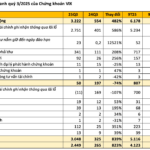

VIX Securities Corporation (Stock Code: VIX, HoSE) recently released its Q3 2025 financial report, revealing a staggering 6-fold increase in operating revenue to VND 3,222 billion compared to the same period last year.

Most business segments demonstrated robust growth. Notably, Fair Value Through Profit or Loss (FVTPL) financial assets generated VND 2,751 billion, a 12-fold surge year-on-year, primarily driven by substantial gains from the sale of financial assets recorded through profit or loss.

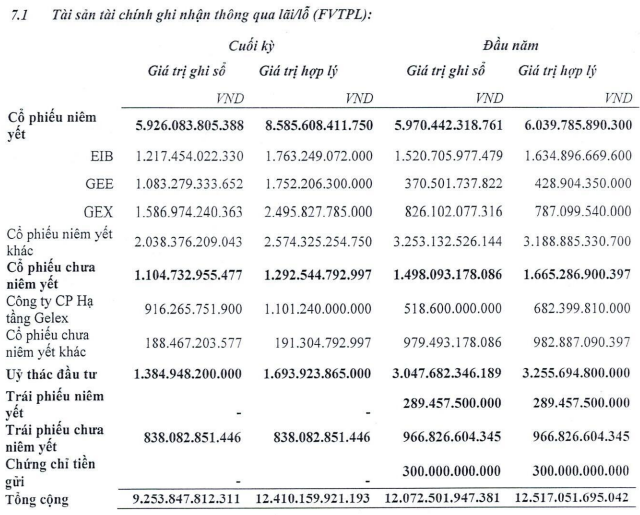

As of September 30, 2025, VIX’s FVTPL financial assets portfolio stood at VND 9,254 billion in original value. Of this, over VND 5,900 billion was invested in listed stocks, currently yielding a nearly 45% profit. Three stocks—EIB, GEE, and GEX—accounted for over VND 1,000 billion. EIB’s original value decreased by approximately VND 300 billion since the year’s start, indicating profit-taking by the company.

Source: VIX

Significantly, VIX no longer holds investments in listed bonds or deposit certificates. Additionally, entrusted investment and unlisted bonds decreased by over 50% to VND 1,385 billion and slightly to VND 838 billion, respectively.

Lending activities contributed VND 341 billion, tripling year-on-year. This was achieved through VND 16,100 billion in lending investments, primarily in margin trading, nearly tripling since the year’s start.

Brokerage services generated VND 92 billion, 3.5 times higher than the previous year. The most significant growth was in Held-to-Maturity (HTM) investment profits, soaring from VND 186 million to VND 23.5 billion. As of Q3 2025, VIX held VND 924 billion in term deposits under one year.

Operational expenses were reduced by 74% to VND 50 billion. Consequently, pre-tax profit reached VND 3,048 billion, and post-tax profit VND 2,449 billion, both increasing over 9 times year-on-year.

For the first nine months of 2025, VIX recorded VND 6,178 billion in operating revenue, a 378% increase. Pre-tax and post-tax profits were VND 5,116 billion and VND 4,123 billion, respectively, both rising over 7 times year-on-year.

On October 9, VIX finalized its shareholder list for the 2025 Extraordinary General Meeting. The meeting’s date and venue remain unannounced.

The agenda includes a proposal to raise the 2025 business plan targets to VND 5,000 billion in pre-tax profit and VND 4,000 billion in post-tax profit, a 333% increase from the plan approved at the 2025 Annual General Meeting. If approved, VIX will have surpassed its annual targets within just three quarters.

As of September 30, 2025, VIX’s total assets reached nearly VND 31,535 billion, a 61% increase year-to-date, primarily due to expanded lending.

In terms of funding, short-term borrowings increased by over VND 7,400 billion to VND 10,283 billion. Interest expenses for the period totaled nearly VND 112 billion.

Thang Long Corporation Invests 110 Billion VND to Establish Two New Subsidiaries

Thang Long Corporation has approved a plan to invest a total of 110 billion VND in establishing two new wholly-owned subsidiaries.