On the morning of October 11th, SJC and PNJ companies simultaneously increased the price of gold bars by 600,000 VND per tael compared to the previous day’s closing session, currently listed at 140.8 – 142.8 million VND per tael (buy – sell).

Regarding gold ring prices, PNJ increased by 300,000 VND per tael for both buying and selling, reaching 136.8 – 139.8 million VND per tael. Meanwhile, SJC maintained its gold ring prices at 136.2 – 138.9 million VND per tael.

Bao Tin Manh Hai is currently trading gold rings at 138.5 – 141.3 million VND per tael, an increase of 400,000 VND per tael compared to yesterday’s closing session.

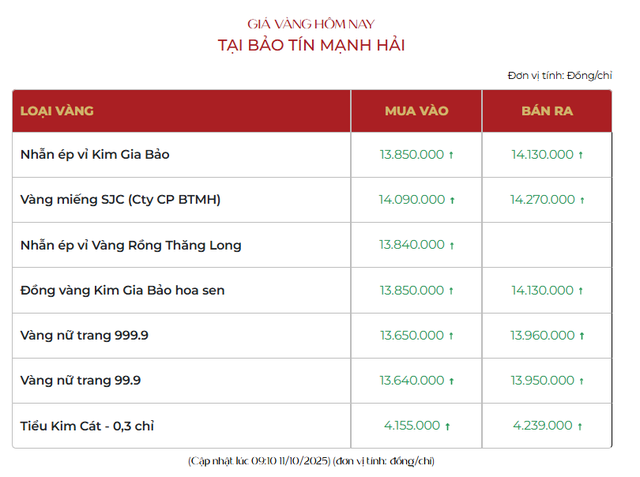

Gold prices listed at Bao Tin Manh Hai this morning, October 11th.

In the global market, the spot gold price this morning stood at $4,016 per ounce, after a swift recovery from Thursday’s sharp decline. The December gold futures contract also rose by $37.1, reaching $4,009 per ounce.

According to analysts, the strong recovery indicates robust investment demand, but the high volatility in recent times reflects short-term risks present in the gold market, which is not necessarily a positive signal in the near term.

Kitco News reports that the global economic and financial landscape remains fraught with uncertainty. International stock markets showed mixed to weak performance overnight, while major U.S. indices are expected to open slightly higher. Investors anticipate the U.S. Federal Reserve (Fed) to continue lowering interest rates at the end of October, but some Fed officials remain cautious due to inflation still being significantly higher than the 2% target.

Meanwhile, the U.S. government enters its second week of shutdown, as the budget impasse between Republicans and Democrats remains unresolved, potentially delaying the approval of a new spending package until next week.

Since the end of 2022, gold has experienced its strongest price increase in modern history, consecutively breaking resistance levels and setting 41 new records this year alone.

Since the beginning of the year, many major banks have forecasted gold reaching $4,000 per ounce, but this is not the first time such a scenario has been mentioned. When gold surpassed $2,000, $2,400, and $3,000 per ounce over the past three years, the market was skeptical, only to see these barriers broken. This time, the difference lies in the surge of investment within a short period.

According to the World Gold Council (WGC), in Q3/2025 alone, gold ETFs recorded a record inflow of 221.7 tons, equivalent to nearly $26 billion, bringing total holdings close to the 2020 peak, just 2% away. However, gold currently accounts for only about 2% of global assets, significantly lower than the 5-10% recommended by experts for a balanced portfolio.

The fundamental factors that drove gold to its peak—including geopolitical instability, high inflation, recession fears, rising public debt, and a weakening U.S. dollar—remain unresolved. In this context, suggesting that gold has peaked is considered premature, as the supportive factors for its price continue to exist and even intensify.

Nevertheless, the $4,000 per ounce mark remains a significant psychological threshold. After a 50% increase since the beginning of the year, some experts believe the market may experience a technical correction of around 10%, equivalent to a retreat to the $3,600 per ounce range, before resuming its upward trend.

In reality, throughout this recent rally, gold has demonstrated remarkable resilience. Since its strong upward movement began in November 2022, the market has only recorded one three-week decline (from May 20th to June 3rd, 2024) with a 2.8% drop. The sharpest decline occurred in November 2024, when prices fell 6.3% over two weeks, but rebounded by 6% the following week.

Analysts believe that gold’s long-term outlook remains positive, especially as central banks worldwide continue to net purchase gold and confidence in fiat currencies weakens. However, in the short term, the market may require necessary adjustments to balance supply and demand after a period of rapid growth.

For investors, this is a time for caution, but also an opportunity to preserve profits and prepare strategies for the next cycle. As history has shown, gold rarely pauses for long at a new peak.

Q3/2025 Financial Report Update: TCBS Announces Pre-Tax Profit Exceeding 2,000 Billion VND, Nearly Double YoY, with Multiple Enterprises Seeing Multi-Fold Growth

As of now, the majority of businesses that have reported their results have demonstrated remarkable growth in their operations.