The conference is part of the State Securities Commission’s (SSC) 2025 Legal Dissemination and Education Plan. Its purpose is to update, disseminate, and educate businesses on newly issued securities and stock market regulations. This initiative aims to ensure companies thoroughly understand and effectively comply with legal requirements in their operations.

Vice Chairman of the SSC, Mr. Hoàng Văn Thu, chaired the conference. Attendees included representatives from SSC departments, the Stock Exchange, the Vietnam Securities Depository, securities associations, and over 500 delegates from public companies, listed firms, securities companies, investment fund managers, trading members, auditing firms, and media outlets from Northern Vietnam.

In his opening remarks, Vice Chairman Hoàng Văn Thu highlighted that during the 8th session of the 15th National Assembly, Law No. 56/2024/QH15 was passed to amend and supplement several laws under the Ministry of Finance’s jurisdiction, including the Securities Law. The amendments focus on three key areas:

First, enhancing transparency and efficiency in securities issuance and offering activities.

Second, strengthening oversight and penalties for fraudulent practices in securities issuance and offerings. This includes clarifying the responsibilities of involved parties to prevent and address violations effectively.

Third, addressing practical challenges, streamlining administrative procedures, and promoting market development to maintain and improve Vietnam’s stock market ranking.

To implement Law No. 56/2024/QH15, the Ministry of Finance issued Circular No. 19/2025/TT-BTC on May 5, 2025. This circular outlines regulations for public company registration, deregistration, and audited reports on contributed charter capital. A key policy innovation is the clear delineation of responsibilities among relevant agencies, reducing processing times, and maximizing convenience for businesses.

Additionally, the Ministry of Finance submitted Decree No. 245/2025/NĐ-CP to the Prime Minister, amending Decree No. 155/2020/NĐ-CP, which details the implementation of certain Securities Law provisions.

“With groundbreaking policies to enhance market quality, streamline administrative procedures, and improve market accessibility, Decree No. 245/2025/NĐ-CP will particularly benefit companies planning initial public offerings and listings. It will also increase market supply and attract foreign investors as Vietnam’s stock market advances in global rankings,” emphasized Vice Chairman Hoàng Văn Thu.

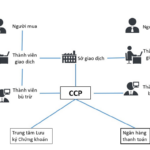

The conference focused on four key topics: (i) Overview of Securities Law amendments in Law No. 56/2024/QH15 and implementing regulations; (ii) New regulations on securities offerings and issuance in Law No. 56/2024/QH15 and Decree No. 245/2025/NĐ-CP; (iii) Amendments to market organization, clearing, and settlement regulations in Law No. 56/2024/QH15 and Decree No. 245/2025/NĐ-CP; (iv) New public company regulations in Law No. 56/2024/QH15, Decree No. 245/2025/NĐ-CP, and Circular No. 19/2025/TT-BTC.

Vice Chairman Hoàng Văn Thu and SSC leaders engage in discussions during the conference panel.

During the panel discussion, SSC representatives and attendees exchanged views on the Securities Law amendments and implementing regulations. SSC officials provided clarifications, explaining the rationale and objectives behind the legal changes to enhance enforcement effectiveness. They also gathered valuable feedback and practical insights to improve market oversight, ensuring fairness, transparency, safety, and sustainable development.

Unlocking Central Counterparty Clearing (CCP): New Securities Laws and Decrees Pave the Way

The Vietnamese stock market is poised to meet new demands for upgrading, attracting foreign investment, enhancing transparency, ensuring systemic safety, and modernizing trading infrastructure.