN30 basket saw green dominate, as 19 constituents rose, 7 fell, and 4 remained unchanged.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.