VNDIRECT’s Extraordinary Shareholders’ Meeting Held on October 10, 2025

|

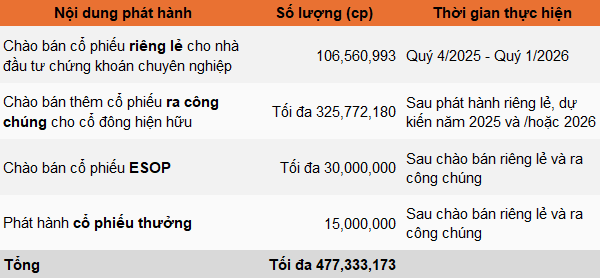

Following the conclusion of the voting session at the extraordinary meeting, three capital increase plans previously approved at the 2024 Annual Shareholders’ Meeting but not yet implemented—including private placement of shares, employee stock ownership plan (ESOP), and bonus share issuance—have been finalized under a new schedule.

Specifically, the plan to privately place over 268.6 million shares to professional securities investors will be scaled down to nearly 106.6 million shares, to be executed in 2025 and/or 2026. If successful, VND will increase its total shares to nearly 1.63 billion, corresponding to a chartered capital of approximately VND 16.3 trillion.

The company has set an official offering price, which will not be lower than the book value per the latest audited/reviewed financial statements (prior to the Board of Directors’ resolution on the issuance). As of the end of Q2, the book value of VND stood at VND 12,896.2 per share.

Regarding the use of proceeds, the company plans to allocate 60% for margin lending and 40% for investing in securities, deposit certificates, and market deposit agreements.

Addressing shareholder concerns about the reduced scale of the private placement, Mr. Nguyễn Vũ Long, CEO of VNDIRECT, explained that the original plan required significant time to find strategic investors. Recently, the company has received numerous proposals from investors for smaller-scale placements.

Mr. Nguyễn Vũ Long, CEO of VNDIRECT, addressing the meeting

|

For the remaining two plans—issuing up to 30 million shares for ESOP and 15 million bonus shares for employees—VNDIRECT will proceed after completing the aforementioned private placement and a public offering.

The public offering will involve up to 325.8 million shares, at a ratio of 5:1 (1 existing share grants 1 purchase right, with 5 rights required to buy 1 new share), based on the post-private placement share count. This will be executed in 2025 and/or 2026.

At a price of VND 10,000 per share, the company estimates raising nearly VND 3.3 trillion, with 60% allocated to margin lending and 40% to securities, deposit certificates, and market deposit agreements.

Initially, the three capital increase plans—268.6 million private placement shares, up to 30 million ESOP shares, and 15 million bonus shares—were approved at the 2024 Annual Shareholders’ Meeting. However, none have been implemented to date.

At the May 2025 Annual Shareholders’ Meeting, VNDIRECT’s leadership approved the continuation of these plans, stating that implementation would depend on market conditions and new development strategies until 2026. Recent adjustments were made at the 2025 Extraordinary Shareholders’ Meeting.

Thus, from the initial plans totaling over 313.6 million shares, VNDIRECT’s new strategy aims to issue up to 477.3 million shares. If successful, the company’s total shares will reach nearly 2 billion, with a chartered capital of approximately VND 20 trillion.

|

VNDIRECT’s 4 Share Issuance Plans

Source: VNDIRECT, compiled by the author

|

Capital Increase is Essential for Maintaining Competitiveness

During the meeting, CEO Nguyễn Vũ Long repeatedly emphasized the urgency of capital increases for VNDIRECT’s operations, particularly its competitive edge.

While current margin debt and financial investment ratios comply with legal requirements, growth potential in the upcoming period—especially post-market upgrade—is limited.

For investment activities, where the company focuses more on underwriting than proprietary trading, increasing capital ensures compliance with regulatory standards aimed at enhancing asset quality.

The company also serves foreign institutional investors, including through Non-prefunding services, which require substantial resources. With strong anticipated demand from foreign investors post-upgrade, capital increases are now critical.

According to the CEO, as securities firms race to increase capital, VNDIRECT’s similar actions are vital to maintaining competitiveness.

– 18:01 10/10/2025

DigiWorld Successfully Completes Distribution of 2 Million ESOP Shares

By October 3rd, Digiworld successfully distributed 2 million ESOP shares to 96 employees and executives.

Novaland CEO Bags Nearly 15 Million ESOP Shares at 74 Billion VND, Pocketing Over 158 Billion VND in Gains

As of October 2, 2025, Novaland employees have successfully subscribed and paid for over 31.53 million ESOP shares out of the planned 48.75 million shares offered. With 17.22 million shares remaining unsold, Novaland’s Board of Directors will continue offering these ESOP shares to company employees at a price of 10,000 VND per share.