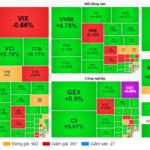

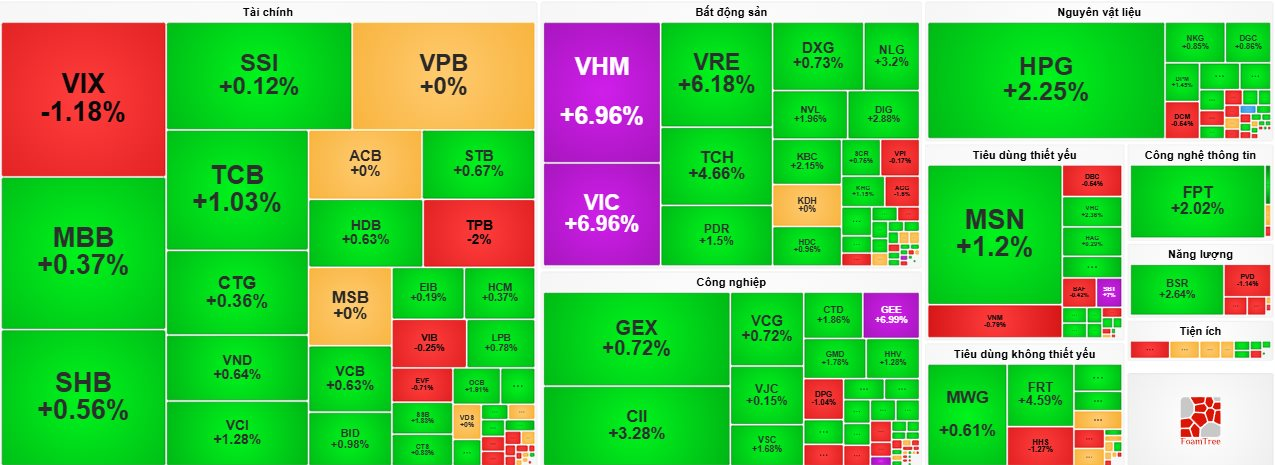

Vietnam’s stock market closed the October 10th session in vibrant green, fueled by a surge in VinGroup-related stocks. This rally propelled the VN-Index to a historic high.

At the close on October 10th, the VN-Index climbed 31.08 points to reach 1,747.55. Conversely, the HNX-Index dipped 1.32 points to 273.62, while the UPCoM-Index gained 1.51 points, settling at 112.21.

Market liquidity remained robust, with total trading value across all three exchanges nearing 36.5 trillion VND. The HoSE alone saw over 33.5 trillion VND in trading volume, a slight decrease of nearly 900 billion VND from the previous session.

Vietnam’s stock market soared on October 10th.

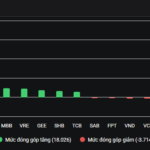

The spotlight of the session fell on VinGroup-affiliated stocks, with VIC and VHM both hitting their ceiling prices at 6.96%, while VRE surged close to its limit at 6.18%. The trio’s impressive performance not only boosted the index but also sparked widespread market optimism. Another VinGroup stock, VPL, also saw a significant rise of 2.06%, closing at 89,000 VND per share.

The real estate sector witnessed further gains, with notable performers including TCH (+4.66%), KBC (+2.15%), NLG (+3.2%), PDR (+1.5%), DIG (+2.88%), and NVL (+1.96%), among others.

Banking stocks continued to provide solid support, with most maintaining their upward trajectory: OCB (+1.91%), SSB (+1.33%), and TCB (+1.03%). Several other banking stocks saw more modest gains of under 1%, including VCB, BID, CTG, SHB, MBB, STB, HDB, EIB, TPB, and NAB.

Notably, steel stocks rebounded positively after a period of stagnation, with HPG (+2.25%), HSG (+0.8%), and NKG (+0.85%) leading the charge.

Additionally, several large-cap stocks across various sectors contributed to the market’s overall upward momentum, including GEE (+6.99%), CII (+3.28%), BSR (+2.64%), FRT (+4.59%), SBT (+7%), VHC (+2.36%), and FPT (+2.02%), among others.

Bucking the trend, some large-cap stocks experienced notable declines, such as TPB (-2%), VIX (-1.18%), and BVH (-1.09%). Other stocks with more modest losses included VIB, EVF, VAB, VNM, DBC, VPI, HDG, and DCM.

Foreign investors were active in the market but remained net sellers, offloading over 700 billion VND during the session. VPB saw the heaviest selling pressure, with foreign investors dumping over 310 billion VND worth of shares. Other heavily sold stocks included CTG (263.14 billion VND), MSN (249.69 billion VND), VRE (195.08 billion VND), SHS (144.49 billion VND), MBB (131.66 billion VND), and VCI (130.22 billion VND).

On the buying side, foreign investors aggressively accumulated HPG, purchasing over 371 billion VND worth of shares. Other popular buys included VHM (275.66 billion VND), VIC (216.45 billion VND), FPT (140.52 billion VND), and TCH (97.65 billion VND).

Analysts attribute the strong performance of leading stocks, particularly VinGroup-related ones, to the return of substantial capital to blue-chip stocks, a factor that could sustain the VN-Index’s momentum in the short term. However, after a period of rapid gains, the market may experience technical corrections as profit-taking pressures increase.

The October 10th session concluded on a high note, with the VN-Index reaching a new peak, signaling a robust return of investor confidence and capital to Vietnam’s stock market, heralding a new growth phase.

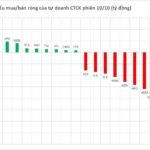

Massive Sell-Off: Brokerage Firms Unload Hundreds of Billions in Stocks During Friday’s Session

Proprietary trading desks at securities companies collectively offloaded VND 636 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the period in question.

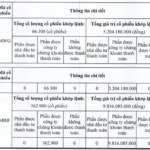

VNDIRECT Processes Payments for Two Non-Prefunding Transactions

On October 8th, VNDIRECT Securities Corporation reported a case of a foreign institutional investor (FII) failing to settle payment within the stipulated timeframe.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.