Caution: Tightening Credit Controls

The draft resolution by the Government on controlling and stabilizing real estate prices has been submitted by the Ministry of Construction for feedback from five ministries before being presented to the Government for issuance.

According to the draft, buyers of a second home can only borrow up to a maximum of 50% of the property’s contract value. For the purchase of a third home or more, the loan limit is set at no more than 30% of the contract value, effective from the resolution’s implementation until March 1, 2027.

Experts argue that while the policy to combat speculation and stabilize housing prices is well-intentioned, the credit tightening measures proposed by the Ministry of Construction are non-market-oriented and contradict modern economic principles.

Dr. Trương Văn Phước, former Acting Chairman of the National Financial Supervisory Commission and a former member of the Prime Minister’s Economic Advisory Board, stated, “The policy is correct, but the solution is flawed. Prohibiting or restricting banks’ lending rights is an administrative approach that contradicts the principles of a market economy—a status Vietnam has worked hard to achieve international recognition for.”

Non-market interventions will have severe consequences.

Echoing this sentiment, Dr. Đinh Thế Hiển, Director of the Institute for Information Technology and Applied Economics, pointed out that no country in the world intervenes as aggressively in the operations of commercial banks or the real estate sector. He emphasized that lending is a civil relationship between banks, developers, and customers, governed by the Law on Credit Institutions. Using administrative mandates to intervene not only violates the law but also distorts the capital market.

“Commercial banks must have the freedom to assess risks and make lending decisions, rather than being constrained by administrative orders. If real estate lending is prohibited, individuals may resort to consumer loans to purchase property, making it harder to control and increasing societal costs while fostering loopholes,” Hiển explained.

Hiển argued that a family buying multiple homes for their children should not be equated with speculation. Similarly, purchasing rental properties, shophouses for business, or simply accumulating assets are legitimate needs. Limiting loans to 30-50% is too restrictive and lacks economic justification.

Careful Consideration Needed for Current Market Conditions

Experts urge the Ministry of Construction to carefully reconsider its proposals to avoid arbitrary decisions. Erratic policy-making will disrupt the market, erode trust, and damage the investment environment.

“Constantly changing policies will undermine investor confidence,” Hiển warned. If implemented, the credit tightening policy could exacerbate supply shortages. Policy uncertainty may lead businesses to suspend investments or exit the market, further shrinking supply. Additionally, developers might delay launching projects until after the lending restrictions expire (March 1, 2027) to “ride out the storm.” This two-year delay would increase capital costs, ultimately driving up property prices.

From a policy perspective, Dr. Trương Văn Phước believes the government’s role should be targeted and appropriate. Specifically, the government must remove legal barriers to enable faster project implementation and increase market supply.

Crucially, the government can reduce input costs for businesses through targeted policies, rather than restricting capital outflow. One key factor is land use fees, which currently account for a significant portion of housing costs.

“Land is owned by the people, with the state acting as the representative owner and manager. The state can lower land use fees to reduce costs for businesses. When input costs decrease, housing prices will naturally follow. This is a rational market intervention,” Phước emphasized.

From a macroeconomic perspective, Dr. Lê Xuân Nghĩa, a member of the National Financial and Monetary Policy Advisory Council, warned that tightening real estate credit is akin to “removing the oxygen supply” from a key economic growth driver. Real estate contributes approximately 10% to GDP and supports over 40 related sectors, from construction materials and interiors to banking. The 2022 crisis remains a stark reminder: capital gridlock led to a frozen market, business distress, and cascading failures across industries, resulting in widespread job losses and threatening growth.

Nghĩa highlighted that the global real estate market is valued at $360 trillion, three times the world’s GDP of $120 trillion, underscoring its importance. In Vietnam, the real estate market is worth $1.5 trillion, three times its GDP.

“No sector is as large or far-reaching as real estate. Administrative tightening will not lower housing prices but will stall the economy. China’s ‘three red lines’ policy is a cautionary tale,” Nghĩa warned.

According to Nghĩa, the primary cause of rising housing prices is not speculation but a strangled supply due to years of legal bottlenecks. Project approval processes are excessively cumbersome, taking 5-7 years or even decades. Meanwhile, housing demand continues to grow.

“Thousands of stalled projects drive up financial costs, forcing developers to raise prices. Removing legal barriers will increase supply, allowing the market to self-regulate based on supply and demand. Misdiagnosing the problem will only worsen it,” Nghĩa concluded.

What Policy Solutions Can Cool Down the Real Estate Market?

In response to the Prime Minister’s directive to curb and reduce housing prices, the Ministry of Construction is actively developing a Government Resolution outlining specific policies aimed at controlling unreasonable price increases.

Experts Highlight 5 Major Risks in the Ministry of Construction’s Proposal to Tighten Second Home Loans

The Ministry of Construction’s recent proposal to tighten lending for second home purchases has sparked considerable debate. Experts argue that the core solution lies in increasing the supply of affordable housing to meet genuine demand, rather than implementing administrative interventions that could negatively impact the market.

Building a Solid Foundation for Long-Term Growth: Phát Đạt’s Strategic Priority

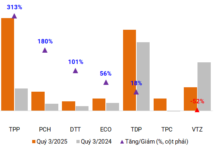

Anticipated Q3/2025 business results indicate that Phat Dat Real Estate Development Corporation (HOSE: PDR) is beginning to accelerate. While the pace isn’t as rapid as market pressures or Phat Dat’s own expectations demand, it clearly reflects the sustainability of the company’s long-term strategic plan.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.