Vietnam’s stock market is experiencing a robust surge, consistently reaching new highs following the official upgrade announcement. Investor sentiment is buoyant, and confidence in the market’s new growth cycle is strengthening. However, even a minor correction of 5-10% can swiftly shift the mood, prompting many investors to hastily take profits or even panic sell.

At the recent Investor Day event, Mr. Le Anh Tuan, CEO of Dragon Capital, emphasized that short-term fluctuations, whether upward or downward, are entirely normal, akin to “bumps in the road” on the market’s long journey.

“Volatility within an uptrend is inevitable. A 5-10% market movement is perfectly normal. Don’t be surprised, confused, or fearful when such corrections occur,”

Mr. Tuan stressed.

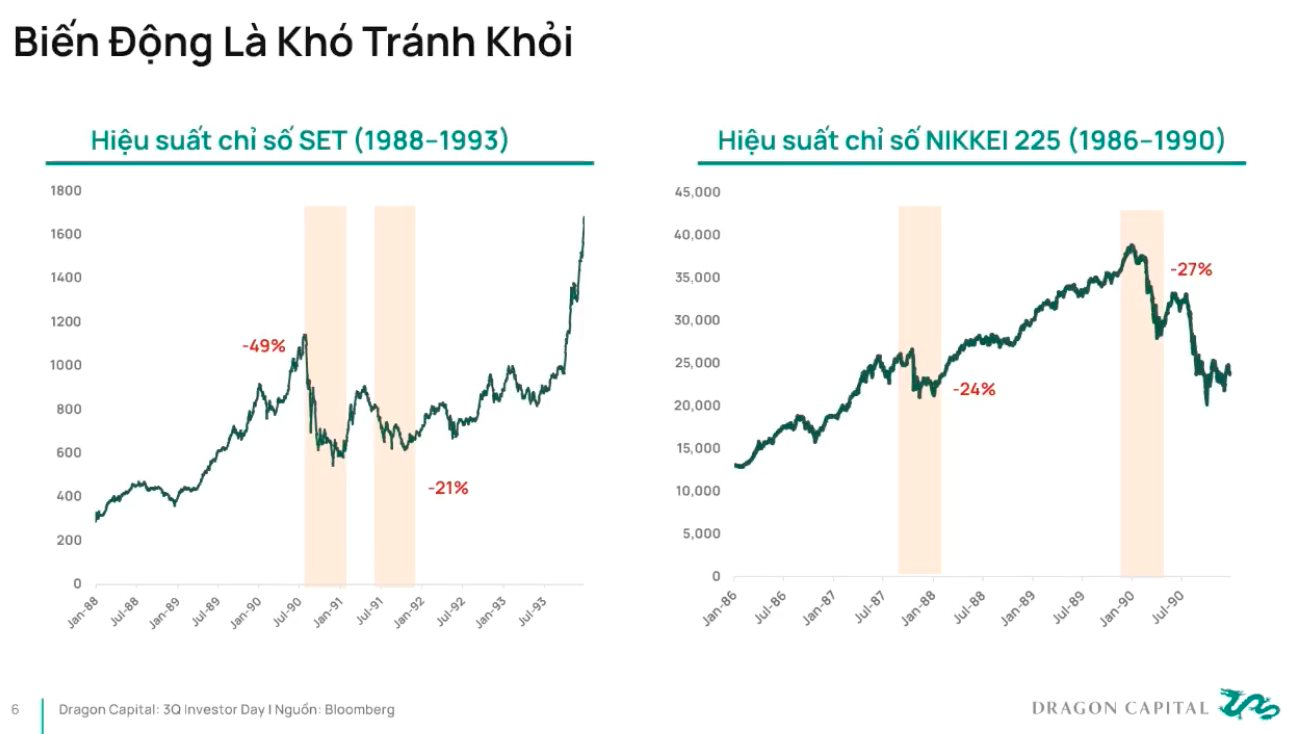

Historical data reveals that even during the most exuberant periods, markets undergo significant adjustments. For instance, Thailand’s SET Index plummeted nearly 50% after a sharp rally, followed by a further 20% correction before entering a robust recovery phase. Similarly, Japan’s Nikkei 225 experienced two declines of 24% and 27% between 1986 and 1990 before reaching new peaks.

“The economy can grow by double digits, yet the stock market may still see 10% corrections. When understood correctly, these corrections become opportunities,”

Mr. Tuan added.

According to Dragon Capital’s leadership, the critical factor is the long-term trend and internal strength of the market, which are being significantly reinforced. Vietnam is on track to be upgraded to the MSCI Emerging Markets and FTSE Advanced Emerging groups within the next 3-5 years—a move that could unlock a new growth cycle for the market.

“The market has surpassed 1,700 points, but I don’t see this as the limit. I anticipate that in the next 5 years, Vietnam’s stock market development will match the achievements of the past 10-15 years combined, in terms of policy, infrastructure, and depth,”

Mr. Tuan predicted.

Sharing this optimistic outlook, Dragon Capital believes that with double-digit GDP growth, corporate profits rising over 20%, and a P/E ratio of just 12-13 times, the VN-Index still has significant upside potential.

Investment bank J.P. Morgan echoes this sentiment, forecasting that the VN-Index could reach 2,200 points within the next 12 months. This projection is based on stable macroeconomic conditions, the return of foreign capital, and expectations of continued strong corporate earnings growth.

“Enhancing Product Quality and Administrative Reforms: A Catalyst for Attracting Foreign Investment, Says Deputy Chairman of SSC”

On October 10th, the State Securities Commission (SSC) hosted a conference to disseminate amendments and supplements to the Securities Law and its implementing regulations.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented National Record, Securing Top 3 Global Position

Billionaire Pham Nhat Vuong is the first Vietnamese individual to achieve this remarkable milestone.

Maybank Securities: VN-Index to Stabilize Between 1,600 – 1,700 Points in October, Targeting 1,800 Post-Accumulation Phase

According to Maybank Securities’ October strategy report, the VN-Index is likely to continue fluctuating within the 1,600-1,700 range in October 2025, before targeting the 1,800 mark. This optimism is driven by expectations of an expansionary monetary and fiscal policy, accelerating corporate earnings, and the potential return of foreign capital inflows.