Illustrative Image

Brazil’s agricultural exports are booming in 2025, as the South American nation capitalizes on robust demand from China and the weakening position of its competitors, particularly the United States, whose economy is grappling with tariffs imposed by Beijing.

According to the latest data from the Brazilian Grain Exporters Association (Anec), soybean exports from Brazil are projected to reach 102.2 million tons by the end of October, surpassing the record levels set in 2023 (101.3 million tons) and 2024. This surge underscores the notable absence of U.S. suppliers, who are struggling to access the Chinese market due to tariff barriers.

Anec reports that Brazil not only achieved a record soybean harvest of over 170 million tons this year but also benefited from sustained demand from China, which now accounts for 79.9% of Brazil’s total soybean exports, up from 74% during the 2021–2024 period.

In September alone, China imported 6.5 million tons of soybeans, representing 93% of Brazil’s total exports for the month. Anec estimates that total soybean exports for 2025 could reach 110 million tons, with an additional 8 million tons expected to be shipped in November and December.

Alongside soybeans, Brazil’s corn exports also saw a significant increase, reaching 6 million tons in October, approximately 380,000 tons higher than the same period last year. Year-to-date, corn exports have totaled 30 million tons, solidifying Brazil’s position as the world’s second-largest grain exporter, trailing only the U.S.

Beyond soybeans, Brazil’s beef industry is also reaping substantial benefits from shifting global trade dynamics. Data from the Brazilian Beef Exporters Association (Abrafrigo) reveals that beef exports to China in September surged by 38.3% year-on-year, reaching a record 187,340 tons. This drove total beef export revenue for the month to $1.92 billion, reflecting a 49% increase in value and a 17% rise in volume compared to the previous year.

China remains the largest market for Brazilian beef. Meanwhile, exports to the U.S., Brazil’s second-largest market, plummeted by 41% in September, falling to $102.9 million. This decline is attributed to Washington’s imposition of a 50% import tax on select Brazilian products, including beef, which already faced a 26.4% tariff.

Despite these challenges, Brazil’s meat industry has demonstrated remarkable resilience. The European Union (EU) has emerged as the second-largest destination, led by Italy, the Netherlands, and Spain, with total imports reaching $131.7 million, doubling compared to the same period last year.

Abrafrigo notes that 130 countries have increased their beef purchases from Brazil, highlighting the nation’s effective market expansion amid global agricultural supply chain disruptions caused by U.S. tariff policies.

Analysts attribute Brazil’s success to its adeptness in meeting China’s demand, the world’s largest consumer of soybeans and beef. Amid ongoing U.S.-China trade tensions, Brazil has positioned itself as a reliable, cost-competitive supplier with vast production capabilities.

With its current export growth trajectory, Brazil is not only cementing its status as a leading global agricultural supplier but also gradually displacing the U.S. in its traditional role within global agricultural trade.

Source: Reuters

The Ultimate Savior: How a 50% US Tariff Led 183 Exporters to Find a New Haven in the BRICS

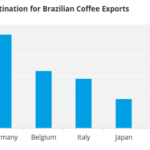

The United States has imposed tariffs of up to 50% on Brazilian coffee, presenting a significant challenge to commodity traders and exporters alike.