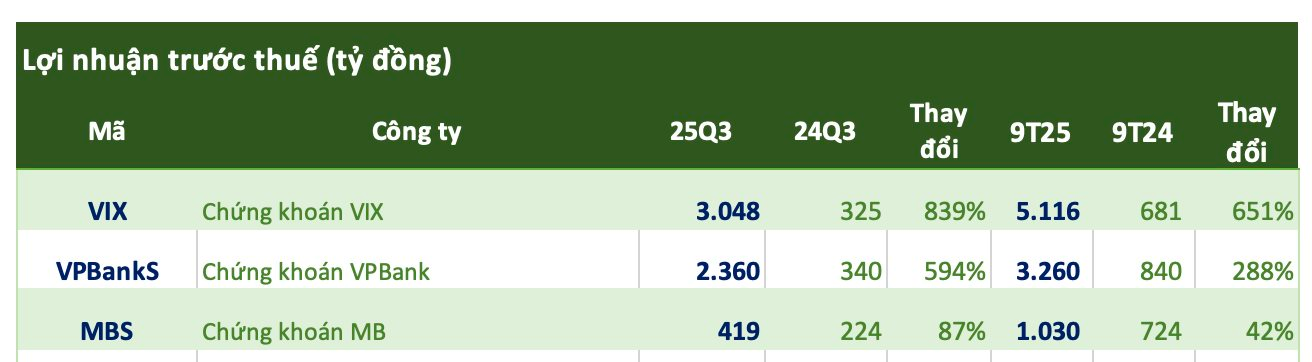

As of October 10th, three securities companies have released their Q3 2025 financial reports.

VPBank Securities leads as the first to publish its Q3 2025 report. The company’s operating revenue soared to VND 3,572 billion, a sixfold increase year-over-year, driven by robust growth across all business segments. Fair value gains from financial assets (FVTPL) reached VND 1,942 billion, over seven times higher than the previous year. Lending and receivables generated VND 567 billion, while brokerage services contributed VND 185 billion, both doubling year-over-year.

Notably, financial advisory services surged from VND 7 billion in Q3 2024 to VND 685 billion this quarter. After expenses, VPBank Securities reported pre-tax profit of VND 2,360 billion, nearly seven times higher than last year.

For the first nine months of 2025, cumulative revenue reached VND 5,457 billion, tripling year-over-year. Pre-tax profit stood at VND 3,260 billion, with post-tax profit at VND 2,614 billion, both nearly quadrupling year-over-year. The company has achieved 77% of its 2025 revenue target and 73% of its profit goal.

VPBank Securities is set to launch an initial public offering (IPO) of 375 million shares at VND 33,900 per share, aiming to raise over VND 12,700 billion. This values the company at approximately VND 63,600 billion (USD 2.4 billion).

VIX Securities reported Q3 2025 revenue of VND 3,222 billion, up 482% year-over-year. Strong proprietary trading performance drove this growth.

After expenses, VIX’s Q3 pre-tax and post-tax profits reached VND 3,048 billion and VND 2,449 billion, respectively, nine times higher than Q3 2024—a record quarterly profit for the company.

Year-to-date, VIX’s revenue totaled VND 6,178 billion, up 378%. Pre-tax and post-tax profits were VND 5,116 billion and VND 4,123 billion, increasing 651% and 648%, respectively.

MBS Securities reported Q3 pre-tax profit of VND 418 billion, up 87% year-over-year. Nine-month cumulative pre-tax profit reached VND 1,030 billion, a 425% increase.