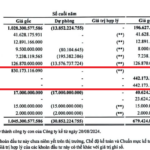

Recently, Vietnam Posts and Telecommunications Group (VNPT) officially registered to sell its entire stake of 2 million shares, equivalent to 5.45% of the capital in Vietnam Technology & Telecommunication Joint Stock Company (VNTT, UPCoM: TTN). Investors can register and deposit from October 8 to 27, with the auction scheduled for 9:30 AM on November 3 at Saigon – Hanoi Securities Corporation (SHS), which is also the advisor for the transaction.

The starting price is set at 28,492 VND per share, approximately 60% higher than TTN’s closing price of 18,000 VND on October 9. This valuation reflects VNPT’s confidence in VNTT’s potential. The divestment aligns with VNPT’s restructuring plan, approved by the Prime Minister, to refocus resources on core business areas.

The Becamex Smart Operations Center (IOC), invested by Becamex, with VNTT as a key partner providing technology and telecommunications solutions (Source: VNTT)

Established in 2008, VNTT plays a crucial role in developing and providing telecommunications and IT infrastructure for industrial zones within the Becamex ecosystem. Starting with a charter capital of nearly 110 billion VND, the company increased its capital to over 367 billion VND by 2022, reflecting its growth alongside the expansion of industrial zones.

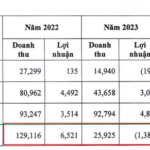

VNTT’s 2025 semi-annual consolidated financial report highlights positive performance. In the first six months, the company recorded net revenue of nearly 174 billion VND, a 13.1% increase year-on-year. After-tax profit grew by 15.4%, reaching over 36.4 billion VND. This growth is driven by strong performance in core services such as telecommunications and data centers, along with increased financial revenue.

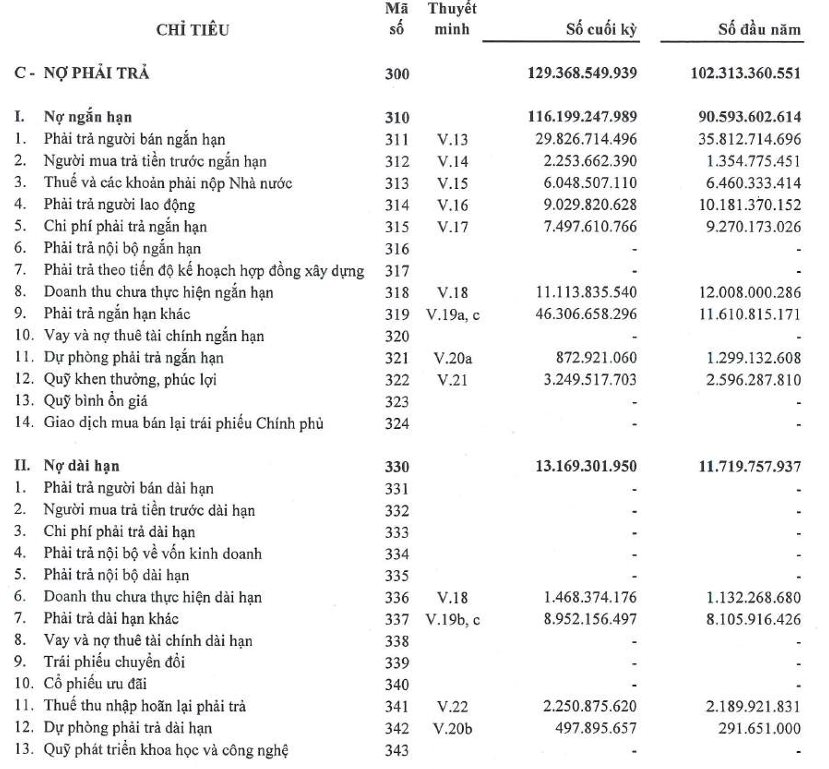

A standout feature of VNTT’s financial structure is its secure capital base. As of June 30, 2025, the company’s total assets reached nearly 600 billion VND, with no recorded financial debt—a rarity among listed companies. Cash, cash equivalents, and short-term financial investments exceeded 230 billion VND, demonstrating strong financial autonomy.

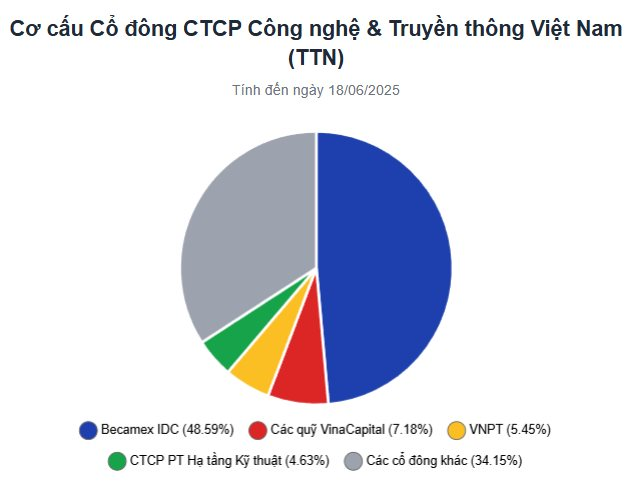

VNTT’s ownership structure is highly concentrated. The largest shareholder is Becamex Industrial Development Joint Stock Company, holding 48.59%. Their business relationship is evident through financial transactions.

In the first half of 2025, revenue from the Becamex ecosystem contributed approximately 33.4 billion VND, nearly 20% of total revenue. Similarly, receivables from this group totaled nearly 47 billion VND by period-end. These figures underscore VNTT’s role as a key partner, providing stable revenue through infrastructure services for Becamex’s industrial zones.

Additionally, the presence of VinaCapital funds, holding over 7% of shares, highlights institutional investor interest in the company.

Saigon Port to Fully Divest from Member Logistics Company

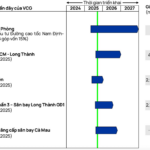

The Board of Directors of Saigon Port (UPCoM: SGP) has approved the divestment of its entire stake in Saigon Port Logistics JSC (SPL). This strategic move aims to restructure the investment portfolio and focus resources on key projects, including the Hiep Phuoc Port and Can Gio Port.

VNPT Honored with “Outstanding Exhibition Space” Award at National Achievements Expo

On the evening of September 15th, the Closing Ceremony of the National Achievement Exhibition, “80 Years of the Journey Towards Independence, Freedom, and Happiness,” marked the culmination of a historic, nation-wide event that attracted a record-breaking 10 million visitors.