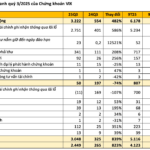

VIX Securities Corporation (VIX) has released its Q3 2025 financial report, revealing a remarkable total operating revenue of VND 3,222 billion, a staggering 482% increase compared to Q3 2024.

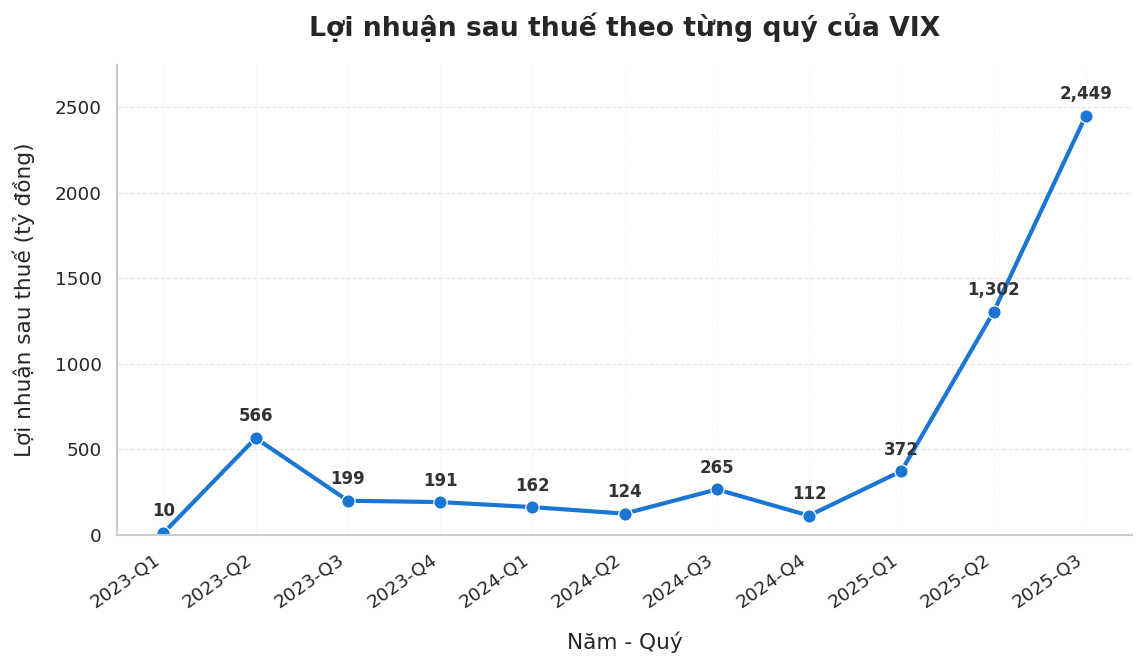

After deducting expenses, VIX’s pre-tax profit and after-tax profit for Q3 2025 reached VND 3,048 billion and VND 2,449 billion, respectively—nine times higher than the figures reported in Q3 2024. This marks the highest quarterly profit in VIX’s operational history.

For the first nine months of 2025, VIX’s cumulative operating revenue hit VND 6,178 billion, up 378% year-on-year. Pre-tax profit and after-tax profit stood at VND 5,116 billion and VND 4,123 billion, reflecting increases of 651% and 648%, respectively.

As of September 30, 2025, VIX employs 84 staff members. This means that, on average, each employee generated nearly VND 61 billion in pre-tax profit for the company during the first nine months, or approximately VND 6.77 billion per person per month.

With these figures, VIX surpasses even SCIC—the state-owned enterprise with the highest pre-tax profit per employee in 2024. SCIC reported a consolidated pre-tax profit of VND 6,169 billion in the first half of 2025, with 242 employees. On average, each SCIC employee contributed nearly VND 4.25 billion in pre-tax profit monthly.

The billions in monthly profit per employee at VIX and SCIC are astonishing, far exceeding those of most listed companies.

VIX’s revenue and profit primarily stem from proprietary trading, where the company uses its own capital to invest in stocks and other financial assets. This activity can yield massive profits when market conditions are favorable, as was the case for VIX in the first nine months of 2025.

Proprietary trading requires minimal staffing. A small but efficient team of analysts and traders can manage portfolios worth hundreds or even trillions of Vietnamese dong. When these investments surge in value, the profit generated far outweighs the personnel costs.

SCIC, on the other hand, does not operate as a traditional production or service enterprise. Its primary role is to manage and optimize state capital across numerous large enterprises. SCIC’s main revenue sources include dividends, profit-sharing from portfolio companies, and successful state capital divestment deals.

These activities eliminate the need for sales, marketing, or operational staff, enabling SCIC to generate trillions in profit with a workforce of just over 200 employees.

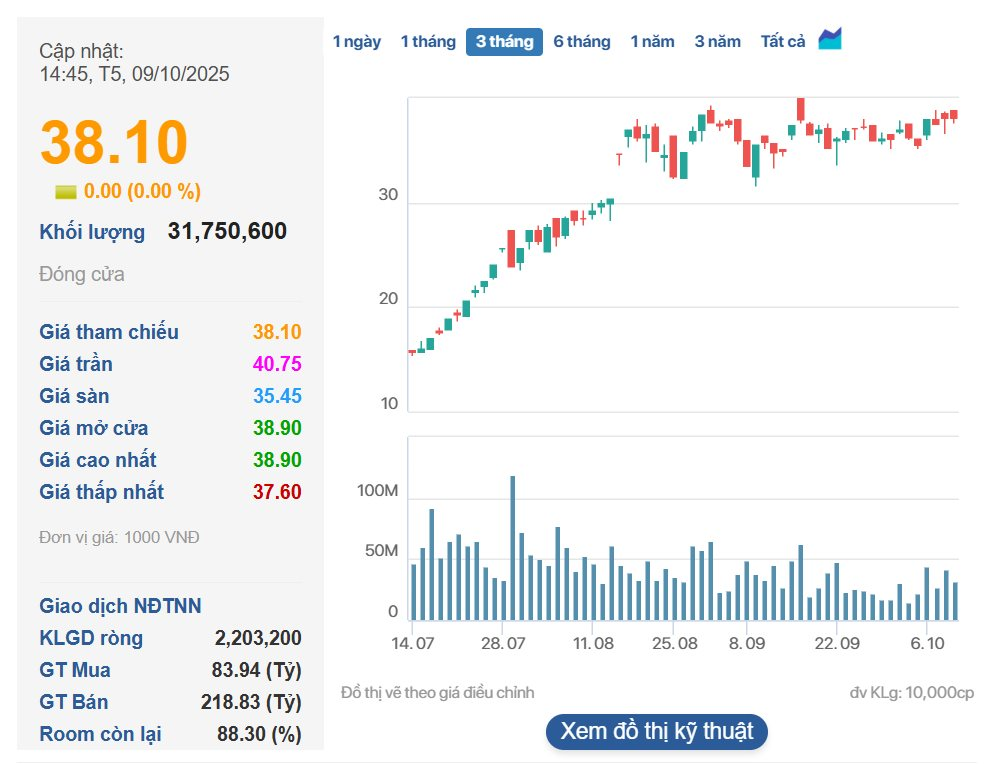

On the stock market, VIX shares are currently trading at VND 38,100 per share.

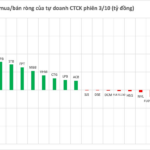

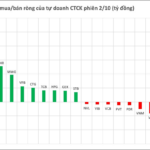

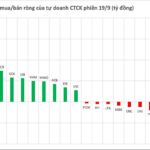

Billions Deployed to Scoop Up Vietnamese Stocks Amid Market Dip: Which Securities Are Brokerage Firms Most Aggressively Targeting?

Proprietary trading firms recorded a net purchase of VND 343 billion on the Ho Chi Minh City Stock Exchange (HOSE).