Illustrative Image

Wheat stands as one of the world’s most vital staple crops. While Vietnam can cultivate wheat, large-scale production remains inefficient due to unsuitable climate and soil conditions. Wheat cultivation is primarily piloted in the northern mountainous regions, such as Mu Cang Chai, Yen Bai, Lao Cai, and Cao Bang, during the winter months to utilize fallow land. However, challenges like pests, unstable yields, and high costs force Vietnam to import the majority of its wheat.

In September 2025, Vietnam imported over 373,000 tons of wheat valued at more than $98 million, marking a 32.7% decrease in volume and a 33.6% drop in value compared to August. For the first nine months of the year, the country spent over $1.1 billion on wheat imports, totaling 4.1 million tons—a 7.8% decline in volume and a 10.6% reduction in value year-over-year.

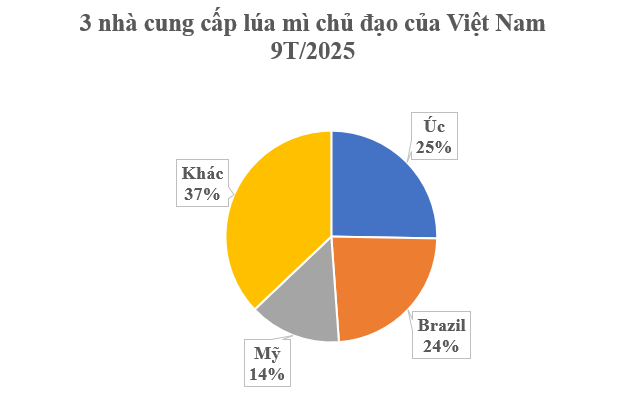

Australia leads as Vietnam’s largest wheat supplier, providing over 1 million tons valued at $289 million, up 18% in volume and 5% in value year-over-year. The import price averaged $272 per ton, down 12%.

Brazil ranks second, supplying over 989,000 tons valued at $254 million, down 16% in volume and 13% in value. The import price rose 3% to $257 per ton.

The U.S. holds third place with over 589,000 tons valued at $162 million, up 56% in volume and 34% in value. The average import price was $275 per ton, down 14%.

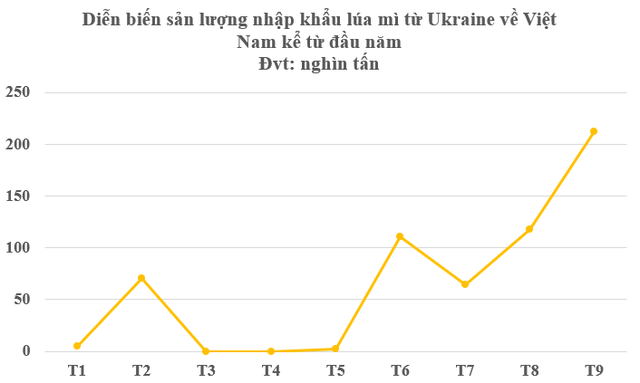

Notably, in September, Ukraine emerged as Vietnam’s top wheat supplier, surpassing the U.S., Australia, and Brazil. Vietnam imported over 211,000 tons of Ukrainian wheat valued at $53 million, an 80% surge in both volume and value compared to August.

In the first nine months of 2025, Vietnam imported over 568,000 tons of Ukrainian wheat valued at $144 million. Ukraine, the world’s tenth-largest wheat producer (over 20 million tons in 2025), has maintained significant exports despite its conflict with Russia. Production is expected to dip 2% due to adverse weather and ongoing conflict.

To ease cost burdens amid volatile global prices, Vietnam’s Decree No. 101/2021/NĐ-CP reduced the MFN import tariff on wheat from 3% to 0%. This policy aims to stabilize feed supply for the domestic livestock industry and boost consumption of related products.

VNDirect forecasts a strong recovery for Vietnam’s livestock sector in 2025, driven by stable, affordable feed supplies. The FAO predicts global wheat production will reach 796 million tons, up 1% year-over-year, with the U.S. expected to produce over 50 million tons, a 2.5% increase.

Maintaining preferential tax policies alongside diversifying import sources will enhance Vietnam’s competitiveness, ensure food security, and support sustainable livestock development.

Surpassing Gold and Silver by 80% Since January: The Hottest Precious Metal Captivating Investors Right Now

Driven by its potential as a substitute for gold and coupled with surging energy demands and persistent supply deficits, hydrogen metal has ignited unprecedented optimism among investors.