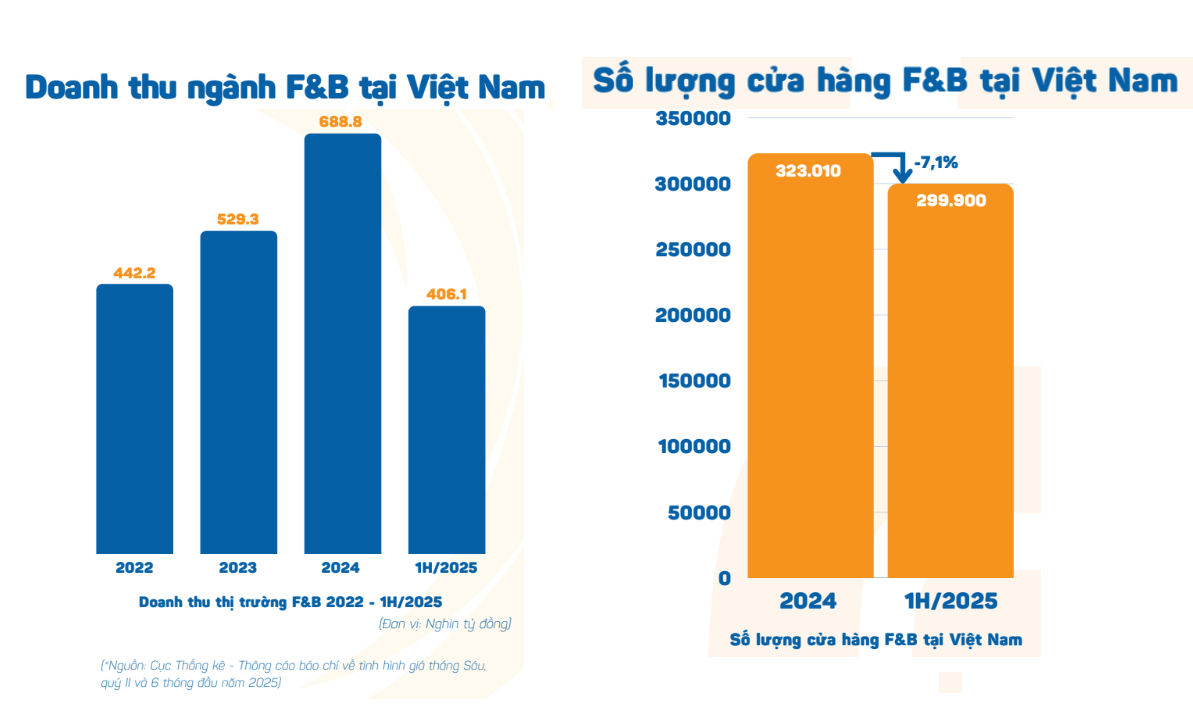

In the first half of this year, Vietnam’s F&B industry witnessed the closure of over 50,000 outlets nationwide, accounting for 7.1% of all establishments. According to the Vietnam Food and Beverage Market Report for the first six months of 2025, released by iPOS.vn at the Vietnam F&B Summit 2025, the sector’s total revenue reached approximately 400 trillion VND, a mere 1% increase compared to the same period last year, falling significantly short of the targeted 10% growth.

Over 50,000 F&B outlets exited the market in just the first half of the year.

Mr. Nguyễn Đỗ Anh Quân, Brand Director of iPOS.vn, described this downturn as the “second wave of market purification” in the F&B industry. In Hanoi and Ho Chi Minh City alone, the decline in outlets reached 11%.

Amid rising input costs, nearly half of F&B businesses (45.3%) were forced to raise prices in the first six months. Key factors included increasing raw material costs, labor expenses, rental fees, and policy changes such as electronic invoicing and business tax regulations. However, price hikes in the mass and mid-range segments often risk customer loss, as consumers can easily switch to more affordable alternatives.

Contrasting the trend of price increases, the market has seen the emergence of ultra-affordable F&B models in Ho Chi Minh City, such as 7,000 VND bubble tea and 69,000 VND hotpot. Mr. Quân explained that this is a “funnel pricing” strategy: the ultra-low prices act as a lure to attract customers, while revenue and profit are generated from add-ons, side dishes, and combos, where consumers are willing to spend more.

A survey revealed that 65% of customers are willing to try low-priced products, highlighting the appeal of this model. However, Mr. Quân emphasized that the core of the ultra-affordable model lies not in promotions but in supply chain efficiency and operational discipline. This includes standardized ingredients, waste control, streamlined menus, and quick service. When capacity stabilizes, fixed costs are diluted, ensuring positive profit margins despite low prices.

Ho Chi Minh City has seen the rise of ultra-affordable food and beverage models, notably 7,000 VND bubble tea.

Urban areas with high concentrations of workers and students, such as Binh Duong, Dong Nai, Can Tho, Da Nang, Hai Phong, and Bac Ninh, are deemed suitable for expanding this model, provided they ensure clustered supply chains, training, and quality control. However, franchising should only be considered once businesses have tight control over sourcing and operations to avoid “artificial booms.”

According to the report, in the next six months at least, a frugal mindset will persist among consumers, while many brands continue to raise prices, creating opportunities for ultra-affordable models to gain market share in the mass and lower mid-range segments.

“Only those who maintain three pillars—sustainable low-cost supply, fast and clean operations, and satisfactory customer experience—can turn cost advantages into long-term benefits. Conversely, short-term growth followed by decline is a common scenario for such models,” Mr. Quân warned.

Alongside ultra-affordable models, the F&B market has also seen trends like matcha green tea drinks and fresh Chaozhou beef hotpot. Ms. Trần Hồng Trang, founder of Matcha Vibe, shared, “Today’s customers are willing to pay more for what they perceive as genuine value.” After multiple failures, she successfully established a chain of 45 outlets by focusing on quality and experience.

Previously, Vietnam’s F&B market experienced trends that captivated young consumers, such as coin-sized pancakes, hand-squeezed lemon tea, chicken and mangosteen salad, and seven-level spicy noodles. These trends attracted significant investment from entrepreneurs, with customers often queuing for hours to try novel dishes.

However, these trends were short-lived, as outlets proliferated across Hanoi, sometimes on the same street. When the trends faded, businesses hastily liquidated equipment and counters at low prices.

Currently, once-popular food and beverage items are no longer prevalent in the market.

Is Modern Technology and Retail Reshaping the Food Industry?

From growing food safety concerns to the rising demand for convenience, Vietnam’s meat market is undergoing a transformative shift. Beyond the foundational market demand, what key factors will empower branded processed meat companies to leverage their strengths and surge ahead in an increasingly competitive landscape?

The Retail Giant Captures Market Share on the Precipice of a New Era

The retail landscape is evolving, and with it, a world of opportunity opens up for savvy retailers. With a potentially huge consumer market still largely untapped, retailers are racing to establish their presence and transform the way Vietnamese shop, not just in urban centers but also in the suburbs.