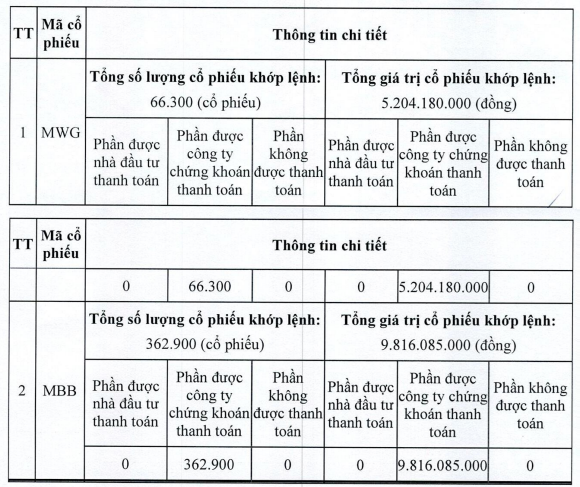

Specifically, foreign investors placed orders on October 7 for two stock codes: 66,300 shares of MWG, valued at over VND 5.2 billion, and 362,900 shares of MBB, valued at over VND 9.8 billion. The total transaction value exceeded VND 15 billion, but payment was not completed. As a result, the entire payment obligation was transferred to VNDIRECT.

Under the new regulations outlined in Circular 68 issued by the Ministry of Finance, effective from November 2, 2024, foreign investors are no longer required to have sufficient funds before placing stock purchase orders (Non-prefunding). If a foreign investor fails to settle the payment post-transaction, the payment responsibility falls on the securities company where the order was placed. Both parties must agree on the required amount when placing stock purchase orders to ensure transparency and financial security.

|

VNDIRECT settled two stock purchase transactions for foreign investors

Source: VNDIRECT

|

Non-prefunding is a critical factor that enabled Vietnam’s stock market to enter the Secondary Emerging Market category under FTSE Russell’s classification. This achievement was highlighted by a senior executive from the rating organization.

David Sol, Global Policy Director at FTSE Russell, emphasized three key factors during an interview following the upgrade. These include the implementation of the Non-prefunding model, which streamlines stock trading; improved mechanisms for handling failed transactions, enhancing transparency and stability; and a significantly simplified account opening process for foreign investors.

– 10:02 PM, October 9, 2025

VNDIRECT Shareholders Finalize Strategy to Boost Capital to Nearly VND 20 Trillion

At the extraordinary shareholders’ meeting held on the afternoon of October 10, 2025, shareholders of VNDIRECT Securities Corporation (HOSE: VND) approved a plan to reduce the scale of the private placement of shares. Additionally, they endorsed a supplementary plan to offer shares to existing shareholders.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Anticipating Portfolio Restructuring Trends Post-Market Upgrade

In today’s volatile market landscape, effective investing is no longer about chasing maximum returns but rather optimizing portfolios to align with specific financial goals. When investors clearly define key factors such as expected capital, investment horizon, and risk tolerance, every decision—from asset allocation to rebalancing and instrument selection—becomes more grounded and verifiable.

International Media: Foreign Capital Set to Surge into Vietnam

According to Reuters, upgrading Vietnam’s stock market status will eliminate numerous technical barriers, which have previously prevented passive funds from investing in domestically listed stocks.