In the stock market, GELEX Electric’s (GEE) shares surged for the third consecutive session on October 10, 2025, hitting the ceiling price of VND 143,800 per share. This represents a 14.4% increase over just two days, pushing the company’s market capitalization to VND 52 trillion (approximately USD 2 billion).

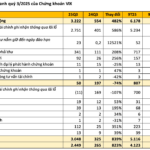

GELEX Electric recently released its Q3 2025 Consolidated Financial Report, revealing a net revenue of over VND 6,444 billion, a 14.7% year-on-year increase compared to Q3 2024.

The revenue growth is primarily attributed to the company’s enhanced cost management and production efficiency, resulting in a gross profit margin of 16.6% (up from 14.5% in the same period last year). This improvement contributed an additional VND 252 billion to the gross profit.

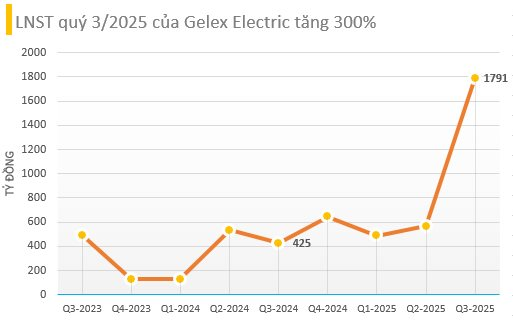

Net profit after corporate income tax for Q3 2025 soared to VND 1,791 billion, a remarkable 329% increase (VND 1,374 billion) compared to the same quarter in 2024.

This stellar performance stems from the robust growth in core business segments, coupled with effective cost optimization and improved operational efficiency. Additionally, the restructuring of the investment portfolio has generated significant returns, further bolstering overall profitability.

For the first nine months of 2025, GELEX Electric recorded a cumulative net revenue of VND 18,235 billion, a 25% year-on-year increase. Pre-tax profit reached VND 3,532 billion, up 162%, while net profit after tax stood at VND 2,845 billion, 166% higher than the VND 1,068 billion reported in the same period of 2024.

The company has achieved 77% of its annual revenue target and surpassed its pre-tax profit goal by 101%.

GELEX Electric’s impressive growth is driven by the strong performance of its subsidiaries, including CADIVI, THIBIDI, and EMIC. The company remains committed to its core business strategy, adapting sales policies to market dynamics, and investing in R&D for new product development. The integration of technology in management, operations, and production has significantly reduced costs and enhanced operational efficiency.

As of September 30, 2025, GELEX Electric’s total assets reached VND 15,141 billion, a 17% increase from the beginning of the year, primarily due to a 49% rise in current assets. Cash and cash equivalents stood at VND 835 billion, up 21%.

Financial ratios, including debt-to-equity, remain stable and within safe limits, reflecting the company’s robust business performance and effective management. This has strengthened investor confidence in GELEX Electric.

TCBS Secures HOSE Listing Approval Following $460 Million IPO Success

Following the successful completion of its IPO of over 231 million shares, Technocom Securities JSC (TCBS) has been approved for listing on the Ho Chi Minh City Stock Exchange (HOSE) under the ticker symbol TCX. This Techcombank subsidiary is projected to achieve a market capitalization exceeding 110 trillion VND, positioning it as the industry leader in the securities sector.