The stock market concluded the week on October 10th with a vibrant session. The VN-Index continued its upward trajectory, driven by the momentum of large-cap stocks, which maintained the market’s rhythm. At the close, the VN-Index settled at 1,747.55, marking a 31.08-point increase, equivalent to a 1.81% gain. While foreign trading remained a detractor, net selling activity decreased, with a total value of 637 billion VND across the market.

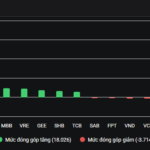

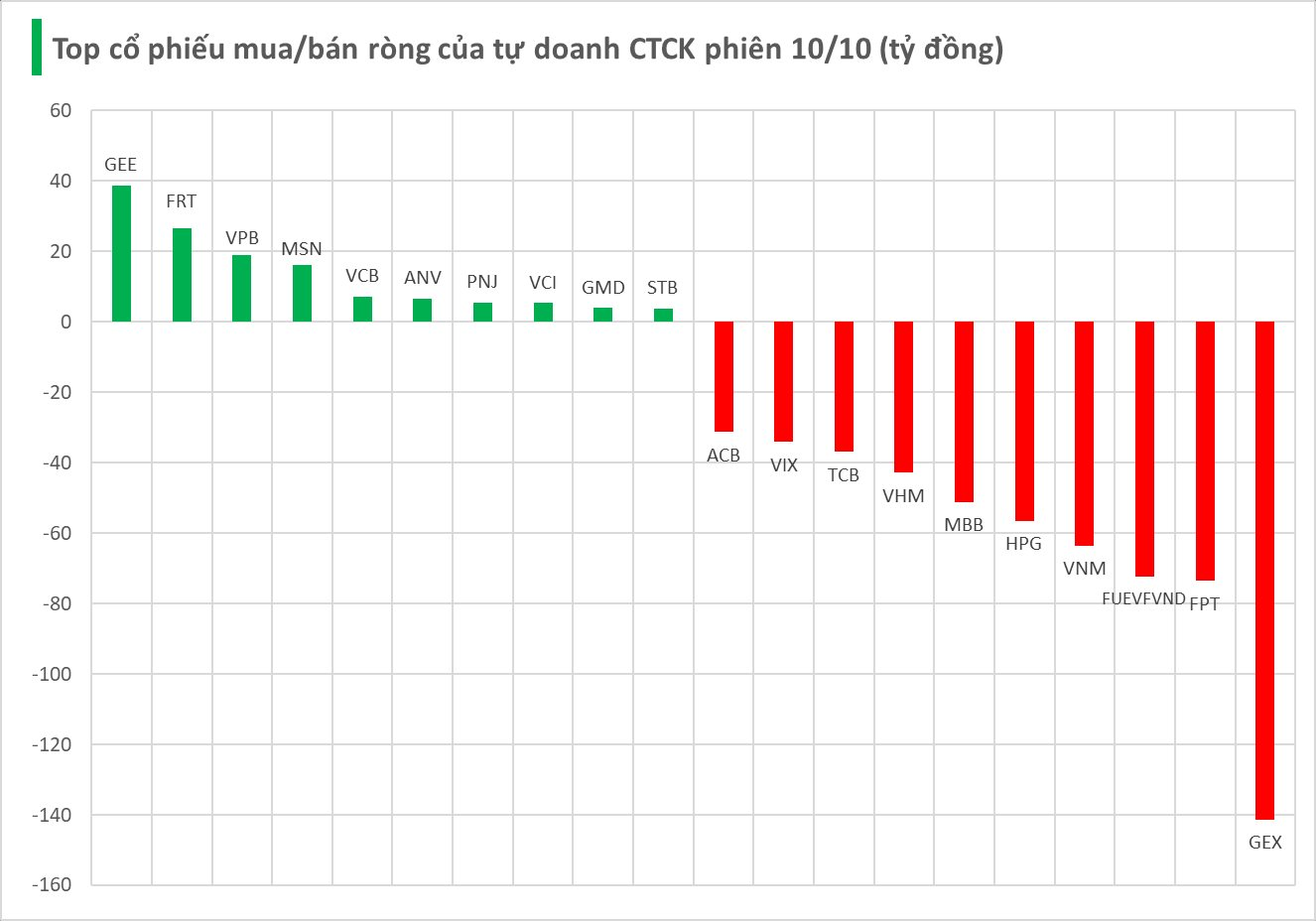

Securities firms’ proprietary trading desks recorded a net sell of 636 billion VND on HOSE.

Specifically, securities firms recorded the highest net selling in GEX, with a value of -141 billion VND, followed by FPT (-74 billion), FUEVFVND (-72 billion), VNM (-64 billion), and HPG (-57 billion VND). Other stocks also saw significant net selling, including MBB (-51 billion), VHM (-43 billion), TCB (-37 billion), VIX (-34 billion), and ACB (-31 billion VND).

Conversely, GEE stocks were net bought with 39 billion VND. FRT ranked second in the net buying list of securities firms’ proprietary trading desks with 27 billion VND, followed by VPB (19 billion), MSN (16 billion), VCB (7 billion), ANV (7 billion), PNJ (6 billion), VCI (5 billion), GMD (4 billion), and STB (4 billion VND).

Stock Market Hits New Highs Following Market Upgrade Boost

Today (October 9th), the stock market celebrated another milestone as the VN-Index officially surpassed the 1,700-point mark, setting a new record. The upward momentum was primarily driven by a handful of large-cap stocks, with Vingroup and banking sector shares leading the charge.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

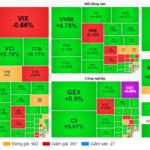

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Technical Analysis Afternoon Session 09/10: Anticipating a Break Above Previous Highs

The VN-Index continues its upward trajectory, with expectations high that it will surpass its previous peak from September 2025 (equivalent to the 1,700-1,711 point range). This optimism is fueled by the emergence of buy signals from both the MACD and Stochastic Oscillator indicators. In contrast, the HNX-Index currently trades below the Middle line of the Bollinger Bands.

Technical Analysis Afternoon Session 10/10: Anticipating a Break Above Previous Highs

The VN-Index has continued its upward trajectory, surpassing its previous all-time high after decisively breaking through the September 2025 peak (equivalent to the 1,700–1,711 point range). Meanwhile, the HNX-Index remains in a state of consolidation, fluctuating around the Middle line of the Bollinger Bands.