Maybank forecasts a 12% year-on-year profit growth for the overall market in Q3/2025, reflecting a moderate increase. Against this backdrop, the VN-Index is expected to consolidate around the 1,600-1,700 range in October before rallying toward the 1,800 mark in the subsequent period.

The securities firm attributes this optimism to favorable macroeconomic factors, including accommodative fiscal and monetary policies, improved corporate earnings outlook for Q4/2025, and the potential return of foreign capital following Vietnam’s market upgrade.

Foreign Capital Inflows and Market Upgrade Momentum

Market liquidity in September 2025 declined by 32% month-on-month but surged 132% year-on-year, influenced by profit-taking sentiment and upgrade-related uncertainties. Maybank highlights regulatory advancements such as relaxed foreign ownership caps (FOL), the implementation of Non-Professional Foreign Investor (NPF) accounts, and collaborative efforts between the government and FTSE.

On October 8th, FTSE officially reclassified Vietnam as an emerging market. This upgrade is projected to attract approximately $1 billion from passive funds and $4-5 billion from active funds.

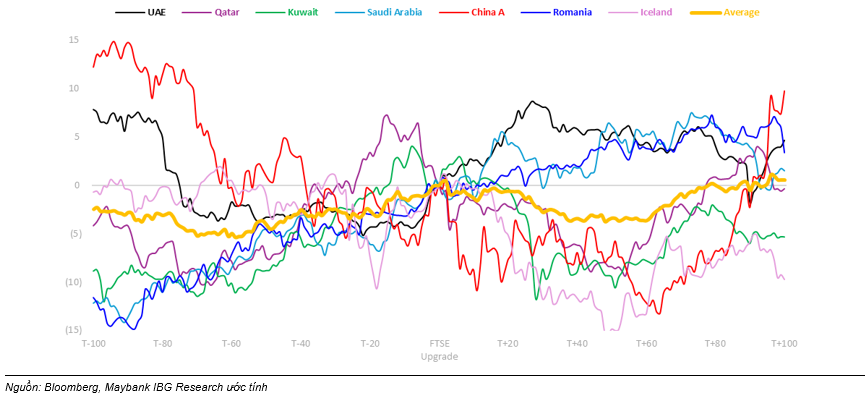

Historical performance of global markets post-upgrade

|

Sectors Poised for Year-End Growth

Maybank notes that currency fluctuations impact sectors differently. Companies with substantial USD-denominated costs (e.g., logistics, aviation, utilities) may face headwinds, while those generating USD revenue (e.g., IT, seafood, banking) stand to benefit. With the VND depreciating only 0.6% in Q3/2025 (vs. 2.2% in Q2), the impact remains manageable.

Maybank maintains its 12% Q3 profit growth forecast but anticipates acceleration to 21% in Q4. Sector-wise, retail, steel, and banking sectors show promise, while beverages may underperform. Select large-cap stocks are expected to directly benefit from the market upgrade.

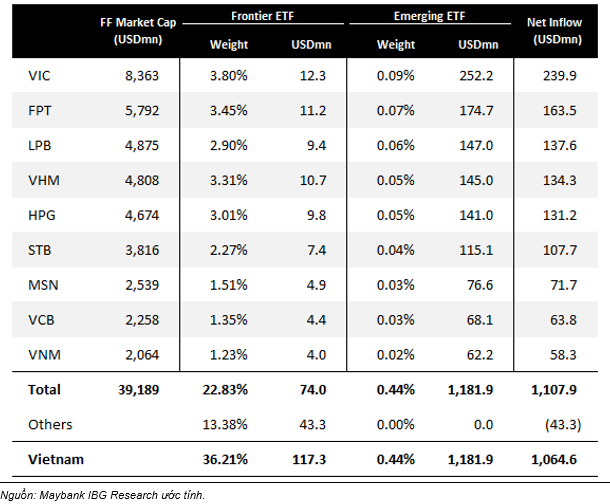

Maybank estimates 9 stocks to enter the FTSE Emerging Market Index

|

– 15:46 10/10/2025

SSI Research Maintains 1,800-Point Target for VN-Index in 2026

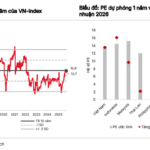

Despite the significant price surge in 2025, the VN-Index is currently trading at a forward P/E of 13.9x for 2025 and 12.0x for 2026, below its 10-year average of 14.0x and the 15-16x thresholds seen during previous market exuberance phases. SSI Research maintains its 2026 target for the VN-Index at 1,800 points.

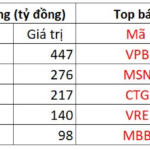

Stock Market Update October 10: Selling Pressure on Shares Remains Mild

Liquidity in the 9-10 session saw a modest uptick, signaling that market support from capital inflows remains intact. Meanwhile, selling pressure on stocks has yet to exert a significant impact.

“Vin Group Stocks Surge, Propelling VN-Index to New Historic Highs”

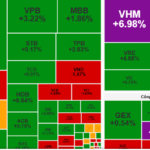

The VinGroup family of stocks soared on October 10th, with VIC and VHM hitting their daily limit, while VRE and VPL surged close to their caps. This collective rally fueled a market-wide euphoria, propelling the benchmark VN-Index upwards by over 31 points.