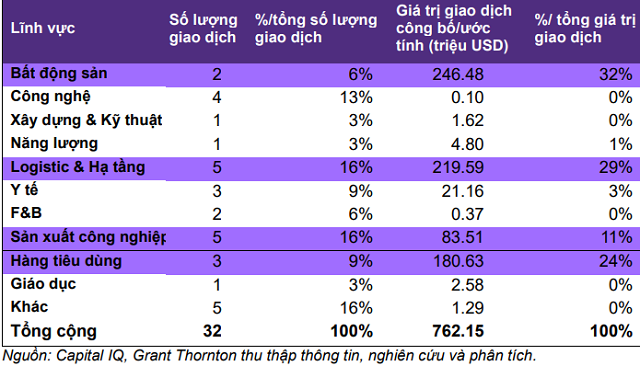

Leading the charge are Logistics & Infrastructure and Industrial Manufacturing, each with 5 deals. Technology follows closely with 4 transactions. Despite significant investor interest, most tech deals remain in early stages and are relatively small in scale.

In terms of disclosed/estimated value, real estate continues to dominate the market, with transactions totaling approximately 246 million USD. Logistics & Infrastructure and Consumer Goods follow, with estimated values of 220 million USD each.

Real Estate Sector

Nova Rivergate LLC and Nha Rong Investment and Trading JSC (affiliates of Novaland Group) acquired 51% stakes in ASCLT1 and ASCLT2 from Amata Long Thanh Urban JSC. The deals, valued at 21.7 million USD (ASCLT1) and 24.8 million USD (ASCLT2), total approximately 46.5 million USD. Both target companies specialize in investing and developing urban areas and satellite services for the Amata Long Thanh Industrial Park (Dong Nai). Following the transaction, Amata Long Thanh Urban JSC fully divested from these companies.

SonKim Land, a member of SonKim Group, successfully secured a 200 million USD private credit facility. The investor’s identity remains undisclosed. The funds will support SonKim Land’s expansion strategy and long-term financial goals, including high-end residential, office, and hotel projects in Vietnam. This development precedes SonKim Land’s announced participation in the auction of 3,790 resettlement apartments in the Thu Thiem New Urban Area on September 17th.

Technology Sector

Concentrix Corporation (NasdaqGS: CNXC), a global leader in customer experience (CX) services and technology solutions, completed the acquisition of SAI Digital LLC, a Ho Chi Minh City-based technology company. SAI Digital specializes in digital transformation consulting and implementation, particularly in digital commerce, cloud, and AI-driven customer experience, serving clients across Asia, Europe, and North America. Through this acquisition, Concentrix integrates SAI Digital into its Asia-Pacific network, enhancing its capabilities in AI, digital commerce, and digital transformation consulting, thereby accelerating its global CX technology development.

iNexus Technology JSC, a Vietnamese fintech startup, successfully raised funding from Ansible Ventures, a domestic venture capital firm investing in tech startups like NativeX and Zitore. iNexus develops platforms that enable banks to extend credit to small and medium-sized businesses (SMBs).

Industrial Manufacturing Sector

Vina CNS LLC, a Korean-invested company specializing in industrial manufacturing, engineering, and household plastic products, announced plans to issue common shares to raise approximately 23 million USD. The transaction involves Fine M-Tec, a Korean company manufacturing IT and automotive components, an existing investor. The issuance was approved by shareholders and is expected to complete in September 2025.

Dat Bike, an electric motorcycle startup, successfully raised 22 million USD in a Series B funding round. The lead investor is FCC, a Japanese company specializing in clutches and automotive components.

The International Finance Corporation (IFC, a World Bank member) announced a quasi-equity investment of up to 38 million USD in Dai Dung Mechanical Construction and Trading JSC (DDC), a Vietnamese steel structure company. The investment will support DDC’s 152 million USD project, including the construction of two new factories in Ho Chi Minh City and Thanh Hoa.

Logistics & Infrastructure Sector

Moller Capital, through its EMIF II fund and in collaboration with VinaCapital, invested in and signed a strategic partnership agreement with ALS Cargo Terminal JSC (ALSC), a subsidiary of ALS Corporation (majority-owned by Vietnam Airlines). This marks A.P. Moller Capital’s first investment in Vietnam’s transportation sector, following notable investments in renewable energy projects like Verdant Energy Vietnam. A.P. Moller Capital is the infrastructure fund manager of AP Moller Group, the global conglomerate owning A.P. Moller – Maersk, a leading global shipping and logistics company.

VII Holding JSC acquired nearly 320.5 million shares of Tasco JSC (HNX: HUT), equivalent to 28.32% of Tasco’s charter capital. Tasco is a Vietnamese multi-sector infrastructure and investment company expanding into automobiles, insurance, and electronic toll collection. The transaction occurred from September 10th to October 9th. VII Holding is affiliated with Mr. Vu Dinh Do, Chairman of Tasco’s Board of Directors.

VII Holding becomes Tasco’s largest shareholder after a 6 trillion VND transaction series

On September 18th, Kawanishi Warehouse and MOL Logistics officially became strategic shareholders of Toan Phat Logistics JSC (TPL), alongside founding shareholder Toan Phat Irradiation LLC (TPI). This alliance aims to establish the Mekong Logistics Hub at the gateway to the Mekong Delta – Vietnam’s first integrated cold logistics center. Leveraging TPI’s adjacent irradiation system, the project creates a closed-loop “irradiation – cold storage – logistics” service model for agricultural and aquatic product exports. Post-transaction, Kawanishi holds 51%, MOL Logistics 39%, and TPI 10%.

Food & Beverage (F&B) Sector

Viet Thai International (VTI) Group, a Vietnamese conglomerate owning brands like Highlands Coffee and Pho 24, acquired the operational rights to the Paris Baguette brand in Vietnam, expanding its F&B ecosystem. Paris Baguette, a renowned bakery-cafe brand under South Korea’s SPC Group, operates in major markets including the US, China, Singapore, France, and Vietnam.

Consumer Goods Sector

Hasfarm Holdings, parent company of Dalat Hasfarm, signed an agreement to acquire 100% of Lynch Group (Australia) for an estimated 270 million AUD (178 million USD). Lynch, an Australian listed flower company, operates in fresh flowers, potted plants, and flower distribution across major markets like Australia and China, with an integrated model from production to distribution. Hasfarm Holdings, headquartered in Hong Kong, has Vietnam as its primary production hub (Dalat Hasfarm) and significant operations in China, Indonesia, Japan, Europe, and now Australia through the Lynch acquisition.

Fresh flower giant Hasfarm acquires Australia’s Lynch Group

Healthcare Sector

Hapaco (HAP) approved a resolution to divest its 35.31% stake in Green International Hospital (Hai Phong) at a minimum price of 20,000 VND per share, expecting to raise at least 424 billion VND. Post-transaction, Green will no longer be a Hapaco subsidiary; the buyer remains undisclosed.

Hapaco divests from Green International Hospital to focus on paper and social housing

– 11:39 10/10/2025

Building a Solid Foundation for Long-Term Growth: Phát Đạt’s Strategic Priority

Anticipated Q3/2025 business results indicate that Phat Dat Real Estate Development Corporation (HOSE: PDR) is beginning to accelerate. While the pace isn’t as rapid as market pressures or Phat Dat’s own expectations demand, it clearly reflects the sustainability of the company’s long-term strategic plan.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.