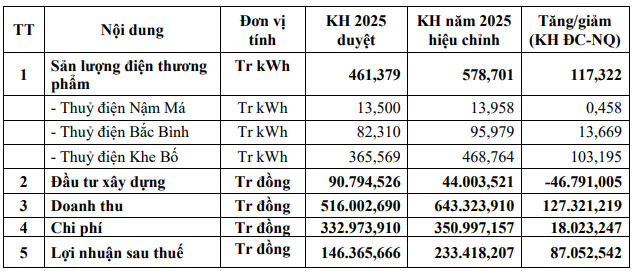

Financial targets such as revenue and post-tax profit have been increased by 25% and 59%, respectively, compared to the previously approved plan, reaching over 643 billion VND and 233 billion VND.

The only adjusted target that saw a decrease was the construction investment value, which was reduced from nearly 91 billion VND to 44 billion VND.

|

VPD’s 2025 Business Plan After Adjustment

Source: VPD

|

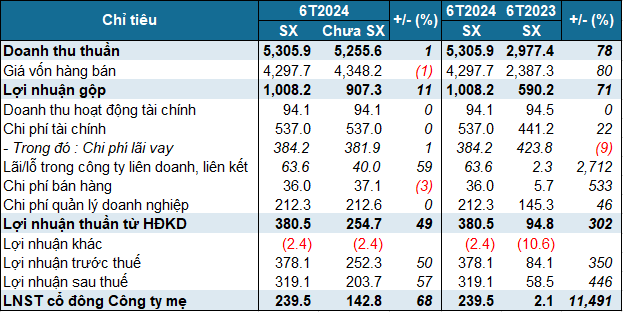

VPD’s decision to raise most of its 2025 targets comes ahead of the Q3/2025 financial report release in October. Earlier, the company’s first-half performance was positive, with total revenue nearing 259 billion VND, a 32% increase year-over-year. Notably, VPD’s post-tax profit exceeded 80 billion VND, 2.2 times higher than the same period last year.

As a result, the company achieved 50% of its revenue target and 55% of its profit target based on the pre-adjustment plan. When considering the adjusted plan, the achievement rates drop to 40% and 34%, respectively.

VPD is an affiliate of Electricity of Vietnam’s Power Generation Corporation 1 (EVN). The company currently manages three hydroelectric plants and a design consulting center, including the Nậm Má Hydropower Plant in Hà Giang with a capacity of 3.2MW, the Bắc Bình Hydropower Plant in Bình Thuận with a capacity of 33MW, and the Khe Bố Hydropower Plant in Nghệ An with a capacity of 100MW.

Thượng Ngọc

– 16:33 10/10/2025

Early Insights: Q3 2025 Business Performance Unveiled by Leading Companies

DIC Corp and Dabaco have emerged as the first enterprises to unveil their estimated Q3/2025 earnings, delivering notably positive results.

“SMC Vows to Recover All Troubled Debt from Novaland Amid Operational Viability Concerns Raised by Auditors”

In March and April of 2025, SMC and the Novaland Group entered into several contracts and agreements for the purchase and sale of real estate. As a result, SMC recognized an increase in construction work-in-progress of VND 279 billion and made advance payments to sellers related to the long-term purchase/lease of real estate totaling VND 156 billion, offsetting the Group’s receivables from the Novaland Group.