The latest strategic report from SSI Securities (SSI Research) suggests that as we move into 2026, Vietnam’s market narrative is shifting from broad recovery to selective leadership. The coming year is expected to favor investors focusing on profit resilience, disciplined valuation, and comprehensive growth drivers, rather than short-term momentum.

Vietnam’s stock market stands at a unique crossroads of reform, resilience, and emerging growth potential. The foundations laid in 2025—improved liquidity, clear policies, and robust domestic investor confidence—are paving the way for a broader and more sustainable growth cycle.

“2026 will no longer be a phase of ‘a rising tide lifts all boats,’ but an investment environment favoring selective stock picking, prioritizing quality over momentum,” the report emphasizes.

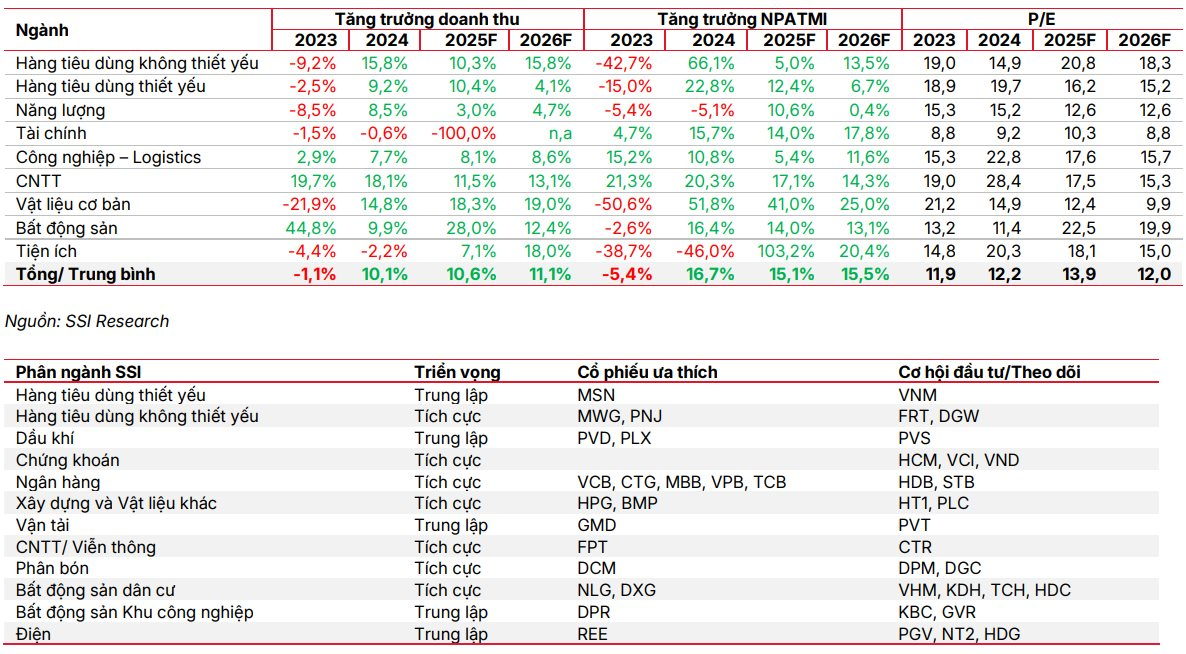

Regarding growth prospects and stocks, SSI highlights the banking sector as a market pillar, supported by strong credit growth and profitability. Key stocks include VCB, CTG, MBB, and TCB. The consumer and retail sectors are also expected to rebound, driven by rising disposable income, with notable stocks such as MWG, PNJ, and FRT.

Real estate and infrastructure themes remain attractive due to public investment, with construction materials like HPG and BMP taking precedence. Fertilizer and chemical stocks (DCM, DPM, DGC) show steady growth, while the IT sector, led by FPT, is recovering from a correction phase.

Additionally, securities firms like VND and VCI continue to benefit from robust market liquidity.

SSI notes that while the path ahead may not be entirely smooth, every market deserving of an “upgrade ticket” must navigate periods of volatility to mature.

With expanding growth drivers, valuations below historical averages, and increasing global recognition, Vietnam’s market is not just closing one chapter but opening a new one.

Risks to Monitor

Despite a generally positive outlook for 2026, SSI Research identifies several short-term imbalances that could impact market sentiment.

High margin loan debt increases volatility risk as individual investor sentiment shifts. While the real estate cycle remains stable, slowing demand could affect credit demand for banks.

Globally, trade tensions and capital shifts may pressure exports and the VND exchange rate. Reform implementation progress, though currently on track, requires close monitoring.

Overall, these risks are set against a strengthening economic and market foundation, mitigating potential short-term negative impacts.

Corrections are natural in the early stages of a bull market, reinforcing growth foundations. With attractive valuations and upgrade catalysts intact, the market’s medium-term outlook remains positive.

SSI Research: 2025 Isn’t the Peak—It’s the Foundation for a New Growth Era

According to SSI Research, the current market dynamics closely resemble the early stages of previous bull cycles, signaling the onset of a new growth trajectory.