Based on the achievements from 2010 to the present, particularly the stagnation since the COVID-19 pandemic, mobilizing resources as outlined in the draft proposal presents significant challenges. This article analyzes various scenarios and capital mobilization capabilities for Ho Chi Minh City’s development during the 2026-2030 period, while proposing solutions to enhance capital mobilization.

Ho Chi Minh City must pioneer innovative capital mobilization methods through existing and effective institutions, while creating new models, particularly those leveraging land value. Photo: LÊ VŨ |

Achievements to Date

According to official statistics (Table 1), the total social investment capital of Ho Chi Minh City in 2010, 2019, and the estimated figure for 2024 are VND 236 trillion, VND 604 trillion, and VND 631 trillion, respectively. The annual growth rates are 11% for 2010-2019, 1.1% for 2019-2024, and 7.3% for 2010-2024.

The city’s GRDP in 2010, 2019, and 2024 is VND 840 trillion, VND 2,050 trillion, and VND 2,716 trillion, respectively. The nominal GRDP growth rates are 10.4% for 2010-2019, 7.3% for 2019-2024, and 8.7% for 2010-2024.

Thus, the total investment capital to GRDP ratio was 28.1% in 2010, 29.5% in 2019, and 23.2% in 2024. This structure increased by 1.4 percentage points from 2010 to 2019 but decreased by 6.2 percentage points from 2019 to 2024, resulting in an overall decrease of 4.9 percentage points from 2010 to 2024.

Regarding investment sources, the budget capital ratio significantly decreased by 14.5 percentage points from 2010 to 2019. It recovered by 7.5 percentage points from 2019 to 2024, reaching 22.2% in 2024.

|

The city’s investment growth potential, drawing from the experiences of other regional cities, lies in budget capital to generate public-private partnership (PPP) capital and private sector capital. To achieve positive private sector capital mobilization, increased central budget allocation to the city is crucial. Additionally, the city must pioneer innovative capital mobilization methods through existing and effective institutions like the Becamex model, while creating new models, particularly those leveraging land value. |

The domestic private sector’s investment ratio increased by 19.9 percentage points from 2010 to 2019, reaching 60.8% in 2019, then decreased by 4 percentage points from 2019 to 2024, settling at 56.9% in 2024.

Foreign direct investment (FDI) ratio decreased from 29.6% in 2010 to 24.5% in 2019 and further to 20.9% in 2024. Thus, FDI growth has consistently lagged behind the average investment growth, indicating a declining attractiveness of Ho Chi Minh City to FDI.

From 2010 to 2019, overall investment growth was 11%; budget capital grew by 2.9% annually, FDI by 8.7%, and domestic private capital by 16%. However, the situation became less optimistic after the COVID-19 pandemic. Overall growth was only 1.1%, with budget capital increasing by 12.1%, while domestic private capital decreased by 4% and FDI by 3.6%.

For the entire 2010-2024 period, Ho Chi Minh City’s investment grew by 7.3%, lower than the 1.1% nominal GRDP growth. Domestic private capital saw the highest increase at 9.8%, budget capital grew by 5.2%, and FDI by only 4.7%.

Even during the most optimistic phase, domestic private investment grew by only 16% annually, with overall investment at 11%. Given the current economic scale and development level, achieving over 20% annual investment growth in five years is challenging.

Investment Capital Scenarios

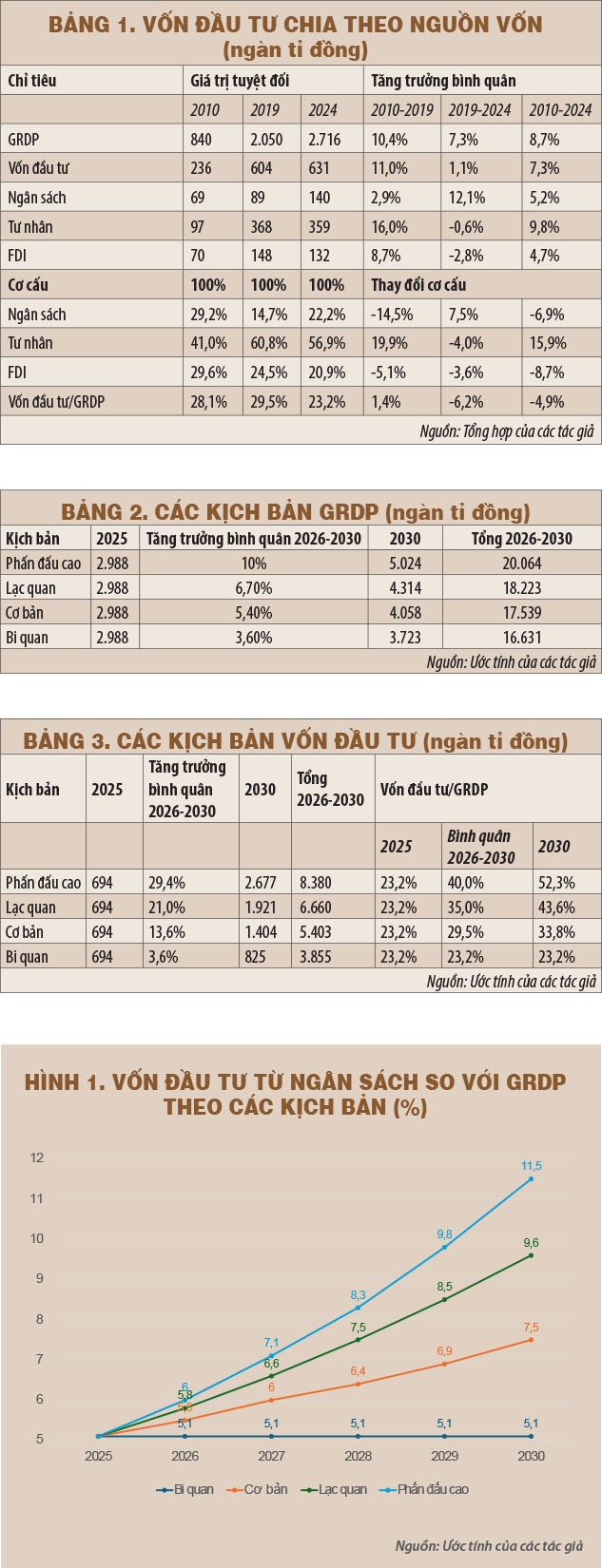

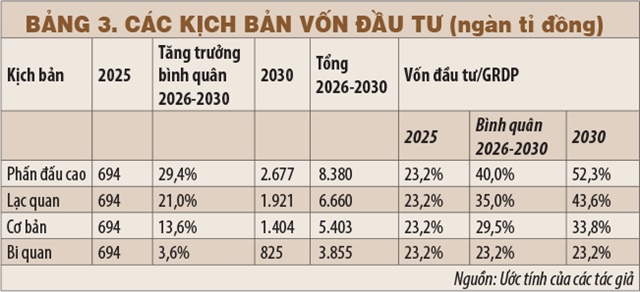

As analyzed in the article “Building Ho Chi Minh City’s Position” in this issue, we present four GRDP growth scenarios for 2026-2030 (Table 2). We assume a 10% nominal GRDP increase in 2025, reaching VND 2,988 trillion. The 2030 GRDP and the five-year period are presented in Table 2.

Ho Chi Minh City must pioneer innovative capital mobilization methods through existing and effective institutions, while creating new models, particularly those leveraging land value. Photo: LÊ VŨ |

|

We also assume a 10% nominal investment growth rate, resulting in a 2025 investment total of VND 694 trillion. To illustrate possibilities, corresponding to the four GRDP growth scenarios, we assume average five-year total investment-to-GRDP ratios of 40%, 35%, 29.5%, and 23.2%. The estimated figures are presented in Table 3.

To achieve these structures, the average annual real investment growth rates (excluding inflation) for each scenario are 29.4%, 21%, 13.6%, and 3.6%. In the baseline scenario, adding 3% inflation results in an annual growth rate significantly higher than the domestic private sector’s best period (2010-2019) as analyzed above.

Thus, achieving a 35-40% investment-to-GRDP ratio is challenging. Specifically, starting from a 23.2% ratio in 2025, reaching 40% by 2030 requires a 52.3% investment-to-GRDP ratio; for 35%, it would be 43.6%.

Figure 1 highlights the budget capital requirements and challenges. In the high-effort scenario, by 2030, total budget investment to GRDP must reach 11.5%, compared to the current 5.1%. Even in the baseline scenario, achieving a 30% investment-to-GRDP ratio requires a 2.5 percentage point increase in budget capital, or nearly 50% of the current level.

Given the current context, achieving double-digit FDI growth is difficult. The city’s investment growth potential lies in budget capital to generate PPP and private sector capital.

Realistically, achieving the baseline scenario’s growth (more than double the 2010-2024 average) would be a significant effort. Increased central budget allocation to the city is crucial for successful private sector capital mobilization.

Additionally, the city must pioneer innovative capital mobilization methods through existing and effective institutions like the Becamex model, while creating new models, particularly those leveraging land value.

Huỳnh Thế Du – Huỳnh Tuấn Kiệt

– 07:00 11/10/2025

Ho Chi Minh City: Vietnam’s Megacity and Engine of Growth

In just a few days, the Ho Chi Minh City Party Congress will officially commence. This event transcends local politics, marking a pivotal moment in the nation’s development. As the first Congress following the city’s expansion through the merger with Binh Duong and Ba Ria – Vung Tau, it heralds the birth of a megacity boasting over 14 million residents. This new metropolis stands as Vietnam’s premier hub for industry, services, finance, and maritime trade.

“A Step Towards Home with Fenica: The Ultimate Residential Solution in Ho Chi-Minh City’s Northeast Infrastructure”

On October 10th, Fenica, a high-rise project located on Tran Quang Dieu Street in Tan Dong Hiep Ward, unveiled its concept “One Step Home,” emphasizing its vision to create a convenient and well-connected living space tailored for young individuals.