Mr. Bob McCooey (left) – Vice President and Director of International Listings, engages in conversation with Mr. Thomas Nguyen – Director of Overseas Markets at SSI Securities Corporation.

|

Mr. Bob McCooey highlighted Nasdaq’s focus on Vietnam, emphasizing the recent market upgrade on October 8th as a pivotal moment for Southeast Asia and a significant opportunity for Nasdaq.

The Nasdaq Vice President praised Vietnam for its exceptional entrepreneurs building remarkable businesses. He believes Vietnam is currently undervalued but anticipates the upgrade announcement will lead to greater recognition of its growth potential and opportunities, particularly for corporations.

According to Mr. McCooey, Vietnam possesses key success factors: a well-educated and diligent workforce, and substantial government investment in infrastructure, including roads, bridges, and telecommunications. The government’s focus on these areas is crucial for the country’s success.

Mr. Bob McCooey – Vice President and Director of International Listings, Nasdaq

|

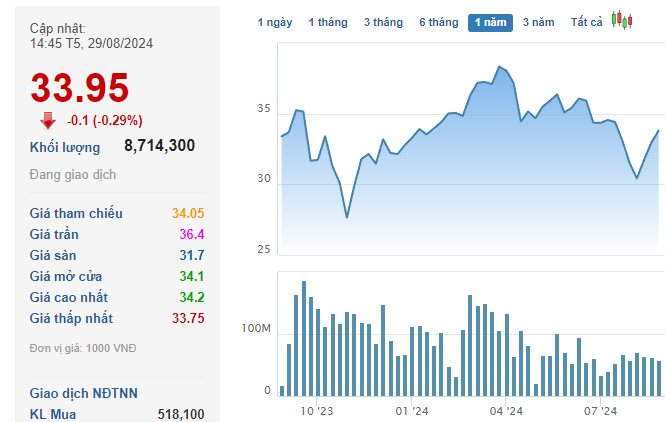

Discussing the market upgrade, Mr. McCooey stressed its positive impact on market liquidity. The upgrade will attract more participants as previously restricted funds can now invest in Vietnam, increasing liquidity. This heightened liquidity will, in turn, attract further investment, creating a positive feedback loop.

Increased liquidity will boost companies’ confidence in listing on the market, knowing their stocks will be more liquid and appeal to a broader investor base.

Regarding quantitative trading, Mr. McCooey noted that all exchanges are now electronic, tightening spreads and enabling fractional trading, which further enhances liquidity and reduces trading costs, potentially leading to free trading as seen in the US.

A higher number of liquidity providers will result in greater market liquidity, stronger growth, and increased participation, ultimately strengthening market confidence over time.

When asked about his top three priorities for advancing Vietnam’s market, Mr. McCooey emphasized the role of regulators.

First, oversight and compliance are crucial. Ensuring top-tier supervision and compliance across all brokerages and exchanges is essential for investor confidence. Without strong regulation, investors will lose trust in the market.

Second, the cautious development of new financial products is vital. As Vietnam’s next generation of investors grows and the middle class prospers, demand for diverse financial products will rise. The challenge is to carefully introduce new products to prevent investors from seeking unconventional options or moving to other markets for successful global products like the Magnificent 7 or NASDAQ 100.

Lastly, building a world-class financial ecosystem is key. Mr. McCooey expressed Nasdaq’s interest in collaborating with organizations like the International Finance Corporation (IFC) and other stakeholders to create a world-class financial ecosystem in Vietnam, working closely with regulators to achieve this goal.

|

On the afternoon of October 8th, 2025, at the State Securities Commission (SSC) headquarters, SSC Chairwoman Vu Thi Chan Phuong met with Mr. Bob McCooey. During the meeting, Mr. McCooey congratulated Vietnam’s stock market on its upgrade by FTSE Russell and affirmed Nasdaq’s readiness to support the SSC in areas of interest. He also expressed optimism about Vietnamese companies’ success in international markets. Mr. McCooey highlighted Vietnam’s dynamic growth and potential to attract US and global investors. Nasdaq aims to serve as a bridge, partnering with the SSC and Vietnamese businesses in listings, capital raising, technology, and trading oversight, leveraging its experience with over 130 global exchanges. |

– 10:10 11/10/2025

$1 Billion EVN Hydropower Project Gets €430 Million Boost from Europe

Vietnam’s Bac Ai Pumped Storage Hydropower Project has officially secured a €430 million funding commitment from European partners. This substantial support will significantly enhance the project’s role in stabilizing the national power grid, aligning with the Just Energy Transition Partnership (JETP) commitments.

European Scooter Brand Enters Vietnam, Starting at Just VND 95 Million

On October 10, 2025, the iconic Italian scooter brand Lambretta officially launched in Vietnam through its distributor, Lamscooter, marking the arrival of a new player in the premium scooter segment.