On October 9th, the VN-Index closed at 1,716 points, up 18 points or 1.1%.

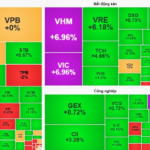

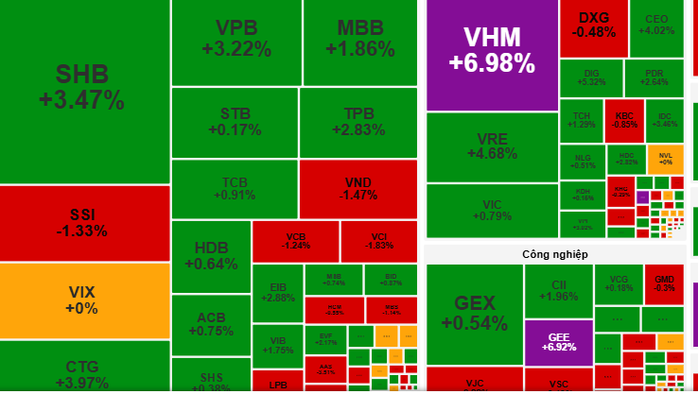

Vietnam’s stock market opened the morning session on October 9th above 1,700 points and quickly approached 1,720 points. Afterward, the VN-Index fluctuated narrowly around 1,710 points. The primary drivers of the index’s green momentum were blue-chip stocks, notably those from the Vingroup family. Specifically, VHM surged to its ceiling price (+6.9%), while VRE climbed 3.03%, contributing significantly to the market’s positive trend.

The afternoon session saw little change, maintaining the upbeat momentum from the morning. In addition to support from Vingroup stocks, banking shares also made notable gains: CTG rose 3.97%, VPB increased 3.22%, and MBB advanced 1.86%. These stocks bolstered the VN-Index’s upward trajectory, helping it sustain its green hue until the close.

A notable highlight was foreign trading activity. After a period of net buying, foreign investors unexpectedly shifted to net selling during the October 9th session, with a total net sell value of 1,604.62 billion VND. The stocks under the heaviest selling pressure included HPG, VRE, and SSI. This shift reflects a strategic adjustment by foreign investors, which may impact market sentiment in the short term.

At the close, the VN-Index settled at 1,716 points, up 18 points or 1.1%.

According to VCBS Securities, the VN-Index surpassing the 1,700-point mark on October 9th is a positive signal, primarily driven by blue-chip leadership. VCBS advises investors to maintain their portfolios of stocks in upward trends while considering allocations to sectors attracting capital inflows, such as Banking, Public Investment, and Retail. This period marks the start of Q3 2025 earnings releases, offering investors opportunities to select promising stocks for short-term goals.

Meanwhile, Dragon Capital Securities (VDSC) notes that the market is sustaining its upward trend and gradually overcoming the 1,700–1,710 resistance zone. Slight liquidity improvement compared to the previous session indicates that capital is still supporting the market, while supply-side pressure remains modest. However, for the market to extend its gains, capital strength must persist and better absorb supply in upcoming sessions.

SSI Research: 2025 Isn’t the Peak—It’s the Foundation for a New Growth Era

According to SSI Research, the current market dynamics closely resemble the early stages of previous bull cycles, signaling the onset of a new growth trajectory.

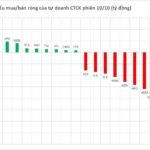

Massive Sell-Off: Brokerage Firms Unload Hundreds of Billions in Stocks During Friday’s Session

Proprietary trading desks at securities companies collectively offloaded VND 636 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the period in question.