The business landscape for foreign-owned life insurance companies in Vietnam remains bleak in the first half of this year. Despite stagnant premium revenue, profits have plummeted due to high compensation costs and a sharp decline in financial investment returns. Amidst a market undergoing comprehensive restructuring, these less-than-rosy figures reflect short-term pressures but also open doors for long-term industry transformation.

Stagnant Revenue, Persistent Compensation Costs

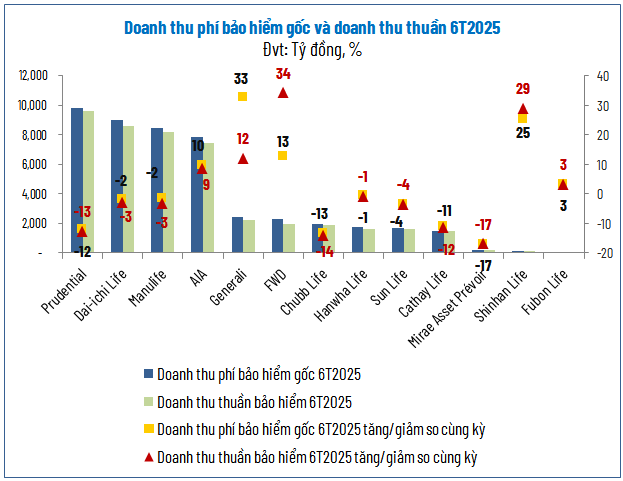

Vietnam’s life insurance market currently boasts 19 active companies, 13 of which are wholly foreign-owned. Closing the first half of the year, foreign insurers’ performance remained subdued, with total gross premiums reaching nearly VND 47 trillion, a 1% decrease compared to the same period in 2024.

Source: Author’s compilation

|

Prudential Vietnam maintains its market lead with gross premiums of approximately VND 10 trillion, yet this figure marks a 12% decline year-on-year. This trend underscores the ongoing challenges in new market penetration.

Conversely, smaller players like Shinhan Life and Funbon Life posted positive growth, with revenues of VND 134 billion and VND 53 billion, up 25% and 3%, respectively. However, these gains are localized and insufficient to significantly impact the overall market.

Source: Author’s compilation

|

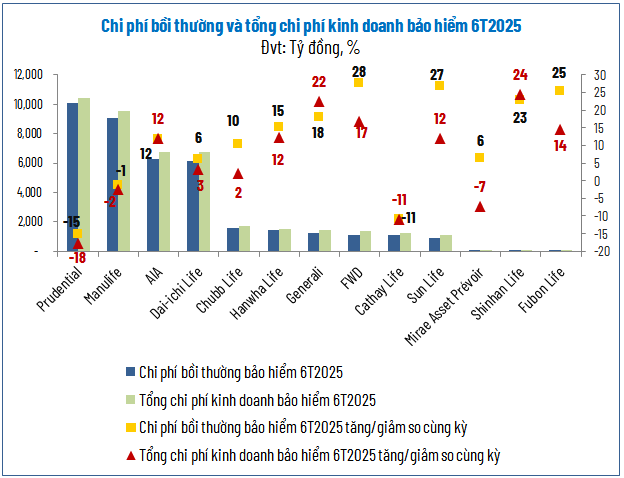

Total compensation and benefit payouts reached VND 39.2 trillion, on par with the previous year. Consequently, total insurance business expenses dipped slightly by 2% to VND 41.9 trillion. However, with stagnant revenue and incompressible costs, gross profit from insurance operations fell by 8% to VND 2.9 trillion.

Source: Author’s compilation

|

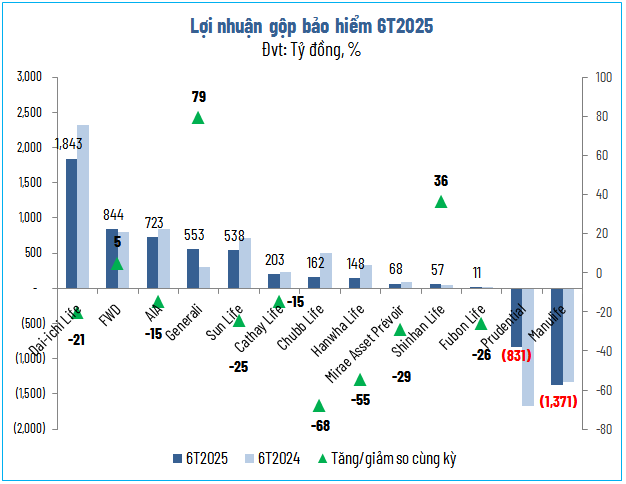

Notably, even industry giants faced insurance segment losses. Prudential, despite leading in revenue, incurred a gross loss of over VND 830 billion as compensation costs outpaced premiums. Manulife also reported a loss of VND 1.37 trillion, a VND 40 billion increase year-on-year. Companies like Dai-ichi Life, AIA, Chubb Life, Hanwha Life, and Sun Life saw profit declines exceeding 15%.

Bright spots were rare. Generali’s insurance gross profit surged 79% to VND 553 billion, while FWD and Shinhan Life saw modest increases. Overall, however, foreign insurers’ insurance profits significantly contracted compared to previous periods.

Financial Investment Profits Slow Down, Delivering a Double Blow to Earnings

As insurance operations grapple with revenue and compensation cost challenges, financial investment returns—a critical pillar for insurers—have also plummeted.

Source: Author’s compilation

|

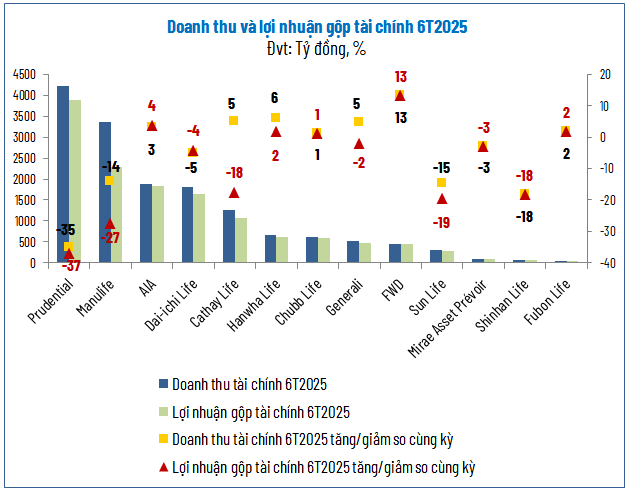

In the first half of 2025, 13 foreign life insurers generated over VND 13.3 trillion in financial profits, a 20% decline from 2024. Financial revenue dropped 15%, while financial expenses surged 50% to nearly VND 1.9 trillion.

Prudential led in financial profits with VND 3.9 trillion, though this was 37% lower year-on-year. Manulife followed with VND 2.3 trillion (down 27%), and Cathay Life with VND 1.1 trillion (down 18%). The primary cause of this financial revenue decline was a significant drop in investment dividends.

Source: Author’s compilation

|

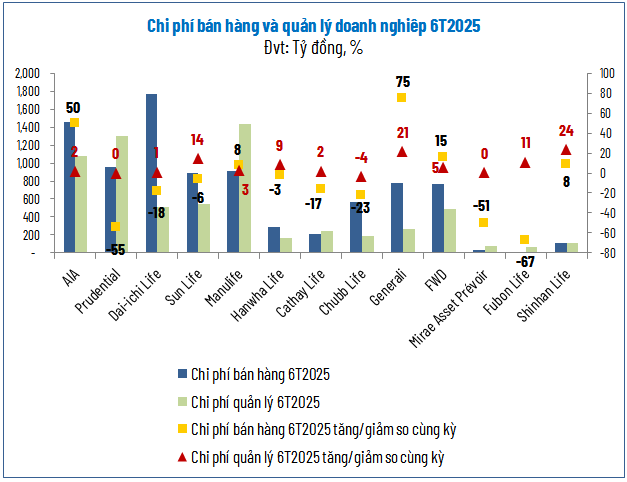

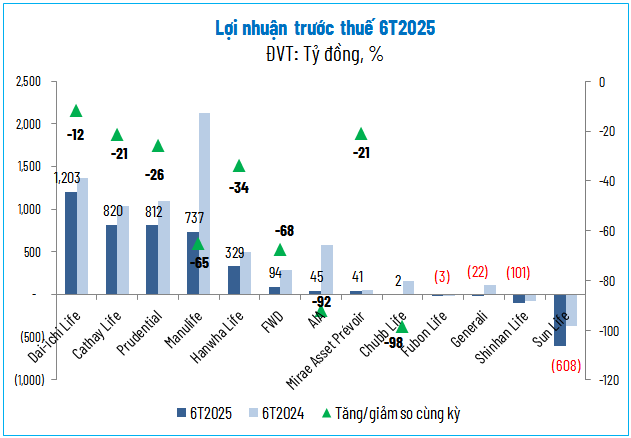

The combined decline in insurance and financial investment profits dragged down overall results. After deducting VND 8.7 trillion in sales expenses (down 9%) and VND 6.4 trillion in management costs (up 4%), the 13 foreign insurers’ pre-tax profit totaled VND 3.3 trillion, more than halving from 2024.

Source: Author’s compilation

|

Four companies reported losses: Sun Life (VND 608 billion), Shinhan Life (VND 101 billion), Generali (VND 22 billion), and Funbon Life (VND 3 billion).

Other companies fared little better. Chubb Life’s profit plunged 98% to VND 2 billion, and AIA‘s dropped 92% to VND 45 billion. While Dai-ichi Life, Cathay Life, Prudential, and Manulife remained profitable, double-digit profit declines highlighted intense competition and rising operational costs.

Is Life Insurance Losing Appeal Among Consumers?

Vietnam’s life insurance market once flourished, with premium revenue growth sometimes exceeding 20% annually. However, recent years have been challenging, with new premium revenue plummeting 14% in 2023. Following a trust crisis, the market is recovering but has yet to fully rebound.

According to economist Tran Nguyen Dan at the “Repositioning the Life Insurance Market” talk show, new premium revenue in the first eight months of this year dipped slightly by 2% year-on-year, with the agency channel declining sharply by 10%. He attributed this slowdown not to consumers abandoning life insurance but to weakened purchasing power due to economic hardships and a sluggish real estate market.

Dan predicted that as the economy recovers and incomes rise, demand for life insurance will rebound. “Consumers still value life insurance as a means of protection and asset transfer for their children. The current focus is on more immediate needs during challenging times,” he noted.

The market’s slowdown is also a necessary evolution, enhancing the quality of the life insurance industry. Since July 1, 2025, the new Insurance Business Law has tightened regulations on consulting and products, leading to significant agent market attrition.

“Previously, selling life insurance was too easy. Products were pre-packaged and often likened to ‘cure-all’ remedies, with agents merely seeking customers. Since July 1, products must be separated, and agents must transform into financial advisors. This shift demands higher capabilities, forcing less qualified individuals out of the market. Thus, this isn’t a downturn but a necessary market renewal,” Dan analyzed.

Repositioning for Sustainable Recovery

At the same talk show, Phung Ba Khang, Deputy General Director of Marketing and Value Commitment Planning at AIA Vietnam, noted that Vietnam’s life insurance market, though young compared to regional peers, is undergoing necessary adjustments. New regulations enhance market transparency and compel companies to improve consulting quality, products, and customer experiences.

Khang sees this as an opportunity for companies to rebuild consumer trust—a cornerstone for long-term growth, aiming to increase Vietnam’s life insurance participation rate to 18% by 2030.

Under this new strategy, the industry must focus on enhancing advisor capabilities (emphasizing post-sales knowledge and skills), innovating products to emphasize core protection values, and investing in digital technology (e.g., contract management apps, AI in claims assessment) to deliver faster, more accurate, and customer-friendly services.

– 12:00 10/10/2025