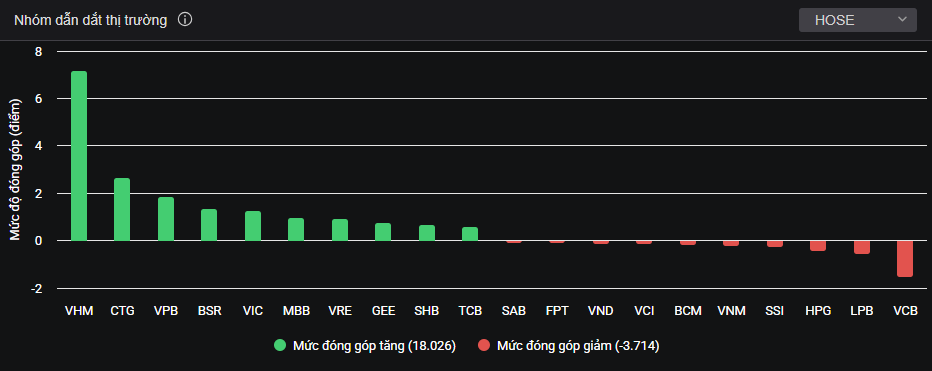

The VN-Index surpassed the 1,700-point milestone, driven primarily by the Vingroup conglomerate. On October 9th, billionaire Pham Nhat Vuong’s duo, VHM and VRE, took center stage with a remarkable surge. VHM hit its ceiling at VND 115,000 per share, while VIC rose by 0.8% and VRE climbed an impressive 4.7%.

Trading volumes also skyrocketed, with nearly 13 million units matched, and a consistent absence of sellers throughout the session. By the close, over 563,000 shares remained unfulfilled at the ceiling price.

VHM leads the market’s driving forces.

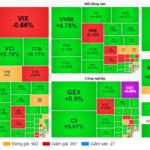

Real estate stocks also performed well, with GEX, CII, CEO, DIG, PDR, and TCH showing positive momentum. Their performance slightly outpaced the broader market, with a return to diversification.

Additionally, the banking sector played a pivotal role in pushing the VN-Index past 1,700 points, with CTG, VPB, MBB, SHB, and TCB leading the charge. SHB saw explosive liquidity, with trading values nearing VND 3.4 trillion and over 189 million shares changing hands. Recently, SHB sought shareholder approval for a 2025 capital increase plan, following its successful capital raise to nearly VND 46 trillion via a 2024 stock dividend.

Meanwhile, the securities sector reverted to red, with leading stocks SSI, VND, and HCM declining 1-2%. Despite earlier market upgrade expectations, the sector’s momentum cooled during today’s session.

At the close, the VN-Index gained 18.64 points (1.1%) to 1,716.47. The HNX-Index rose 1.6 points (0.59%) to 274.94, and the UPCoM-Index added 0.39 points (0.35%) to 110.82. Market liquidity remained stable, with HoSE recording over 1.09 billion shares traded, valued at VND 33.945 trillion.

Foreign investors resumed net selling, offloading over VND 1.744 trillion, primarily in HPG, SSI, VRE, VHM, VCI, and VIX.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

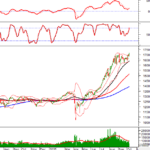

Technical Analysis Afternoon Session 09/10: Anticipating a Break Above Previous Highs

The VN-Index continues its upward trajectory, with expectations high that it will surpass its previous peak from September 2025 (equivalent to the 1,700-1,711 point range). This optimism is fueled by the emergence of buy signals from both the MACD and Stochastic Oscillator indicators. In contrast, the HNX-Index currently trades below the Middle line of the Bollinger Bands.

Technical Analysis Afternoon Session 10/10: Anticipating a Break Above Previous Highs

The VN-Index has continued its upward trajectory, surpassing its previous all-time high after decisively breaking through the September 2025 peak (equivalent to the 1,700–1,711 point range). Meanwhile, the HNX-Index remains in a state of consolidation, fluctuating around the Middle line of the Bollinger Bands.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.