A significant legal step has been taken with the enactment of Law No. 56/2024/QH15, which amends and supplements certain provisions of the Securities Law. This law was passed by the National Assembly and will come into effect in 2025. To further refine the subordinate legal documents, Decree 245/2025/NĐ-CP was issued by the Government on September 11th.

The decree aims to: Perfect the legal framework for market organization and operation, aligning Vietnam’s stock market with international standards; Create a more open, transparent, and attractive investment environment for both domestic and foreign investors; Enhance infrastructure capacity, ensure system safety, and prepare for the Central Counterparty Clearing House (CCP) model; and Support enterprises and issuers in raising capital efficiently and sustainably.

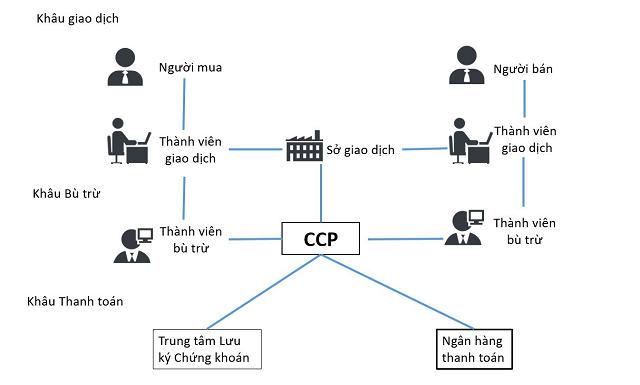

One notable aspect of the decree is the amendments regarding the registration, depository, clearing, and settlement of securities transactions. This provides the legal basis for Vietnam to implement the CCP mechanism, a requirement emphasized by rating organizations such as MSCI and FTSE Russell in their assessment reports.

Illustration of the Central Counterparty Clearing House (CCP) model

|

Firstly, Law No. 56/2024/QH15 (effective from 2025) clarifies that clearing members have the right to clear and settle transactions for securities traded on the trading system. In the case of clearing and settling derivative securities transactions, clearing members that are commercial banks or foreign bank branches may only clear and settle transactions for themselves.

This regulation aims to establish the legal foundation for implementing the CCP model in the primary securities market. It is a solution to enhance market quality and meet the criteria for upgrading Vietnam’s stock market.

Additionally, the Law allows the Vietnam Securities Depository and Clearing Corporation (VSDC) to establish subsidiaries and delegate certain rights and obligations to them, subject to approval by the Ministry of Finance. This is a crucial legal basis for implementing the CCP function in the securities market.

The Law also revises provisions on clearing and settlement, specifying that these activities, along with determining payment obligations for securities and cash, are conducted through VSDC or its subsidiaries. It further empowers the State Securities Commission to manage, inspect, and supervise the securities operations of VSDC’s subsidiaries.

The CCP model is expected to be implemented by the end of 2027 at the latest.

Based on the Law, the Decree amends and supplements regulations requiring companies to complete securities registration with VSDC before listing securities on the stock exchange. This separation clarifies that securities registration does not imply compliance with listing or trading requirements.

Furthermore, the Decree mandates that competent authorities requesting securities ownership information from VSDC must specify the content, purpose, form, and legal basis for such requests. This ensures VSDC can comply while maintaining client information confidentiality.

A notable amendment in the Decree excludes debt instruments and corporate bonds from the CCP clearing and settlement mechanism. VSDC’s subsidiaries are authorized to perform clearing and settlement under the CCP model as delegated by VSDC. These subsidiaries must allocate 5% of their annual revenue to establish a risk prevention fund, a critical resource for ensuring transaction settlements.

The Decree also simplifies administrative procedures by removing the requirement for State Bank approval for commercial banks and foreign bank branches to provide clearing and settlement services. VSDC may refuse to act as a counterparty for transactions that could jeopardize the clearing and settlement system’s safety.

Importantly, the Decree stipulates that the CCP model must be fully implemented by December 31, 2027.

– 11:02 11/10/2025

UBCKNN’s New Policy Set to Expand Market and Attract Foreign Investment

At the conference disseminating the amended Securities Law, Vice Chairman of the State Securities Commission (SSC) Hoàng Văn Thu emphasized that Decree 245 and Circular 19 will play a pivotal role in expanding market scale, increasing the supply of goods, and attracting foreign investors, particularly as Vietnam’s stock market ascends to a higher classification.

When Capital Tells a Story: 10 Lessons from the Resilient Leaders of The Investors Season 2

After three months on air, *The Investors – The Resilients* talk show has delivered a wealth of inspiring insights from influential figures representing leading organizations such as VPBankS, Dragon Capital, STI, FiinGroup, Đạt Phương, DNSE, and SSID. Their powerful statements continue to resonate, leaving a lasting impact on audiences.

Will the “Wave of Upgrades” Emerge?

According to experts, if upgraded, the VN-Index could surge past its historical peak in the short term, fueled by robust domestic capital flows and active participation from proactive investment funds.