VPS Securities Corporation (VPS) has released a report detailing the results of its recent share issuance aimed at increasing its charter capital from equity sources.

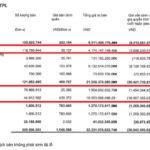

On October 10, VPS successfully allocated 710 million shares to 13 shareholders. The rights execution ratio was 1:1.245, meaning for every 1 share held, shareholders received an additional 1.2 new shares.

The issuance capital, sourced from equity, is based on the mid-year 2025 financial report, comprising: VND 85.4 billion from the supplementary capital reserve fund, VND 103 billion from the financial and business risk reserve fund, and VND 6,911 billion from undistributed after-tax profits.

The purpose of this issuance is to expand operational capital and financial capacity, supporting margin lending and advance payment for securities sales.

The newly issued shares are unrestricted for transfer. The share transfer date is scheduled for October 10, 2025. Upon completion, VPS’s charter capital will increase from VND 5,700 billion to VND 12,800 billion.

This is one of three capital increase plans approved at the Extraordinary Shareholders’ Meeting on September 29, 2025. Following the bonus share issuance, VPS plans to conduct an IPO of up to 202.3 million shares.

All IPO shares will be unrestricted for transfer. The offering is expected to take place between Q4/2025 and Q1/2026, pending approval from the State Securities Commission (SSC).

The offering price has not been disclosed but will not be lower than the book value stated in the 2025 semi-annual financial report, which is VND 22,457 per share.

At this price, the total expected proceeds from the offering are VND 4,543.2 billion. VPS plans to allocate 74% of the capital for margin trading, 20% for IT infrastructure investment, and 6% for human resource development.

Investors can subscribe for a minimum of 100 shares. The IPO shares will be distributed directly through VPS and partner securities companies, including SSI, MBS, FPTS, KIS Vietnam, SHS, DNSE, and OCBS.

VPS has proposed to its shareholders that all shares will be registered and centrally depository at the Vietnam Securities Depository (VSDC) and listed on the Ho Chi Minh City Stock Exchange (HoSE) post-IPO.

If VPS fails to meet the listing requirements after the IPO, the shares will be registered for trading on the Unlisted Public Company Market (UPCoM).

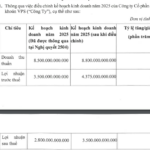

In other developments, VPS recently announced an adjustment to its 2025 business plan.

The company aims to achieve annual revenue of VND 8,800 billion, with pre-tax and after-tax profits of VND 4,375 billion and VND 3,500 billion, respectively.

Compared to the plan approved at the 2025 Annual Shareholders’ Meeting, VPS has increased its revenue target by 3.5% and profit target by 25%. If achieved, this would mark the highest profit in the company’s history.

TCBS Secures HOSE Listing Approval Following $460 Million IPO Success

Following the successful completion of its IPO of over 231 million shares, Technocom Securities JSC (TCBS) has been approved for listing on the Ho Chi Minh City Stock Exchange (HOSE) under the ticker symbol TCX. This Techcombank subsidiary is projected to achieve a market capitalization exceeding 110 trillion VND, positioning it as the industry leader in the securities sector.

VPS Securities Expands Brokerage Market Share on HOSE Ahead of IPO

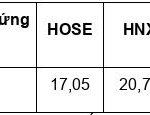

The latest HOSE statistics reveal that VPS Securities JSC’s market share in stock brokerage surged by 1.68 percentage points in Q3/2025 compared to the previous quarter, reaching an impressive 17.05%.

VPBankS Unveils Record-Breaking Profits Ahead of Highly Anticipated IPO

With robust results from proprietary trading, financial advisory services, and lending activities, VPBank Securities Joint Stock Company (VPBankS) reported pre-tax profits of nearly VND 2.4 trillion in Q3 and approximately VND 3.3 trillion for the first nine months of the year. This marks a significant year-over-year increase and achieves over 73% of the annual target. Another notable highlight is the margin loan balance reaching a new milestone.

Over 50 International Partners Explore Opportunities in VPBank’s IPO Venture

VPBankS has successfully conducted an international roadshow across Thailand, Singapore, Hong Kong (China), and the United Kingdom, engaging with numerous global partners. This initiative aimed to showcase investment opportunities, share growth strategies, and expand international collaborations, setting the stage for the largest IPO ever by a Vietnamese securities firm.

VPS Securities Raises Full-Year Profit Target Above 4,300 Billion VND

VPS Securities has revised its full-year profit targets upward, setting pre-tax and post-tax profit goals at VND 4,375 billion and VND 3,500 billion, respectively. Both figures represent a 25% increase compared to the plan approved at the Annual General Meeting of Shareholders.