MB Securities Corporation (stock code: MBS, listed on HNX) has released its Q3/2025 financial report, revealing an operating revenue of VND 1,162 billion, a 44% increase compared to the same period last year.

The primary revenue drivers were lending activities, contributing VND 408 billion, a 1.5-fold increase year-on-year. Brokerage services followed closely with nearly VND 370 billion, a 2.7-fold surge. Held-to-maturity (HTM) investments also doubled to over VND 83 billion.

While profits from financial assets measured at fair value through profit or loss (FVTPL) decreased by 15% to VND 242 billion, the net profit from proprietary trading rose to VND 147 billion, a VND 100 billion increase year-on-year, thanks to reduced losses from these assets.

Operating expenses for the quarter rose by 8.4% to VND 406 billion. After deducting expenses, MBS reported a pre-tax profit of VND 418 billion and a post-tax profit of nearly VND 333 billion, both up by approximately 86% year-on-year.

For the first nine months of 2025, MBS recorded an operating revenue of VND 2,623 billion, an 11% increase. Cost-cutting measures contributed to a pre-tax profit of VND 1,030 billion and a post-tax profit of VND 823 billion, a 42% rise year-on-year. This performance equates to 79% of the annual profit target.

As of September 30, 2025, MBS’s total assets stood at VND 30,535 billion, a 38% increase since the beginning of the year.

Half of the total assets, approximately VND 15,700 billion, are in lending, primarily margin loans, up by VND 5,400 billion year-to-date. HTM investments account for VND 7,000 billion, a VND 2,000 billion increase over the first three quarters.

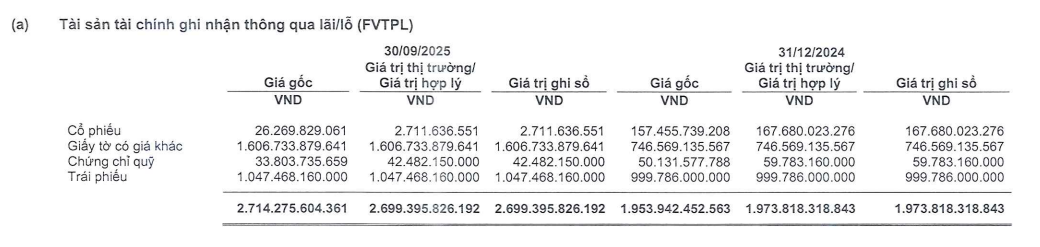

The FVTPL portfolio has a book value of over VND 2,700 billion, a VND 700 billion increase year-to-date. Bonds make up over VND 1,000 billion, while other securities doubled to over VND 1,600 billion. Equity holdings decreased from VND 157 billion to VND 26 billion and are currently facing a near 90% loss.

Source: MBS Q3/2025 Financial Report

The Available-for-Sale (AFS) financial assets portfolio is valued at over VND 2,900 billion, with VND 2,500 billion in bond investments and VND 300 billion in equities.

On the funding side, MBS has over VND 19,500 billion in short-term debt, primarily from bank loans. Long-term bond debt exceeds VND 1,500 billion, a VND 500 billion increase year-to-date. These bonds, issued between 2023-2025 with interest rates ranging from 6.8% to 7.6%, will mature in 2027-2028.

In other developments, MBS is in the process of offering 68.7 million shares to existing shareholders. The rights issue ratio is 100:12 (for every 100 shares held, shareholders can purchase 12 new shares).

The record date for shareholders is September 25, 2025. The subscription and payment period runs from October 3 to 23, 2025, with rights transferable from October 3 to 15, 2025.

The shares are freely transferable. The offering price is VND 10,000 per share, expected to raise VND 687.3 billion. Of this, VND 150 billion will bolster capital for proprietary trading and underwriting, while VND 537 billion will enhance margin lending capital.

Upon completion of this offering, MBS’s chartered capital will increase to VND 6,587.1 billion.

MBS Joins the “Billion-Dollar Club” for the First Time, Surging to Top 6 Market Share on HOSE

MBS Securities Corporation has unveiled its Q3 2025 financial results, reporting a remarkable profit of VND 418 billion, a 1.9-fold increase compared to the same period last year. With a cumulative nine-month profit of VND 1,030 billion, MBS has achieved a significant milestone by joining the prestigious “Thousand Billion Club” and securing a position among the top 6 brokerage firms on the Ho Chi Minh City Stock Exchange (HOSE).

VPS Securities Expands Brokerage Market Share on HOSE Ahead of IPO

The latest HOSE statistics reveal that VPS Securities JSC’s market share in stock brokerage surged by 1.68 percentage points in Q3/2025 compared to the previous quarter, reaching an impressive 17.05%.

VPBankS Unveils Record-Breaking Profits Ahead of Highly Anticipated IPO

With robust results from proprietary trading, financial advisory services, and lending activities, VPBank Securities Joint Stock Company (VPBankS) reported pre-tax profits of nearly VND 2.4 trillion in Q3 and approximately VND 3.3 trillion for the first nine months of the year. This marks a significant year-over-year increase and achieves over 73% of the annual target. Another notable highlight is the margin loan balance reaching a new milestone.